According to a McKinsey survey, about 87% of tech executives see the talent gap as their main challenge in keeping up with a fast-paced market reality. Fierce competition for top developers and soaring labor costs only add fuel to the fire. So, many overseas businesses are opting for budget-friendly solutions, with a whopping 65% choosing to outsource to Eastern Europe. But is it worth the candle?

I’m Dmytro Ovcharenko, Alcor’s CEO, with over 15 years of experience in helping US and Western European IT companies expand to Eastern Europe and Latin America. We have already built fully backed R&D centers for such tech giants as People.ai, ThredUP, BigCommerce, and Grammarly.

In this article, I’ll provide some key insights into software development outsourcing in Eastern Europe, including its IT scene, talent pool, average developer rates, and taxes, and cover some of its principal IT hubs. So, let’s jump right in!

4 Latest Worldwide Trends in IT Outsourcing

1. India is losing its ground as a leading IT outsourcing destination

India was considered one of the top IT outsourcing destinations for over a decade. While some countries were making the first steps in their long outsourcing journey, India could already provide foreign tech companies with a large and cheap IT workforce. But as we know, low price often comes with its own cost, and in the case of India, it’s the quality of the code.

So, what are the prerequisites for that? Firstly, it’s an ineffective college education. According to the National Employability Report for Engineers, only 60% of Indian developers can produce clear code, while just 3% possess new-age tech skills. Secondly, it’s attitude towards work. Since most Indian programmers are paid low wages and are forced to undertake several projects at a time, it’s not uncommon for them to show inadequate motivation, dedication, and accountability. As a result, they tend to perform mediocre work (if not resorting to plagiarism). Another aspect is cultural mentality, which is a stumbling block to effective cooperation between American tech companies and Indian developers.

Since today’s software outsourcing goes well beyond mere cost reduction, India falters in comparison to destinations with a much better price-to-quality ratio. One of such alternatives is IT outsourcing to Eastern Europe.

2. China’s IT outsourcing pitfalls scare away more and more companies

Known for its enormous tech talent pool, China has been luring foreign IT companies to leverage the benefits of software outsourcing by getting diverse expertise and technology. However, with the rapid expansion of the outsourcing market and the appearance of various outsourcing alternatives, the drawbacks of IT development delegation to China became more vivid.

The first aspect is copyright issues. As it is known, Intellectual Property Rights (IPR) protection is of great importance when it comes to outsourcing. Since vendors get access to sensitive data, they could put the exclusivity of the client’s end product at risk. Not all service providers in China comply with international IPR rules, which sometimes results in data breaches. The same applies to quality control since Chinese standards differ from those in the USA and Europe.

Other issues are language barrier and time difference which undermines efficient communication and production, increasing the chances of getting a poor-quality software product. Keep reading to learn more about the differences between software outsourcing in Eastern Europe and Asia.

3. Nearshoring to Latin America is on the rise

As the global outsourcing scene transforms, Latin America has emerged as a top region for nearshoring among North American companies. According to the new report by the U.S. Chamber of Commerce and Ipsos, 28% of businesses manufacturing in Asia are eyeing an exit from the region within the next five years. Meanwhile, a significant portion of companies not yet established in Mexico (14%), South America (11%), or Central America and the Caribbean (6%) are planning to enter LATAM during that same period.

The report by IDB states that nearshoring could add an annual $78 billion in exports of goods and services in Latin America and the Caribbean, with Mexico and Brazil set to reap the lion’s share of benefits. So, what factors attract more and more business to this region? A sizable pool of skilled workers, reduced labor costs, long-standing bilateral relations, as well as time zone and cultural compatibility, stand out as the primary attractions for nearshoring to Latin America.

4. BPO services outsourcing is booming

Amidst the rise of the gig economy and the persistent challenge of finding skilled talent amidst escalating costs, technology companies are increasingly turning to outsourcing in Eastern Europe and other offshoring regions to fuel their growth. In fact, Business Process Outsourcing (BPO) stands tall as a dominant force in the global outsourcing market, with forecasts predicting its market size to soar to $586.92 billion by 2030, growing at a 9.6% CAGR.

Workforce managers can strategically harness various BPO services, from front-office tasks like marketing, customer service, and tech support to back-office essentials like payroll, HR, compliance, office logistics, and hardware procurement. For IT companies eyeing team expansion, back-office BPO services emerge as an attractive option, seamlessly integrated into their offshore development centers. This approach offers operational flexibility and cost savings while allowing them to stay laser-focused on their core objectives. Moreover, it shields them from the risks often associated with traditional IT outsourcing.

