The ongoing race for tech dominance is prevailing in the global arena. Many IT companies find themselves in a bind, wrestling with the challenges of dwindling talent resources and the uphill climb of labor costs. As a result, they’re increasingly turning their gaze to fresh, ripe markets, and Mexico stands tall as a promising choice. So, what does this Latin American destination have to offer?

I’m Sergiy Ovcharenko, CBDO at Alcor. We provide software engineering staffing in Mexico under our R&D center solution for US and European tech companies. In this article, I will take you on a deep dive into the software development industry of Mexico, exploring the growth of its key tech sectors. And the best part? You’ll uncover how to make the most of this thriving nearshoring destination. So, let’s jump right in!

Mexican IT Industry Overview

The race for digital transformation has propelled the IT industry in Mexico to remarkable heights, making it the second-largest technology market in the Latin American region. In just two years, its value surged from $22 billion in 2020 to an impressive $28 billion in 2022, and this growth shows no signs of slowing down. The tech market in Mexico is anticipated to grow at a CAGR of 10.6% over the next five years and is already significantly contributing to the country’s economic development and GDP.

What’s striking is Mexico’s robust and innovative tech ecosystem, encompassing government initiatives, tech parks, and startup investment. With 38 IT clusters and over 440 startups, the nation’s tech scene is thriving, with a significant concentration in Mexico City, one of the primary tech hubs in Latin America. But the tech prowess extends beyond the capital, with other vibrant tech hubs in places like Guadalajara, known as the Silicon Valley of Mexico, and Monterrey.

IT Services Market in Mexico

The IT sector in Mexico is on the fast track to success, driven by a shift towards service-centric offerings. Its value, along with the value of the digital economy, has already reached $60 billion, and a significant portion of that pie belongs to IT outsourcing. It has been growing at an average of 10%-15% annually, translating into $46 billion in exports. Impressive, right?

The largest revenue share in the Mexican technology industry comes from enterprise software, with $1.5 million in 2022 and a forecast to exceed $2 million by 2027. SaaS is expected to become the top IT product and service segment in Mexico over the next five years.

When it comes to software engineering companies, Mexico boasts around 400 of them. They cover everything, from IT consulting to custom software development, IT managed services, and web and mobile development.

The main driver of Mexican IT sector growth is the increasing proliferation of nearshore software outsourcing in Mexico. Here are a few reasons why North American IT companies opt for it:

- 700,000 software developers who rank 2nd in LATAM and 4th in the world for technology skills;

- Moderate labor costs, which are about 40-60% lower than in the USA;

- Geographic proximity and overlapping time zones which make the cooperation efficient and fruitful;

- Favorable business condition, ranking 10th in Kearney’s Global Services Location Index for financial attractiveness, people skills, and a business-friendly environment;

- Availability of USMCA, which establishes free trade relations, facilitates foreign investment and enhances protection of intellectual property rights.

Technology Trends in Mexico for 2024-2030

Cybersecurity. The fast proliferation of informational technology in Mexico and a surge in data processing made the country increasingly susceptible to cyberattacks. This vulnerability became evident during the pandemic, with a staggering 66% of all cyberattacks in Latin America targeting the Mexican IT industry. According to the Global Cybersecurity Index, Mexico currently holds the 52nd position among 182 countries regarding cybersecurity preparedness.

To fortify Mexico’s cybersecurity defense and attract more international companies to the market, the Mexican government introduced a comprehensive national cybersecurity strategy. Within this strategy, both AI and cloud technologies are recognized as potent tools to combat and mitigate cyber threats. These proactive steps have already set in motion the growth of Mexico’s cybersecurity market, which is projected to expand substantially, reaching an estimated value of $3.89 billion by 2028.

Learn more about IT outsourcing in Latin America and software development outsourcing in Mexico!

5G Technology. A notable trend within the Mexican technology industry is the deployment of 5G infrastructure. This advancement promises not only faster and more reliable internet connectivity but also bolsters the growth of domestic enterprises and attracts foreign investments, paving the way for new applications and services. On a longer-term horizon, by the year 2035, the integration of 5G technology into Mexico’s digital landscape is forecasted to yield a substantial economic and social impact, amounting to an impressive $730 billion across various sectors.

Currently, roughly 15% of Mexico’s population has access to 5G services, a figure trailing behind the United States, where 61% enjoy such connectivity. Nevertheless, 5G is poised for rapid adoption in the mobile broadband market, with expectations that 25% of mobile lines will incorporate 5G capabilities by 2023.

