70% of tech leaders in the US report difficulties in filling roles, according to the latest ManpowerGroup research. With talent scarcity burning like wildfire, it’s no surprise that IT executives from the US go nearshore, with Chile shining brightly as one of the promising destinations. So, is there an untapped opportunity in the Chilean tech industry awaiting your tech business?

I’m David Gomez, Lead LATAM IT Recruiter at Alcor, a full-cycle R&D service provider that helps US tech companies hire top-notch software engineers in Latin America and Eastern Europe alongside comprehensive Employer of Record and other back-office support.

In this article, I’ll walk you through the thriving Chilean information technology market, describing its latest trends and issues. I’ll also compare the IT industry in Chile vs the US and provide you with an effective solution to enter this country’s tech market with flying colors.

Chile IT Industry Overview

General

The information technology industry in Chile is not only growing at an astonishing rate but also contributing greatly to the country’s economic growth. With a market value of $15.89 billion in 2022, it’s projected to reach $25.14 billion by 2027 at a compound annual growth rate (CAGR) of 9.61%.

But that’s not all — this Latin American gem also shines with a thriving startup environment. In 2023, Chile ranked 2nd in the region in the Global Startup Ecosystem Index, trailing only behind Brazil. Additionally, the country showcased a robust culture of innovation, securing the 2nd position in Latin America in the Global Innovation Index 2023. Thus, most of the startups are concentrated in the country’s capital, Santiago, which has been selected as the headquarters for 290 startup companies. No wonder this city made it into the top 5 of the Leading Cities for Startups in Latin America and the Caribbean in 2023. Today, Chile proudly hosts well-known unicorns such as Cornershop, a grocery delivery service acquired by and recently merged with Uber, and NotCo, a food technology company.

Yet back in 2022, the Republic of Chile found itself facing a shortage of 6,000 software engineers. This yearly deficit spurred the government into action, leading to the launch of digital transformation programs like Chile 2035, aimed at cultivating a new generation of skilled coders. Thanks to these initiatives, Chilean software developers now demonstrate an impressive level of expertise. As per the Coursera Global Skills Report 2023, local tech wizards have secured the 4th spot in Latin America and the Caribbean for their prowess in technology skills. They shine in areas such as cloud computing, programming, operating systems, and data analysis.

Eager to discover more about other tech markets in LATAM? Read our articles on information technology in Argentina and the Mexican tech industry!

By Sector

But wait, there’s even more! Some leading IT sub-sectors in the technology industry in Chile are worth particular mention, namely:

Telecom. Did you know that in 2024, Chile ranks 4th in terms of the speed of fixed broadband globally? What’s more, just two years ago, it had the fastest internet worldwide. What could be a better testament to the telecommunication services in the country? But wait, there are some more interesting numbers. Last year, for instance, Chile’s telecom market was worth a staggering $7.22 billion, and it’s expected to reach the $10 billion mark by 2029 with a growth rate of 6.13%.

In addition, Chile led the charge in Latin America by being the first to turn on 5G networks in 2021. But what’s truly impressive is the rapid pace at which 5G coverage has expanded across the country. By 2025, about 90% of Chile’s population should have 5G coverage, yet it has already reached 92%, encompassing 17.7 million users.

Fintech. The Fintech sector in Chile doesn’t trail behind and is experiencing a meteoric rise — last year, there were around 300 Chilean fintech startups, compared to 179 in 2021. Interestingly, over half of these startups focus on payments, remittances, financial management, and lending. All in all, the popularity of fintech in Chile is clear as today, around 85% of Chileans are on board with digital payments and have bank accounts, compared to 50% in 2011 and 2014.

According to Statista, this year, the largest market in Chilean fintech will be Digital Assets, with assets under management of $172.80 million. Moreover, in 2025, this market is projected to show a revenue growth of 15.72%.

E-commerce. Since the beginning of the Covid-19 pandemic, e-commerce has gained popularity among Chileans. According to International Trade Administration, the number of e-commerce users in Chile reached a whopping 12.7 million, which accounts for 64.8% of the population. And by 2027, the number is expected to reach 13.7 million.

Today, the Chilean e-commerce market stands as the 32nd largest globally. Moreover, projections indicate that this year, it is anticipated to reach an impressive $10,103.2 million. The forecast for the upcoming years also looks very promising — revenue is expected to grow at a rate of 8.6% annually, leading to market volume of over $14 million by 2028.

