Since at the early stages, startups sometimes don’t even have enough revenue to pay salaries, one of the most common ways to inspire and support co-founders is a startup equity split. In this article, I am going to describe the ways to share equity between founders in a startup at their earliest stages. You’ll also learn the typical startup equity structure, what happens to share allocation if a startup is purchased by another company, and how to scale up in these conditions.

Why Allocate Equity among Startup Co-founders?

The answer is quite simple – to boost loyalty. An equity split is the distribution of one’s degree of ownership in an entity. This is the most expensive yet valuable asset. If a co-founder owns some shares of your company, he/she is automatically given some authority in decision-making processes. This elevates co-founders’ enthusiasm while showing your gratitude and respect to them. Startup equity allocation only underlines the importance of the contribution made by each team member to the company that motivates your partners to do their best.

It’s important to note that investors pay special attention to the way co-founders divide shares in a company because it tells them a lot about engagement and solidarity inside the team. If in a team of three co-founders one person owns 80% of startup shares and the other two people only 10%, investors are likely to doubt trust in this team.

Who Gets Startup Equity

When thinking about how to share allocation for a startup, the first question should be: how many shares should a startup issue? There are different opinions on this matter, but the average number of shares for a startup in tech is between 10 to 20 million.

The second question is: who is going to be involved? Very often not only co-founders, but also other people like investors, key employees, or advisors take part in the startup equity split. There are several levels of the priority list. Co-founders go first, then a start-up should consider the interests of investors. If you have an advisor or a professor who contributes to the startup project, it’s reasonable to put this person before your first employee.

As a rule, the share percentage of independent startup advisors is around 5% (or no equity at all). Investors claim 20-30% of startup shares, while the founder and co-founder share percentage is over 60% in total. You may also leave some available pool (say 5%), but don’t forget to allocate 10% to employees. It makes sense to define roles within the company and assign job titles based on the most outstanding skills of co-founders. It’s also worth mentioning that while distributing the responsibilities, startuppers should think about their long-term expectations. It means that you need to figure out the future of your career, potential responsibilities & risks. Leave all uncertainties behind and open up to the team.

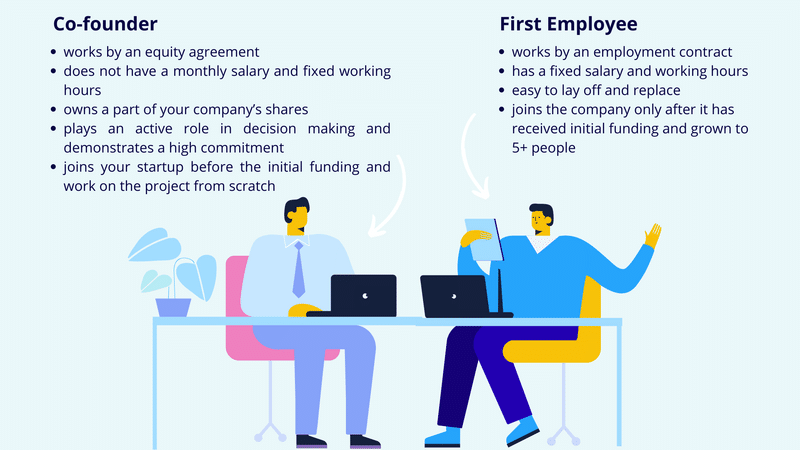

Co-founder vs. First Employees

When it comes to equity allocation, startups need to understand the difference between the first employees and co-founders. This will enable them to fairly share distribution in a startup. First and foremost, an employee works by an employment contract. They have a fixed salary and working hours. An employee doesn’t take any huge risks working for you – and from your side, it’s easier to lay off and replace this person. De facto, you may find it difficult to let them go but de jure it’s quicker and less painful. And as a rule, first employees join the company only after it has received initial funding and grown to 5+ people.

By contrast, a co-founder does not have a monthly salary but owns a part of your company’s shares due to an equity agreement the startup offers to them. This person plays an active role in decision making and demonstrates high commitment. Co-founders may work either “24/7” or just a few hours per week as a part-time job. Their primary motivation is the idea, and that’s why co-founders tend to think in the long–term perspective and are good at strategy planning. These people join your startup before the initial funding and work on the project from scratch.

Nevertheless, if one co-founder suddenly leaves the company, this affects the whole team and business. Legally the founder’s shares will stay with this person, and this creates a headache for the startup team. Unless otherwise provided by the startup employment contract, these equity shares are wasted. That’s why you should think clearly when putting together the co-founding contract and initial agreements.

