The Economist summarizes the boost that the pandemic has given to tech hubs in Latin America: LATAM startups boomed in 2021 and attracted up to $16 billion. Meanwhile, the number of new firms backed by venture capital increased more than twofold in 2020-2023. In 2024, there will be even more startups. So, what do Latin American tech hubs have to offer?

I’m David Gomez, Alcor’s Lead IT Recruiter in LatAm. Our EoR and IT recruitment agency operates across Latin America and Eastern Europe. With Alcor, you can build a team of software developers from 0 to 100 in a year and even open your own R&D center abroad.

In today’s article, I’ll guide you through the list of top LATAM tech hubs, give you the stats regarding their ecosystem and overall potential, and explain how tech firms hire in Latin America.

Top Tech Hubs in Latin America in 2025

The future looks bright for tech. The Deloitte Tech Trends 2024 report singles out three macro and three micro forces driving the IT sphere. The major trends center around interaction, information, and computation. They, in turn, cover the soaring realms of digital engagement, machine learning, data analytics, and cloud. The minor IT trends include the business of technology, cyber and trust, and core modernization.

There’s more: AI, 5G enablement, cloud, and edge will be making strides in IT. In 2023, 30% of businesses in Latin America were producing AI-based solutions, while the cloud market in the region is expected to reach $18.7 billion by 2027, Technavio claims. As for 5G, Latin American tech is actively adopting this solution — Brazil, Chile, and Uruguay will have 77%, 68%, and 65% 5G coverage by 2030.

In this rating of LATAM tech hubs, I’ve factored in the IT trends outlined above, the IT Market in Latin America, the Global Startup Ecosystem Index 2023, plus more stats. We will first look at Central America, namely three prominent hubs in Mexico, and then at South America, covering Brazil, Colombia, Chile, Argentina, and Uruguay.

Ready to get an overview of LATAM software development? Off we go!

Mexico City

Accenture expects Mexico to become one of the Big Six in 2025, while Goldman Sachs forecasts it will rank as the world’s fifth-largest economy by 2050. This country is blazing the trail with its government programs and tech infrastructure. 500 Startups LatAm and Fondo Nacional Emprendedor offer support for aspiring software engineers.

Mexico has 700,000 coders, 2nd in LatAm and 4th in the world for tech skills, according to Coursera. In addition, there are 20+ tech parks across the country, including Apodaca Technology Park, Creative Digital City, Guadalajara Software Center, and Monterrey Technology Park.

If you plan to hire developers in Latin America, Mexico is a place to consider. Let’s start with the biggest tech hub, Mexico City.

Here’s the gist:

- Rating: 1st in Mexico, 1st in Central America

- Startups: 386

- Top in: Fintech

- Top universities: the National Autonomous University of Mexico and the National Polytechnic Institute

- Foreign tech corporations with hubs in Mexico City: Google, Amazon, Microsoft

Mexico houses 9 unicorns, most of which originated in Mexico City. In fintech, Clara, Clip, and Konfio lead the way with valuations of $1.3B, $1B, and $2B. Clara helps enterprises manage expenses, Clip designs multiple payment systems and an in-built phone card reader, and Konfio revolutionizes the industry by powering SMEs with funding.

Monterrey

Monterrey is magnetic for investors with its 100+ innovation parks and 320 companies, counted by El Economista.

Here’s more:

- Rating: 2nd in Mexico, 2nd in Central America

- Startups: 92

- Top in: Edtech

- Top universities: Tec de Monterrey, University of Monterrey, and Autonomous University of Nuevo Leon shining bright

- Foreign tech corporations with hubs in Monterrey: Cisco, Honeywell

Monterrey has produced stunning unicorns. Take Nowports. The automated digital freight forwarder rose from $80 million in 2021 to a $1.1 billion valuation in 2022 — quite a leap for a startup. In Edtech, there are more companies to watch, such as Vinco, Robin Academy, and Labgo, which have a rising revenue curve.

Guadalajara

Guadalajara is often considered the Silicon Valley of Mexico. The city is designed following the Triple Helix model of innovation, which creates a space for efficient interaction between academia, industry, and the government.

Guadalajara also has a Creative Digital City project for the future, and here’s what its ecosystem looks like now:

- Rating: 4th in Mexico, 4th in Central America

- Startups: 64

- Top in: Fintech

- Top universities: ITESO, Universidad de Guadalajara, and Universidad Autónoma de Guadalajara

- Foreign tech corporations with hubs in Guadalajara: IBM, Intel, Oracle

Guadalajara’s most famous unicorn, Kueski, provides online microloans for consumers. It’s widely recognized — in 2024, Amazon Mexico partnered with Kueski to offer personal loans and Buy Now Pay Later (BNPL) solutions, completely entrusting the tech part to the platform.

São Paulo

Brazil has a potent entrepreneurial culture. With over 43 tech parks in operation and 60 yet to be implemented, it provides a robust tech environment for 500,000 IT specialists.