Major players in the tech realm, such as Google, Amazon, Microsoft, Apple, Oracle, and Intel, have already reaped the rewards of establishing offshore software development branches, tapping into the potential of this evolving business model.

Reasons to Outsource IT to Eastern Europe

Large IT Talent Pool

Eastern Europe boasts 1.5 million software developers, with Poland, Romania, and Ukraine leading the pack. This pool broadens year by year, as local higher educational institutions bring up about 80,000 STEM specialists annually. In fact, 133 of these universities are in the QS World University Rankings which means that Eastern European programmers receive the best tech qualification.

Unparalleled Tech Expertise

Software developers from Eastern Europe have earned recognition as some of the most well-versed tech experts in the world. Taking leading positions in renowned skill rankings such as SkillValue, TopCoder, and HackerRank, they demonstrate exceptional excellence in JavaScript, Python, C++, TypeScript, PHP, and HTML. In fact, Coursera Global Skills Report 2023 included Slovakia, Ukraine, Bulgaria, Poland, and Czechia in the top 25 countries globally for technology skills. This contributes to the growing demand for developers from these countries among tech companies that outsource IT to Eastern Europe.

Slashed Labor Expenses

Another reason for software development outsourcing to Eastern Europe is its cost-effectiveness. The table below shows that the annual salaries of programmers in popular Eastern European tech hubs are about 2-3 times lower than in the US. For instance, American Data Engineers usually demand $150,000 annually, while their Romanian, Ukrainian, Bulgarian, and Hungarian counterparts charge less than $45,000 annually. That’s about 70% of saved labor costs, can you imagine?

|

Gross Annual Income, USD |

|||||||||||

| Positions | |||||||||||

| USA | Poland | Romania | Ukraine | Bulgaria | Hungary | Czechia | Slovakia | ||||

| Full-Stack Software Developer |

130,000 | 52,000 | 50,000 | 47,000 | 48,000 | 43,000 | 53,000 | 45,000 | |||

| Front-End Software Developer |

110,000 | 44,000 | 42,000 | 40,000 | 40,000 | 30,000 | 40,000 | 42,000 | |||

| Back-End Software Developer |

120,000 | 48,000 | 45,000 | 45,000 | 45,000 | 32,000 | 45,000 | 45,000 | |||

| Mobile Developer | 110,000 | 40,000 | 37,000 | 35,000 | 33,000 | 35,000 | 33,000 | 38,000 | |||

| DevOps Developer | 135,000 | 52,000 | 52,000 | 42,000 | 42,000 | 38,000 | 45,000 | 50,000 | |||

| Blockchain Developer | 145,000 | 60,000 | 56,000 | 58,000 | 55,000 | 54,000 | 60,000 | 58,000 | |||

| Data Engineer |

150,000 | 60,000 | 42,000 | 40,000 | 43,000 | 40,000 | 57,000 | 52,000 | |||

| Software Development Engineer in Test |

90,000 | 36,000 | 30,000 | 30,000 | 33,000 | 30,000 | 38,000 | 37,000 | |||

In addition, outsourcing Eastern European developers can save you on taxes. In general, taxes in this region are much lower than in the United States and even in some Western European countries. For instance, Bulgaria, Romania, and Hungary offer the lowest CIT among the EE countries, ranging from 9% to 16%, while in the US, it can reach 33%.

Moreover, programmers from this region can be employed on B2B terms, which will liberate you as an employer from costly social contributions and taxes. For example, Polish software developers acting as independent contractors pay a lump sum tax of only 8,5-12%, while social contributions range from $900 to $2,600 per annum, depending on annual revenue.

| USA | Poland | Romania | Ukraine | Bulgaria | Hungary | Czechia | Slovakia | |

| Corporate Income Tax | 21-33% (including both federal and state taxes) | 19% | 16% | 18% | 10% | 9% | 21% | 21% |

|

Personal Income Tax |

10-50.3% (including both federal and state taxes) | 12-32% | 10% | 18% | 10% | 15% | 15%-23% | 19%-25% |

Business-friendly Environment

Governments in the EE countries pay special attention to enhancing their IT infrastructure and business climate. Such IT outsourcing destinations of Eastern Europe as Poland, Hungary, Bulgaria, and Romania are included in the top 30 of the 2023 Kearney Global Services Location Index, having high financial attractiveness, business environment, and availability of talent, which lures more foreign IT companies to outsource to Eastern Europe.

Talking more specifically about conditions of doing software development in Eastern Europe, the majority of EE locations have an A2 business climate thanks to political and economic stability, developed infrastructure, overwhelming digitalization, and attractive incentives for IT companies engaged in R&D activities. For instance, Slovakia offers a 200% R&D expenses deduction from the tax base, Poland allows businesses that generate income from their IP rights to pay 5% tax, while Romania provides 0% income tax for R&D companies for 10 years.