Smart Cities. Mexico’s National Digital Strategy is a blueprint for the nation’s dedication to ushering in the era of smart cities underpinned by digital technologies and data-driven solutions. Monterrey, Guadalajara, Mexico City, Querétaro, Tequila, and Puebla have embarked on the journey to become “smart cities.”

Their shared focus is developing robust digital infrastructure featuring vital components such as fiber-optic networks, smart mobility systems, public Wi-Fi networks, innovative waste management solutions, and energy-efficient technologies.

State of Different IT sectors in Mexico

Fintech

Since 2015, Mexico’s government has embarked on a mission to revolutionize how their citizens handle money. They’ve been championing electronic payments, waving goodbye to traditional cash transactions. The result? The tech industry in Mexico is now proudly home to the second-largest fintech ecosystem in Latin America, hosting over 20% of all fintech companies in the region.

Even in the face of a drop in investment funding due to fluctuating interest rates, the fintech landscape in Mexico is thriving. The number of fintech companies in Mexico surged in the past year, reaching a remarkable 650 financial tech startups, up from about 500 just the year before. Among them are such stars as Bitso, Clip, Konfio, Kueski, Stori, and Clara, all making waves in the fintech world. These companies specialize in payments and remittances, personal financial management, crowdfunding, and lending.

Due to the rapid evolution of fintech industry of Mexico, the government introduced the Fintech Law, positioning Mexico at the forefront of regulatory issues. The law is all about making finance more inclusive, offering greater clarity for users of fintech services, and igniting a vibrant spirit of competition within the market.

Artificial Intelligence

Since 2018, Mexico has embarked on a remarkable journey to promote the development of artificial intelligence (AI), unveiling its National AI Strategy. In doing so, it became the tenth country in the world and the pioneering nation in Latin America to formalize its approach to AI.

According to the Latin American Artificial Intelligence Index, Mexico’s AI landscape is thriving and ranks 5th globally, specifically in registering patents related to AI technology in Mexico.

This rapid AI advancement is further accelerated by the exceptional skills of Mexican software engineers, who are widely recognized as some of the region’s best experts in data analytics, management, and visualization. They have exciting opportunities to work at groundbreaking Mexican AI startups, such as Yaydoo, VR3io, FoodBot AI, and Omica.bio.

Mexico’s potential in AI technologies has not gone unnoticed by foreign IT companies either. For example, US-based software engineering company, Ascendion, is set to establish a center for Generative AI skills in Monterrey. This initiative is expected to inject at least $100 million into the country’s economy, underlining the immense promise of AI for the Mexican IT future.

Healthtech

For quite a long time, Latin American countries, including Mexico, have been struggling with a lagging medical system. Limited access to quality medical services, resources, and the need to modernize administrative processes served as driving forces for change.

The HolonIQ LATAM Health Tech 50 report is a testament to the remarkable strides being made in South American countries, particularly in Brazil and Mexico. These nations are emerging as hotspots for healthcare startups. One exciting development is the Mexican startup Prosit, which recently secured a significant $100,000 in funding from Google. This investment will supercharge Prosit’s focus on health innovation, harnessing the power of AI and LLM technologies.

In the bigger picture, the health technology market in Mexico has seen explosive growth, nearly doubling in size since 2018, now estimated at a staggering $1.6 billion. This rapid expansion has been most evident in such areas as mental health, telemedicine, health insurance, and dental solutions, all of which are leaving a positive impact on healthcare accessibility and quality.

Learn how to perform company incorporation in Mexico and explore how the EoR solution can free you up of its burdains!

Telecommunication

Recognizing the pivotal role of the telecommunications sector in driving digital transformation, Mexico’s government initiated a bold reform. Since 2013, it has yielded remarkable results, with a significant 42% reduction in the costs of mobile services. This has had a profound impact, extending internet access and enhancing communication quality for 81% of mobile customers across the region.

The outcome? Mexico has swiftly ascended to become the second-largest telecom market in the region, trailing only behind Brazil. In 2022, this thriving sector generated an impressive $30 billion in revenue. Notably, the mobile segment took the lead, constituting around 58% of this substantial sum, followed by pay TV at 25%.

What’s even more exciting is the future outlook. It’s anticipated that the total revenue from telecom and pay-TV services in Mexico will grow at a CAGR of 4.4%, primarily supported by contributions from fixed broadband and mobile segments.

