Mexico stands out as a top choice for IT companies from neighboring North American countries that seek nearshore software development. Its skilled workforce, moderate labor costs, and geographic proximity are those factors that lure international tech giants like Google, Netflix, Apple, Microsoft, Oracle, and Dell to embrace Mexico’s potential.

However, taxes for owning a business in Mexico remain a burning concern for international tech companies. Alcor, with its legal advisers and IT headhunters in Mexico, is here to guide you!

I’m Viktoriia Keliar, COO at Alcor, with deep expertise in legal compliance and tax structuring for IT businesses. In this article, I’ll take you through Mexico’s tax landscape, shedding light on potential challenges and ways to partner with local developers. And that’s not all – I’ll also unveil how the R&D solution coupled with IT recruiting in South America can speed up your expansion while keeping your tax obligations in check.

Mexican Economy Overview

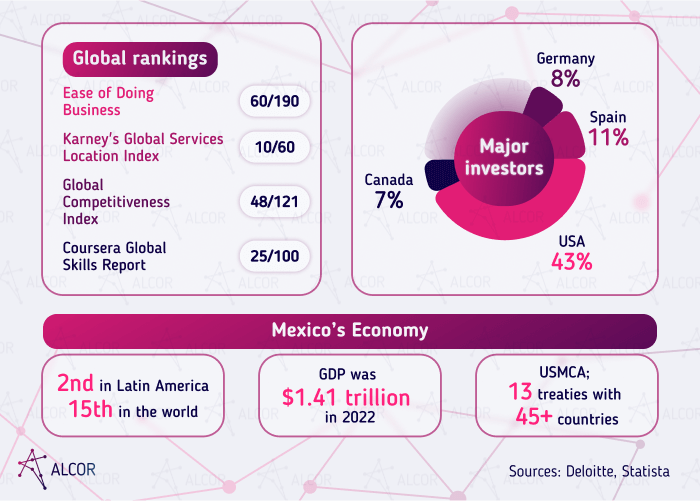

Over the past decade, Mexico’s economy has been evolving unprecedentedly, becoming more open, competitive, and full of attractive opportunities. In 2022, Mexico achieved a historic milestone, with its GDP soaring to a record-breaking $1.41 trillion. This solidified Mexico’s position as the second-largest economy in Latin America and 15th largest globally. Some of the main drivers of Mexico’s GDP growth are the national IT industry and the digital economy.

The software development industry in Mexico saw skyrocketing growth in recent years, with an average annual growth rate of 10.6%. What’s igniting it? The AI sector in Mexico is booming, and the wealth of highly skilled and affordable talent makes it a hotspot for nearshoring. Deloitte even predicts that this business practice could inject a substantial 3% boost into Mexico’s GDP over the next five years.

Another contributor to the thriving economy in Mexico is international partnerships. The USMCA trade agreement increases Mexico’s exports while allowing the USA and Canada to trim their expenses on goods and services. Furthermore, Mexico’s network of 13 treaties with over 45 countries provides a gateway to a whopping 61% of the world’s GDP and over 50% of global trade. It’s like having a golden ticket to the heart of the worldwide marketplace!

In general, doing business in Mexico with a partner to confirm documents/taxes with the local laws is beneficial. Mexico ranks 60th in the Doing Business index, making it the second-best performer in Latin America. In Kearney’s Global Services Location Index, Mexico shines in the 10th position, offering exceptional financial attractiveness and a business-friendly environment.

Unsurprisingly, many international companies allocate their funds to Mexico’s development. The government’s incentives and tax breaks, part of the Mexico Investment Program, are a magnet for foreign direct investment. The majority of these investments come from the USA (43%), followed by Spain (11%), Germany (8%), and Canada (7%).

Mexican Regulation for Tech Business

In Mexico, no specific legislation is tailored to regulate the IT business. The lack of dedicated IT laws means that software product development activities fall under the purview of civil and commercial laws, such as the Code of Commerce, the Federal Consumer Protection Law, and Mexican Standards (NMX). However, speaking of the Fintech sector in Mexico, there is a notable “Fintech Law” that regulates electronic financial technology institutions (FTIs), including crowdfunding companies and institutions engaged in electronic fund payments (e-money institutions).

As for regulatory authorities, the Federal Telecommunications Institute (IFT) oversees information and communications technology (ICT) activities. The Mexican Consumer Protection Agency (PROFECO) manages e-commerce activities and safeguards consumer rights in online transactions. Additionally, the Federal Institute for Access to Public Information and Data Protection (INAI) is tasked with supervising the enforcement of Mexican Data Protection Laws, ensuring the privacy and security of personal data in the digital realm.