IT industry of Chile vs the US

As of 2024, the IT services market in the USA has surged to $461 billion, solidifying its position as the largest globally. With over half a million tech businesses and a workforce exceeding 9.1 million people employed in IT, the information technology market in the US is substantially larger than that of Chile.

Regarding their startup ecosystems, the countries also differ significantly. Nevertheless, the startup scene in Chile is booming, the United States is home to around 75,056 startups, holding a leading position worldwide. But what’s truly captivating is the rise of fintech startups. Just like in Chile, the number of fintech startups in the US has also skyrocketed, doubling since 2020 to over 10,755 in 2024.

But what about the IT talent pool and local salary rates? The technological sector in the US boasts a talent pool of over 4.4 million software engineers. Despite this rich abundance of developers, employers in the United States still encounter difficulties in filling roles. Regarding wages, those in the US are ca. 2.5-3 times higher than in Chile. For instance, a frontend developer in Chile gets around $38K a year, while the counterparts from the US earn $109K annually.

Talent scarcity combined with high hiring costs lead US entrepreneurs to explore alternative solutions, with IT nearshoring and outsourcing from Chile being among of them.

Are US Tech Companies Outsourcing to Chile?

Last year, American companies turned their gaze southward, boosting their hiring efforts in Latin America by 50% due to the burning talent scarcity back home. With Chile ranking among the top 5 IT markets in Latin America, US tech businesses are actively tapping into its flourishing talent pool, which boasts 61,000 ICT professionals. Result? This year, the IT outsourcing market in Chile is expected to reach a whopping $657.2 million. What’s more, this trend doesn’t show any signs of slowing down, with a CAGR of 12,16%, pushing the market volume to surpass the $1,04 billion mark by 2028.

As of April 2024, the Chilean tech sector hosts around 200 IT services companies that offer IT strategy consulting, custom software development, cloud consulting & SI, web and mobile app development, as well as BI & Big Data consulting.

Are there any global tech players in the country? The tech industry in Chile hosts giants such as Google, Microsoft, IBM, Amazon, Uber, Oracle, Meta, and more. Case in point: Recently, with an intention to roll into South America, Tesla decided to take its first steps in Chile and already opened its first store in Santiago a couple of months ago. What can better prove the promising potential of this Latin American tech market? Well, see yourself:

Software Team from 0 to 100 — Possible?

Intrigued by the idea of leaving your mark on the IT sector in Chile? Alcor can make it happen with our all-in-one solution for establishing your own software R&D center at 20%-40% lower costs than outsourcing and outstaffing. And here’s what it includes:

1. IT Recruitment

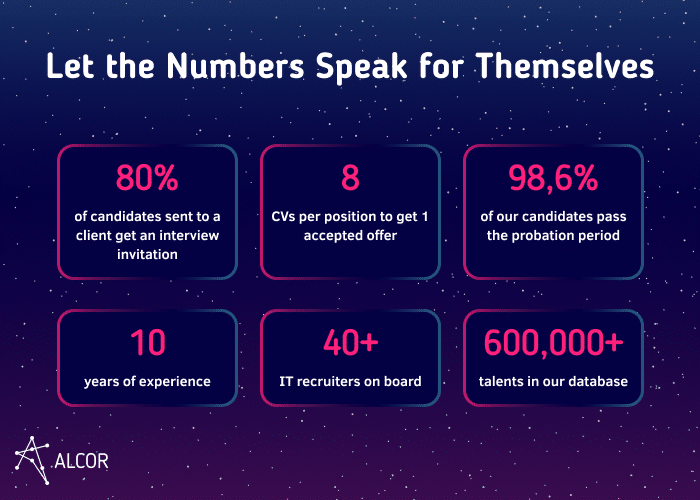

Our internal IT recruitment department comprises 40 seasoned headhunters dedicated to full-cycle IT staffing in Chile and other countries. We handle everything:

- crafting the perfect candidate profile;

- developing a tailored hiring strategy;

- sourcing, headhunting, and pre-screening candidates;

- providing weekly progress reports;

- conducting HR interviews;

- evaluating candidates based on their experience, English proficiency, and soft skills.

We can find your ideal developer within 3-6 weeks, ensuring their top-notch quality with a remarkable 98.6% success rate in passing the probation period.