Employee Stock Options

It is worth mentioning that dedicated employees can also get a small percentage of equity shares, the so-called employee stock option. Simply put, a stock option is a right given to an employee to buy a certain number of shares in the company’s stock. Private companies, and especially startups, frequently use a stock option plan to reward their key employees. You might consider 10% of your startup equity for the most dedicated employees.

Employee stock options typically fall into two categories: outright award and performance-based award. The latter is also referred to as an incentive award. Companies either grant outright awards of stock options (upfront) or on a vesting schedule, i.e. they grant incentive stock options per the achievement of specific targets.

Stock Option Plans for Offshore Developers

In Poland, there are many offshore software development teams that work as an offshore development center of US-based tech companies. Employed as independent contractors, these developers are often considered to have no access to the startup bonus system. On the contrary, local software engineers may feel a part of the startup team and contribute as much. So naturally, co-founders should consider rewarding their offshore employees with stock options.

In case a startup wants to expand offshore, employee stock options are also applicable to offshore teams that work in a software R&D center. At their growth stage, startups look for alternative opportunities, weighing offshoring pros and cons. As a result, they may find IT talents in other nearshoring countries (hire Bulgarian developers, for example). In addition, the question of product vs. project mindset also matters. Having a product-oriented mindset, the local tech specialists are highly interested in contributing to the success of their startup company (even if they work remotely). Several US tech companies are illustrative offshoring examples that have made use of stock options for their Eastern European software development teams, and this practice is just going to continue.

Stock Option in Startups Can Be Risky

The most important thing is to understand that an option is not equity or stock in the startup company. Stock option plans only give employees the right to buy startup shares. Stock options are useful when a startup company cannot offer a competitive salary. In this way, employers balance out lower wages. However, startuppers should keep in mind that this bonus is quite risky. On the one hand, if the company will be doing well, owners of stock options will be able to buy a pre-determined number of shares. Since you agree upon the fixed price, chances are the price on shares will raise and you will get a good bargain. On the other hand, if the company fails the stock option and shares will have no value.

For employees, it is vital to understand the percentage of their ownership. It seems that 10,000 stock options are a really good number, but it doesn’t mean anything unless you understand their percentage. For instance, 10,000 can be 10% (10,000 of 100,000) or 1% (10,000 of 1,000,000) of the overall stock. For this reason, get more information on the recent round of investment and the market value of your company.

How to Split Equity among Founders

First of all, you need to have deep discussions with your co-founders to ascertain what each of them is bringing to the table. For the most part, the contribution of co-founders is fairly equal and the main task is to define any gaps and present them in numbers (percentages). For example, one business partner looks for investors, arranges business processes and does marketing, while another co-founder codes and leads all product development. At first sight, it seems to be a fair 50/50 founding team equity split – but what if the latter works only part-time, and the former umpteen hours per day?

As can be seen, time and engagement can make a significant difference, so while splitting equity you should take into account the following:

– Experience and expertise

– Time and commitment

– Business plan preparation

– Responsibilities and risks

– Money invested

Startup Idea in Equity Allocation

It is a common misbelief that the idea is everything. Yet the idea alone isn’t an asset until it is brought to life. There are dozens of examples when promising startups with brilliant business ideas failed due to inefficient management. That’s why make sure you don’t overestimate “the idea guy” in your team of co-founders. What really matters are expertise and time – because they make the business move. The more committed a founder is, the more result he/she brings. It goes without saying that previous experience can be a game-changer because the knowledge and expertise of co-founders may keep your startup distanced from many troubles. This is also connected to responsibilities and duties because the level of responsibility presupposes more skills, workload, and stress.

When evaluating the risks each of you is exposed to, try to include both personal and financial factors. For instance, one of the founders has to leave their job to start up with you, and another invests the largest amount of cash. After that, add points to those who participated in the creation of your business plan. The following template demonstrates the major points for consideration when discussing startup equity allocation with co-founders. It’s still up to you to decide which type of contribution deserves priority.

On this account, you could discuss a percentage ratio. If your team of founders consists of only two people, you can divide equity equally – 50/50 – and although this is a common practice many startup advisors don’t recommend it.