São Paulo attracts 60% of Brazil’s start-up investments and has the highest concentration of regional unicorns — 11 highly evaluated startups. Here’s more stats about this tech hub:

- Rating: 1st in Brazil, 1st in South America

- Startups: 1098

- Top in: Fintech

- Top universities: University of Sao Paulo, Sao Paulo State University, Federal University of Sao Paulo, Brazil State University

- Foreign tech corporations with hubs in São Paulo: Amazon, Uber, Spotify

The most widely recognized Brazilian unicorn is Nubank, one of the world’s largest platforms for digital financing. In 2023, its customer base expanded to a whopping 80 million!

Bogotá

Software development in Colombia will reach a market value of $35 billion by 2027. The country houses 1300 startups and 150,000 software engineers, while 15,000 Latin American developers graduate annually.

The country’s public sector provides incentives for tech businesses, such as the Young Entrepreneurs Law, which promotes business activity and investment.

62% of Colombian tech companies have headquarters in Bogota. Here’s more about this tech hub:

- Rating: 1st in Colombia, 2nd in South America

- Startups: 807

- Top in: Food tech

- Top universities: National University of Colombia, University of America in Colombia, University of the Andes Colombia, Pontifical Javeriana University

- Foreign tech corporations with hubs in Bogotá: Accenture, Microsoft, Teravision

Bogota is home to Addi, an online platform for point-of-sale financing. In 2021, it had a valuation of $700M. And despite a dip in VC investment, it secured $86M of funding in March 2024. In the food tech sphere, there’s a soonicorn Frubana, an online marketplace connecting local farmers with restaurant chains.

Santiago

Chile can rightfully be called the tech mecca of Latin America. Why so? It leads AI development in the region, boasts 92% 5G coverage, and has recently had a 53% rise in cloud investments. Chile ticks all the IT trend boxes!

Chile also has the 3rd largest IT workforce in LatAm. Chilean coders stand out in English skills, securing 10th place in the region, as well as tech skills — 12th globally and 39th in data science.

Learn more about Santiago:

- Rating: 1st in Chile, 3rd in South America

- Startups: 435

- Top in: Fintech

- Top universities: University of Chile, Pontifical Catholic University of Chile, University of Santiago de Chile

- Foreign tech corporations with hubs in Santiago: Amazon, Microsoft, Google, Oracle

Santiago delivers spectacular unicorns. A recent one, Betterfly, is the only Latin American insurtech in the top 50 from CB Insights. The platform offers flexible employee insurance, including life insurance increasing with trackable healthy habits.

Buenos Aires

Argentina’s IT market value of $11B makes it 3rd most significant in Latin America. The country also flourishes with 3,800 tech businesses and 1,107 startups, including unicorns like Mercado Libre, OLX, Globant, Neuralsoft, and others.

Software development accounts for 58% of foreign direct investment, so the Argentinian government enacts innovative programs, such as Argentina Innovadora 2020, Argentina Conectada, and Argentina Programa 4.0. The latter strives to teach 70,000 young programmers in a year. That adds to a robust IT talent pool of 130,000 programmers and 20,000 yearly STEM graduates. Argentinian IT professionals rank third for tech skills and first for English proficiency in Latin America.

Let’s take a look at its capital, Buenos Aires, one of the top 5 tech hubs in LatAm:

- Rating: 1st in Argentina, 4th in South America

- Startups: 369

- Top in: E-commerce, Fintech

- Top universities: University of Buenos Aires, National Technological University, Buenos Aires Institute of Technology

- Foreign tech corporations with hubs in Buenos Aires: Intel, IBM, HP, Cisco

Mercado Libre is the resounding confirmation of Argentinian startup potential. It’s not just a unicorn but LatAm’s largest e-commerce company with a valuation surpassing $10B. It’s also doing well on the stock market. Today, Mercado Libre’s stocks are worth 84% more than one year ago. And that’s not all: in 2023, the digital king from Argentina earned $685 million and expanded its business in 18 markets.

Medellìn

Medellin is a 2nd vibrant LATAM hub based in Colombia. Let’s see what it’s got:

- Rating: 2nd in Colombia, 7th in South America

- Startups: 286

- Top in: E-commerce, Fintech

- Top universities: University of Antioquia, Pontificia Bolivariana University, EAFIT University, CES University

- Foreign tech corporations with hubs in Medellìn: Amazon, Huawei, Tuya Smart

Medellìn has yet to deliver unicorns, but its startups are no less noticeable on the tech scene. One of them is La Haus, a Colombian end-to-end online residential platform for buying and selling real estate. This “proptech” raised $135 million and was backed by Jeff Bezos in one of the rounds.

Montevideo

Despite being small, Uruguay is set to reach new heights: its software market will hit more than $308 million in 2028, while the IT services market will peak at $1 billion in 2029. Besides, Microsoft concluded that Uruguay has the highest proportion of programmers skilled in AI tech in Latin America, overtaking Chile and Brazil.