Taxes in Mexico for IT Sector

If you’re considering the option to incorporate in Mexico, it’s essential to understand the country’s taxation regime, especially if you’re in the IT domain. Here are some essential business taxes in Mexico that tech companies should be aware of:

Value-Added Tax

The value-added tax (VAT) is one of the most common business taxes in Mexico City and throughout the country, constituting 16%. Interestingly, taxpayers with tax addresses in the northern border region of Mexico may qualify for a reduced 8% VAT rate if they meet specific requirements.

It’s crucial to note that VAT applies to most transactions in Mexico, even when a Mexican company provides services to American clients. The transfer pricing rules may also be an issue if a US company decides to establish a branch in Mexico.

Corporate Income Tax & Withholding Tax

Among other taxes for businesses that move to Mexico from the USA is corporate income tax (CIT). The Federal Income Tax Law (LISR) in Mexico states that every company in Mexico (including foreign entities with permanent establishments) must pay a corporate income tax of 30%. Meanwhile, when dividends are paid from profits that have already been subject to a CIT 30%, an additional 10% Withholding Tax is applied to the remaining amount, resulting in an overall effective corporate tax rate of 37%.

Besides, business taxation in Mexico is quite different if research and development activities are performed. For example, some companies may apply for a tax credit of up to 30% on the company’s R&D income.

Personal Income Tax

Income Tax in Mexico (ISR in Spanish) hinges on the tax residency status, and the Federal Tax Code determines this. To be considered a tax resident in Mexico, you must have established your life here, which could mean having a home or vital interests in the country.

An individual must pay income tax in Mexico if they have a job, operate a business, rent a property, or maintain an interest-bearing bank account. Just like in the US, the tax rate you’ll face depends on your earnings, deductions, and various factors. In Mexico, personal income tax rates range from 1.92% to 35%.

For instance, let’s take a software developer with an annual salary of $60,000. They can expect an overall tax obligation of around 30% of their salary. This means their net income, after taxes, would amount to $42,000.

When an employee is classified as a non-resident for Mexican tax purposes, the tax rate applied to their compensation will fall within the range of 15% to 30%. An important point is that the first $7,000 of employment income received within a 12-month rolling period is exempt from taxation.

Check out our article, if you also want to know more about corporate taxes in Colombia

In the meantime, managing taxes for US companies doing business in Mexico and relocating their employees can be complex and time-consuming. Employees may be required to file tax returns in both Mexico and the United States, which could result in double taxation if not handled correctly by legal experts. The real issue is that hiring foreigners is restricted by the Mexican Labor Code. Generally, only ten percent of employees in a company can be foreigners.

To address the issue of double taxation, Mexico has established around 75 tax treaties designed to lessen or eliminate tax withholding for non-residents. The USA and Canada have entered into double taxation agreements with Mexico, providing relief and clarity in this area.

Taxes on Employment & B2B

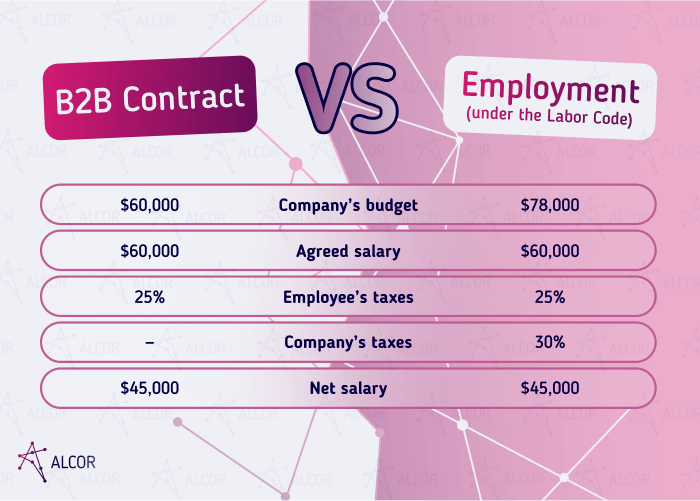

Apart from taxes, American IT businesses that want to take advantage of the affordable developer salaries in Mexico should consider optimal models for hiring these tech experts. Basically, there are two of them.

The traditional employment model (under Mexico’s Labor Code) presupposes taxes for software developers and the employer. For example, when an employee earns $60,000 per year, they are subject to a 25% tax from their income, while the company is obliged to pay 30% in taxes.