2. EoR services

There’s no need to establish your legal entity if you hire with Alcor. In addition, we take care of all the nuts and bolts for your software development team, such as:

- employment of software developers;

- compliance with all local laws;

- tax payments;

- onboarding/offboarding;

- monthly payroll management;

- employee benefits coverage.

In case of a fine because of our mistake, we provide 100% compensation.

3. Full operational support

We don’t stop there and go even further with our additional surviсes:

- your employer’s brand promotion in the local market;

- hardware procurement for your software research and development team;

- office lease, plus negotiations of the best price and contract terms;

- insurance assistance;

- background verification;

- legal services (stock options plans (SOP), migration services);

- visa support;

- IT support.

We don’t stop there and assign a dedicated account manager to make your scaling experience in Chile as smooth and easy-going as possible.

Tech Trends in Chile for 2024-2030

AI

As for the tech trends, Chile’s making big waves in AI development across the region, as per the Latin American Artificial Intelligence Index. Indeed, Chile’s AI game, with an AI index of 73,21, surpasses the LATAM average, which is 42,61, with businesses and the government leading the charge. What’s our secret sauce, you ask? Well, it’s a winning combination of an inclusive citizen-involved AI strategy along with a dedicated coordinating body and active participation in shaping global AI standards and regulations. Interestingly, the Minister of Education recently announced the integration of digital technologies, including artificial intelligence and programming, into the national curriculum.

In the meantime, 70% of local companies are hopping on the AI bandwagon, as Accenture reports. These tools are helping them sift through mountains of data, streamline processes, and make smarter decisions. But it’s not just the big players in the private sector getting a digital makeover. Thanks to the national Chile Digital 2035 program, the country is on track to digitize the entire public sector by 2035. Now, that’s what I call progress!

Cloud computing

Apart from AI, cloud computing is also kicking into high gear in the country. Last year, for instance, this technology sector in Chile amounted to $1,112.82 million. Moreover, 53% of local IT companies planned to increase their budget in cloud migration.

Among the most recent updates is that Amazon Web Services (AWS), a leading cloud computing provider, got the go-ahead to build its first data center in Chile, Santiago. This project is no small feat, coming in at a hefty $205 million. It’s clear as day that the region has a growing appetite for cloud services. The numbers speak for themselves: by 2028, this market is set to reach $1,615.00 million.

Chile Technology Issues

The groundbreaking development of informational technology in Chile also gave rise to some acute issues. Just within the first half of 2023, over 4 billion cyber-attacks took place in the country. Yet these problems were not limited to Chile alone but affected the entire Latin American region, with Chile ranking as the 5th most affected country by such incidents.

The good news is that the nation has been actively addressing these cybersecurity risks. In late 2023, Chile revealed its cybersecurity plan for 2023-2028, aiming to protect critical information infrastructure. The bill also puts forth a fresh idea: requiring both public and private sectors to step up their cybersecurity game. Furthermore, in March 2024, the country took a significant step forward by enacting its flagship cybersecurity regulation, known as the Framework Law on Cybersecurity and Critical Information Infrastructure. The purpose of the Act is to guarantee the safety and uninterrupted delivery of vital services, even in the face of cyberattacks.

But let’s also look at the numbers: the cybersecurity market in Chile is projected to show a CAGR of 10.63% within the next four years. Thus, by 2028, the market volume will result in $439.50m.

We Build Turnkey R&D Centers in Latin America & Eastern Europe

Alcor is not a typical IT outsourcing agency. Instead, we help tech companies build their R&D centers and hire developers from Chile, Mexico, Poland, and Ukraine, as well as nearshore technology to Uruguay and other countries in LATAM and Eastern Europe. With this solution, you maintain complete control over decision-making and product development. Moreover, with our extensive back-office support and transparent pricing, you can select services tailored to your business needs.

Imagine this: A US-based company, People.ai, had big plans to expand offshore with its own team of software engineers. To make a smooth entry into the foreign tech market, they teamed up with Alcor. Our IT headhunters snagged over 25 top-notch tech talents, with half of them specializing in AI engineering. Our legal and finance experts took care of all the nitty-gritty details for People.ai’s setup in their preferred location. After this, we wasted no time in getting their office up and running. In just 4 short weeks, the company proudly opened its doors, fully equipped and ready to conquer the market. What about now? Well, they’ve got a bustling team of over 220 people on board, all geared up to fulfill People.ai’s ambitious plans.

Success stories don’t end with People.ai, as we also help such prominent tech players as Sift, Dotmatics, Gotransverse, and others.