A Fair Split Doesn’t Work

The investor and entrepreneur Mike Moyer states that equal-stake founders follow their blind guesses about the future in terms of company value and individual contributions. According to him, start-uppers should be very specific and precise while dividing equity in advance of actual work. On the one hand, both co-founders are financially balanced and secured. On the other hand, it can scare investors away. They usually find a 50/50 split impractical and immature, as if you are not ready to talk about money seriously. Startup decisions will only become more complicated later on, so you need to come up with clear agreements from the get-go.

“A quick, even split suggests that the founders don’t have the business maturity to have a tough dialogue,” says Noah Wasser, Harvard Business Professor.

From your perspective, a 20/80% equity split seems to be a better percentage ratio for startups with several founders. It shows investors that your team is actually in agreement and has one prominent decision maker. To have a strong leader is good unless there are only two of you in a startup. In the case of only two people, when one co-founder owns over 70-80% of company shares, the other partner may feel underestimated. His/her 20% will be diluted to 10-14% of shares after investors come in with their 20-30%. Consequently, your partner could be left with almost nothing and become demotivated.

The win-win solution for two co-founders is 45/50. This model includes everything: leadership, responsibilities, risk, and expertise. Give the 5% to the “idea man” in the startup or your CEO for his/her key business acumen. The figures can fluctuate around 45/50, giving preference to the most distinguished contribution point. Anyway, be ready with some explanation of such allocations in front of investors.

How to Divide Equity to Startup Founders, Advisors and Employees

If your startup comprises of three co-founders, the most suitable startup equity split is 30/30/40 – investors will not make a big fuss and your company still has a decision maker. It’s also possible to go for other options like 15/15/70, 20/20/60, or 25/25/50. However, in this situation, your co-founders receive less than 30% of company shares, which will become diluted even more in the end. If you are serious about working together with your team for years, express it with the help of numbers!

Three Possible Pitfalls to Consider

Investors

Never forget about venture or angel investors and their interests in your business. At the seed stage of funding, they usually ask for 20-30% (not more than 33%) of ownership in your startup. As a result, your shares will be diluted proportionally. As mentioned above, if initially, you had, for example, a 20/80 split and the investor received 30%, your percentage ratio of startup equity would fall to around 14/56. It may be unpleasant to admit that the investor now owns more of your startup than one of its co-founders. You can hardly do business without investments, yet make sure you take care of your partners and provide them with enough ownership at the beginning.

Co-founders

Unfortunately, one cannot be 100% sure in their partners. To secure oneself, it is highly recommended to put co-founders on a vesting schedule. Normally, sensible start-uppers sign a vesting agreement according to which co-founders will get their equity shares only over 4 years with a one-year “cliff” period. It means that in the first 12 months the person wouldn’t receive anything (even if he/she decided to leave the company). After this period, the agreed founder shares ownership percentage is transferred to the partner every quarter (or monthly) over the next four years. A vesting schedule helps to ensure that founders are a nice fit – and if you happen to have problems while working together, there’s a year to fix them with no losses.

Shareholder’s agreement

It is advisable to think about what would happen if one of your shareholders decided to leave the business and sell his/her shares. To avoid letting unwanted people into your company, consider the priority right for other shareholders to buy these shares (and include this point in the shareholder’s agreement). In addition to this, keep in mind that your former co-founder could become a “competitor” to your startup business and, what is more, headhunt your key employees. To be on the safe side, consult IT lawyers and work out a well-built shareholder’s agreement.

Share Allocation After Startup Acquisition

Some corporations might want to buy startups. The former gain control over the latter by purchasing all or a part of the startup’s shares/other assets. These deals are called Mergers & Acquisitions (M&A). In this case, the corporation can completely control and divide shares acquired during an M&A. The startup is taken over by a corporation and thus receives new decision-makers and shareholders. Shares of previous shareholders are usually sold to the acquiring corporation.

If your company wants to purchase a startup or a smaller tech company in Eastern European countries like Ukraine or Poland and needs M&A assistance, our team can provide you with proper legal and compliance services for IT.

A few years ago, Luxoft was considering purchasing an IT company in Ukraine. The main issue was in the restructuring of the IT company, but they also needed other M&A preparations. Luxoft decided to contact Alcor to receive these and other services. To start with, we filed a pre-M&A report and specified possible M&A opportunities and risks. The second step was to prepare a due diligence report that verified the legality of employment relations in the acquired company and proved that the company has ownership over its IP rights. Our lawyers and legal advisors conducted a detailed audit of the acquired IT company assets, real estate, IP & its protection, and business tax structure. Finally, we made the M&A purchase agreement prior to the deadline.