Programmers contracted on the B2B terms with an income of $60,000 annually are subject to 25% of taxes. It’s worth mentioning that most Mexican IT specialists work based on a traditional employment model. However, they are usually open to B2B relations if their employer is a foreign company.

Below, you can find the evaluation of personnel taxation in Mexico:

* This table illustrates tax calculations with an assumed annual income of $60,000. Please note that tax rates can vary based on the income level.

Taxes in Mexico vs the United States

The federal corporate income tax rate in the United States is a flat 21%, offering a 9% advantage over Mexico’s rate (30%). But here’s the twist: 44 US states have their own corporate income taxes, ranging from 1% to 11.5%. This is quite different from Mexico, where corporate income isn’t taxed at the state level.

When it comes to personal income tax, the United States has a bit of a mixed bag. The federal income tax ranges from 10% to 37%. On top of that, state income taxes can vary widely, from 0.25% to a high of 13.3%, notably in California, which imposes the highest state tax rate.

One important difference to note is that not all businesses are taxable as corporations in the U.S. Some, known as pass-through entities, like sole proprietorships, limited liability companies, and S corporations, are subject to personal income tax.

In contrast, Mexico takes a simpler approach. Personal income tax is exclusively a federal matter, and it ranges from 1.92% to 35%, depending on an individual’s annual income.

When it comes to taxes, it’s important to note that businesses and individuals in the United States must also make social security contributions (SSC). Here’s a breakdown:

- American employees and employers each contribute 6.2% of an employee’s wage, resulting in a combined contribution of 12.4%.

- Additionally, there’s a separate Medicare insurance tax of 2.9% applied to wages.

Sole proprietors in the U.S. are responsible for a total SSC of 15.3%.

Mexico follows a somewhat more complex structure:

- Social security contributions for companies in Mexico can vary, ranging from 44.9% to 60%, depending on various factors.

- In contrast, employees in Mexico contribute 2.8% of their relevant wage to social security.

Value-added tax for business in Mexico City and the country’s states constitutes 16%. On the other hand, the United States also has a similar system, but the sales tax rate can vary. It’s determined by individual states and local jurisdictions.

Typically, the total sales tax rate is calculated by combining the state and local rates, resulting in a range from 1.8% to 9.5%. Some US states, however, do not impose a sales tax. Instead, they opt for a gross receipts tax, with rates generally falling between 0.1% to 1%.

This shows that while both countries have a taxation system in place, the specific rates and methods can differ significantly.

| Taxes | USA | Mexico | |

| federal | state | federal* | |

| Corporate Income Tax | 21% | 1%-11.5% | 30%** |

| Personal Income Tax | 10%-37% | 0.25%-13.3% | 1.92%-35% |

| VAT/Sales Tax | ≈1.8%-9.5% | 16% | |

| Social Security Rate | 15.3% | 44.9%-62% | |

* Mexico imposes the mentioned taxes only at the federal level.

** Please note that the final corporate tax rate would be 37% (effective), considering the withholding tax applied to dividends.

Prevalent Challenges of Doing Tech Business in Mexico

Complex payroll

Payroll in Mexico requires many calculations and comprises various payments: personal income tax withholding, occupational risks, sickness, maternity, disability, retirement, social benefits, and state payroll tax.

Some of those payments are deducted from the employee’s salary but need to be calculated and withheld by the employer at source. Other payments are the employer’s obligations, which lead to higher budgeting costs. For instance, if the agreed employee’s salary is $60,000, the actual employer’s budget for this employee can be $78,000 or even higher.

Another issue to consider is a 13th-month salary payment, which is mandatory for doing business in Mexico. This is a bonus paid by December 20th. It is calculated as 15 working days of the employee’s salary and an allowance based on a 365-day year.

Strict labor rules

The labor law system in Mexico is notably pro-employee. That’s why it’s crucial to understand its nuances when employing software developers to ensure you comply with their rights. The most prominent differences include:

- possibility of having a 48-hour workweek

- 2x salary for overtime work

- 8 annual paid public holidays

- guaranteed 12 days of paid vacation after one year of work.

Currency rates fluctuations

The official Mexican currency is MXN (Mexican peso). All transactions within Mexico have to be made in MXN. It is a fully convertible currency; however, its exchange rate is relatively volatile, which may lead to hardships in budgeting.

Ban on Outsourcing in Mexico

In April 2021, the Mexican Federal Labor Law Amendment prohibited employers in Mexico from subcontracting their personnel (unless for specialized services). This change has posed challenges for foreign companies looking to benefit from software outsourcing to Mexico. The fine for carrying out prohibited subcontracting activities or intermediation without authorization in 2023 is set at up to $300,000.