Cryptocurrency & Blockchain

In Latin America, although the crypto economy is smaller compared to other regions, it’s thriving due to grassroots solid adoption. Notably, three countries have made their mark in the top 20 of the Global Crypto Adoption Index: Brazil (ranked 9), Mexico (ranked 16), and Argentina (ranked 15).

Mexico’s crypto segment is on a remarkable trajectory, expected to reach $980.3 million in revenue by 2023, with a robust compound annual growth rate (CAGR) of 14%. A pivotal moment occurred in June 2022 when Bitso, a leading Mexican cryptocurrency exchange, successfully processed $1 billion in crypto remittances between the US and Mexico. This milestone garnered global attention, spotlighting Mexico’s rapid progress in the world of cryptocurrency.

In the realm of blockchain technology, Mexico’s banking sector is the vanguard, representing a substantial 29.7% of the market value. Other industries are also embracing blockchain, including manufacturing (11.4%), discrete manufacturing (10.9%), and professional services (6.6%). What’s truly remarkable is that 40% of Mexican companies are actively exploring blockchain and cryptocurrencies, with a striking 71% specifically focused on cryptocurrency usage.

Curious about other LATAM markets? Unlock the trends and nearshoring benefits of the IT market in Chile and the IT sector in Colombia!

IT in Mexico vs USA

Just like Mexico, the USA is on its mission to supercharge its technological industry, actively embracing cloud computing, AI, ML, robotic automation, and 5G technologies. Over 582,000 IT companies in the US are already implementing these cutting-edge technologies, collectively adding a substantial over $400 billion in revenue to the national economy.

However, the growing number of tech product companies competing for qualified developers has created a burning issue: a talent shortage in the USA. According to the US Bureau of Labor Statistics, the demand for software engineers is projected to surge by a significant 22% between 2022 and 2030. Consequently, the competition for IT experts in the US drives up annual salaries, which currently exceed more than double the average wage in the US private sector.

In stark contrast, the technology sector in Mexico offers a wealth of skilled IT talent with annual compensations ranging from $20,000 to $70,000, depending on the level of expertise. As a result, engaging staff augmenation model in Mexico has emerged as an optimal solution for US tech businesses seeking to bridge the talent gap while maintaining cost-effectiveness.

Nice to meet you! We are Alcor — a Trusted IT Recruitment & R&D Partner

If your US-based IT company is struggling to find the right tech professionals, expanding abroad to hire developers in Mexico or any other Latin American country could be the solution you’re looking for. Dotmatics, for example, once were in the same situation. They had a vision to develop scientific software for biologists but needed help hiring experts. That’s where Alcor came in as their trusted partner. With our comprehensive assistance, Dotmatics successfully ventured into a new IT market and got a dedicated team of over 30 software engineers within a year. Similar success stories abound, with companies like People.ai, Sift, ThredUp, and many others.

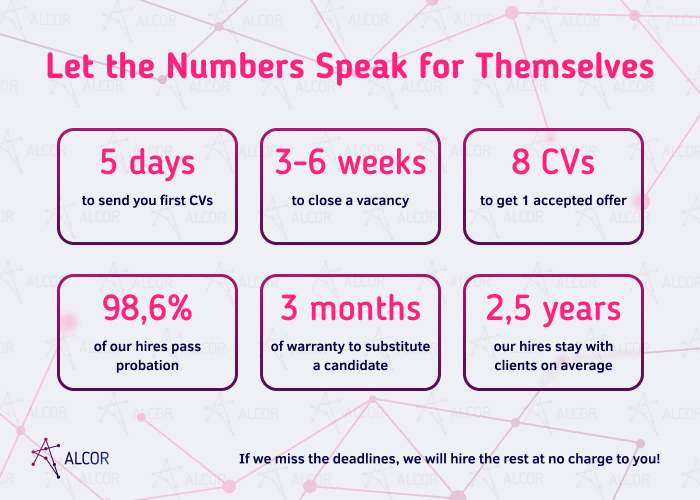

You can also achieve the same results with Alcor! We offer our R&D solution in Mexico, Argentina, Colombia, and Eastern Europe. It includes full-cycle IT recruitment, legal & compliance, payroll, tech infrastructure setup, and other operational support.

You can rely on the efficiency and quality of our services, as we’re committed to assembling a team of 20 developers, fully compliant with local labor laws, within just three months. Moreover, 98% of our candidates successfully pass their probation period.

Sounds interesting? Then get in touch with us to embark on your exciting R&D journey!