Scaling Up Engineering Resources in Eastern Europe

Eastern European countries are known for their talented software engineers and low taxes. The biggest IT talent pools can be found in Poland, Romania, and Ukraine – more than 500,000 developers. In terms of taxes, developers pay only 8%-14% in Poland, and there is no personal income tax for developers in Romania. If you have ever considered IT staff augmentation in these countries, it’s also necessary to think about the capacities of your company. Usually, to set up an offshore software team in Eastern Europe, co-founders should have enough investments starting from the Series A funding round.

Learn about BOT model in outsourcing to choose the most effective way of starting a business abroad!

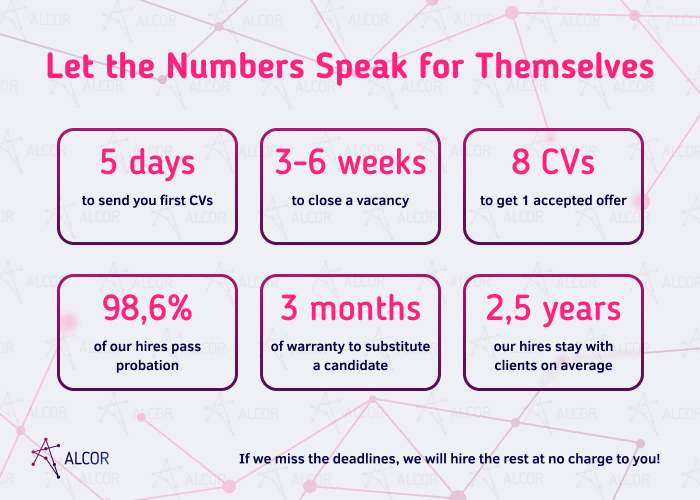

However, it’s not only about money but also about management resources and time. I recommend partnering up with a trustworthy international recruitment services provider in Eastern Europe to take the most out of offshoring. At Alcor, we specialize in hiring senior/lead developers for foreign tech companies in Poland, Romania, Ukraine, Hungary, Czechia, and Slovakia. Our IT recruitment department consists of 40 professionals who can hire a whole development team in a short period of time. We commit to hire 5 developers in a month, otherwise, we’ll hire them for you free of charge! Our candidate selection & hiring process is based on recruitment KPIs like time-to-hire (6 weeks) and CV pass rate (80%). To let you track the progress of IT recruitment, we file weekly IT hiring reports with analytics.

Moreover, Alcor can also deliver other operational functions that your business might need in Eastern Europe: legal & compliance support, payroll & accounting management, IT recruitment marketing services like employer branding and even stock option clarification for developers. A few years ago, the leading online fraud detection & management solutions provider from the USA – Sift – wanted to set up their software hub in Eastern Europe. They didn’t have enough internal recruiters to hire a team of developers and sought assistance in Alcor. With our help, Sift obtained a team of 30 developers in 1 year that included Head of R&D, Full Stack Engineers with rare skills, and many other positions. Alcor also explained to the client’s programmers the importance of stock options, ensured the legal compliance of the new Sift branch in Ukraine, and helped with employer branding.

Final Thoughts

No one would ever say that starting up a business is easy. Co-founders encounter the most crucial difficulties at the very start of their work, and startup equity allocation is one of them. Equal or close-to-equal splits of startup equity among co-founders are the most reasonable choice but you can allocate shares in a different way based on what value each of them brings to the project.

Investors value fair allocation of shares because it reveals to them a lot about the team’s cohesiveness. If a startup is not looking for investments but soon is going to be bought by another company, share allocation will be a task for the new owner. And in the case you have already handled this process among co-founders and began working with investors, you can get complete legal support and tech staffing assistance at Alcor.

FAQ

1. How many shares should a startup company have?

The average number of shares that a startup may issues is around 10-20 million.

2. How to divide equity among partners in a startup at the early stages?

In general, independent startup advisors account for a maximum of 5% of shares. Investors own 20-30% of startup shares, while the founders and co-founders should have more than 60%. You can also leave around 5% of available shares but allocate 10% to employees.

3. What happens to share distribution if a startup is bought by another company?

If a bigger company or corporation wants to buy a startup, it either purchases all or a part of startup shares. The purchased shares are fully controlled and distributed by the acquiring company. Shares of previous shareholders are sold to the new company.