Montevideo is home to 85% of IT professionals, and it’s time to examine its infrastructure:

- Rating: 1st in Uruguay, 9th in South America

- Startups: 56

- Top in: E-commerce & Retail

- Top universities: University of the Republic, University of Montevideo, Catholic University of Uruguay

- Foreign tech corporations with hubs in Montevideo: Cognizant, Microsoft, Oracle, Netflix

Uruguay’s unicorn, dLocal, nabbed a $5B valuation after five years of maintaining the platform for connecting global merchants with emerging market consumers. TechCrunch emphasized that the last few billion came in a matter of months.

How to Choose Where to Build Your Software Team in Latin America

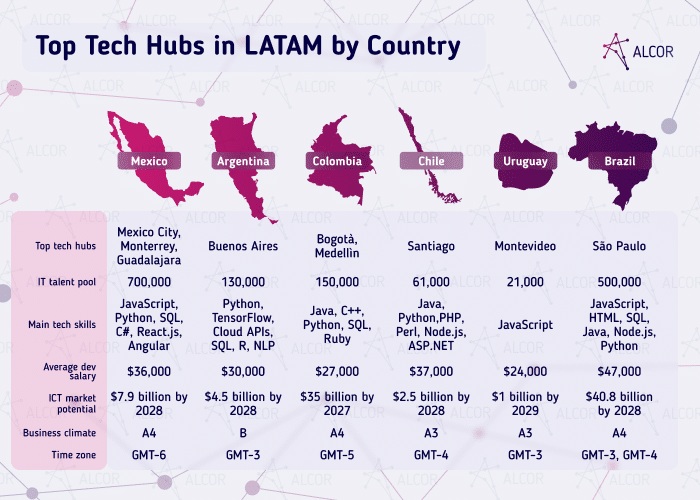

Let’s conclude with a summary of the things to know about the countries mentioned:

With such a wide choice of Latin American tech hubs, what is the best way to expand to these bustling areas? You’ll need to decide on the model and the provider.

IT Outsourcing

When it comes to cooperation models, outsourcing to LatAm is the most popular option. It takes product development off your shoulders by engaging a team of developers via a third party. However, that doesn’t come without pitfalls. It’s rather short-term, you incur data security risks by sharing your IP, and code quality may not be the best — programmers tend to show limited dedication, not to mention cloudy pricing.

Staff Augmentation

IT staff augmentation in LatAm, which involves leasing certain software developers employed by your provider, is a slightly better option but shares a common vice with outsourcing. Want to hire the coders as part of your team? Pay exorbitant buyout fees.

Employer of Record

There is a way to cooperate with LatAm coders without the hassle and risks of outsourcing. Employer of Record is the ultimate solution for tech companies expanding their development teams abroad. With this model, you can hire coders on your behalf without opening a legal entity in LatAm. Your local EoR provider will cover everything from the employment of software developers, HR, and payroll to compliance and employee benefits management.

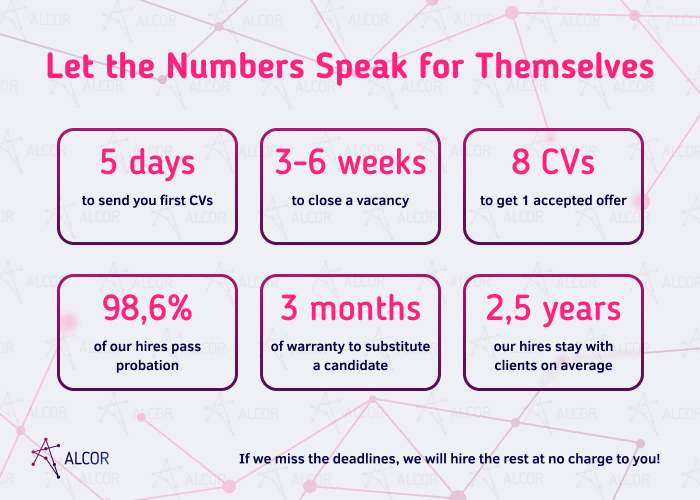

How to choose a partner? Look at their expertise in the local market, experience in tech recruitment, pricing model, track record, client reviews, and guarantees. For example, we at Alcor are well-versed in tech and legal — check out our case for Ledger. Our recruiters close a tech position in 2-6 weeks and work via a transparent pricing model — no buyout fees or rate cards, only direct salaries. Additionally, we fully compensate any fines caused by our mistake. Our 95% NPS score speaks for itself!

Tip to Build Your Software Team in Latin America Fast and Easy

Alcor’s team of 40 headhunters, lawyers and accountants, experienced in LATAM IT recruitment, offers a unique solution: EoR and tech recruitment in one place. We specialize in hiring senior software developers and focus on “wowing” our clients, hence our 100% EoR customer retention rate in 2023.

Let me share our “wow” results for Dotmatics, a US scientific software company aiming to hire 30+ talented developers abroad in a year. Not only did we do that and hire a Director of Engineering, Full Stack, React, QA Automation, DevOps, Node.js, and other professionals, but we also filled most positions with the first candidate. On top of that, we took care of legal matters and back-office operations, ultimately helping Dotmatics run a fully transparent business abroad.

We offer even more: an opportunity to open your R&D center in your chosen location, with Alcor in charge of office lease and IT equipment procurement on top of managing hiring and legal aspects.

Curious? Drop us your request!