Why is it taking place? In Mexico, there’s something called profit sharing, where employers are obligated to share 10% of their profits with employees (excluding general directors and managers). However, some companies discovered a way to avoid these payments, prompting the government to take decisive action.

How can foreign IT companies work with Mexican software engineers? To nearshore software development legally and efficiently, foreign tech companies can consider two potential solutions:

- Use the EoR services of the local partner. This cooperation model allows foreign tech companies to engage with software development teams without establishing a legal entity in Mexico. Programmers are employed on B2B terms, which makes the cooperation lawful and profitable for both parties.

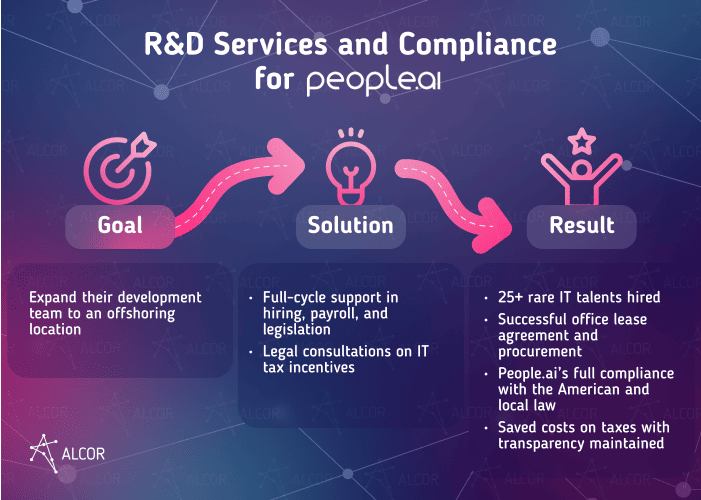

- Assemble your R&D team. Due to overwhelming bureaucracy, starting a business in Mexico and paying taxes can be a time- and cost-consuming process. Plus, there is an obligatory CIT for permanent establishments. Still, it’s possible to have a dedicated team of programmers under an R&D model. It encompasses IT recruitment coupled with operational support to help foreign companies navigate the Mexican labor and legal landscape. Here is the case of People.ai to give you an idea of how it works for US-based product IT companies abroad:

Hiring Developers in Mexico Can be Simple with Alcor

As you can see, taxes in Mexico regarding business are a total of peculiarities. Plus, it can be a real headache for IT companies to hire software engineers in Mexico. So, if you decide to use nearshore technology in Mexico, your panacea is cooperation with a service provider like Alcor.

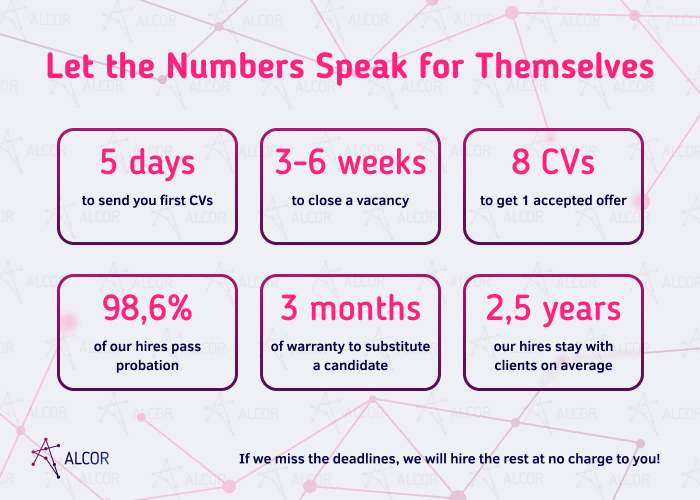

We are your boots on the ground in Latin America and Eastern Europe, specializing in full-cycle IT recruitment and R&D services. Our team of 40 tech headhunters will find and hire perfect fits for your development team, while our accounting and legal departments will serve you as guiding stars in Mexico’s tech market. In addition, we’ll assign an account manager to help you deal with any operational matters.

Our one-stop-shop services came in handy for a US-based IT company, Sift. Not only did they get a team of 30 developers within one year, but also received comprehensive legal guidance. We made our client fully compliant with American and local laws and performed tax management, labor & contract law assistance, and IP rights protection.

Ready to supercharge your IT company with top-tier talents in Mexico? Alcor will build you a fully compliant R&D team in 6 weeks!