Learn more about Eastern European technology recruitment!

Cultural Affinity

One more reason to opt for Eastern European software outsourcing is Western-like mindset and business ethics. is a Western-like mindset and business ethics. Programmers from this region stand out for their adaptability, flexibility, and dedication. They can act independently and don’t hesitate to offer best practices to improve the quality of your product. In addition, Eastern European software developers are good communicators and team players, further enhanced by their outstanding command of English. Most EE countries rank in the top 30 on the English Proficiency Index. Problem-solving, self-development, and creativity are strong traits of these developers.

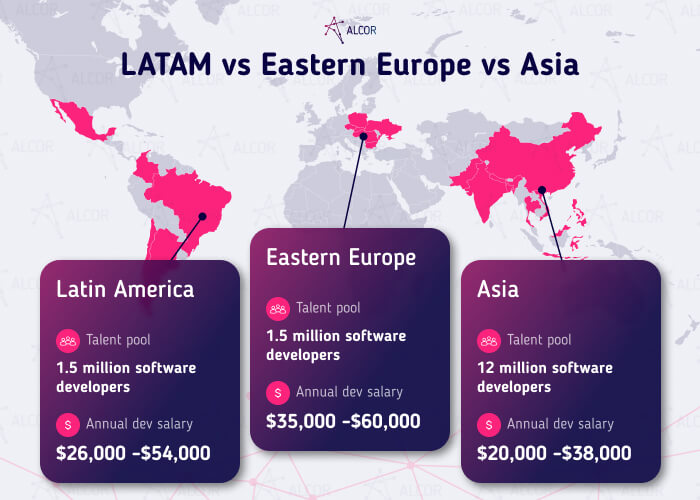

Eastern Europe vs LatAm vs Asia

Latin America

The Latin American IT market has almost the same number of software developers as Eastern Europe, exceeding 1.5 million tech professionals. Mexico leads the pack with over 700,000 IT experts, followed by Brazil with 500,000 programmers and Colombia with 150,000 coders.

Regarding technical prowess, Latin American developers are right up there with their Eastern European counterparts, with many countries ranking in the top 30 in the Coursera Global Skills Report 2023. Notably, developers from Mexico, Brazil, and Argentina shine in data science skills, scoring over 90 points in the rankings. The skill stack of LatAm software engineers typically includes .Net, Java, Ruby, Python, C++, C#, React, and Node.js. However, when it comes to English, these IT experts give in to EE developers, with only Argentina showing high English proficiency in the ranking.

What makes software outsourcing to Latin America more attractive than outsourcing to Eastern Europe is its geographical proximity to the USA. Most of these countries have no or little time difference with most American states. For instance, Mexico shares the same time zone (UTC-5) with California, while Colombia has time alignment with New York and Washington D.C. It minimizes delays, facilitates real-time communication, and enhances the overall efficiency of product development.

Asia

According to Statista, Asia retains its status as the largest tech outsourcing market globally, with projected revenue exceeding $113 billion by 2024, growing at a CAGR of 11%. This offshoring powerhouse boasts a talent pool four times larger than Eastern Europe and Latin America combined, boasting over 12 million IT experts. Most of these specialists are concentrated in China, with 7 million developers, and India, with around 5 million programmers. Renowned for their cost-effective outsourcing services, these destinations offer potential savings on software development projects. Thanks to good higher education, most developers in this region have decent tech and data science skills, with Japan, Indonesia, and Singapore topping the list.

Despite supposedly high tech competence, the quality of the IT outsourcing services in Asia is less clear-cut than in Eastern Europe. For instance, low English proficiency in leading locations like India (ranked 60th) and China (ranked 82nd), significant time differences with the US (ranging from 10 to 15 hours), and differences in work ethic and mentality can significantly disrupt the development process. To avoid possible miscommunication, production delays, and even delivery of the poor-quality products, some tech companies prefer IT outsourcing to Eastern Europe or Latina America.

Is it Safe to Outsource Software Development to Eastern Europe?

Despite the ongoing war in Ukraine, Central and Eastern European countries remain safe havens for global investors, offering a resilient and stable economic environment, bolstered by their membership in NATO and the EU. Despite geopolitical turbulence, CEE capitals are projected to outshine the GDP growth of some of their Western Europe peers during 2023–2026. Poland has notably emerged as the sixth largest economy in the European Union.

Realizing potential instability and possible risks, many international enterprises and companies continue to outsource software development to Central and Eastern Europe due to appealing cost-effectiveness, high talent availability, and strategic location. Between 2021 and 2022, the FDI projects in several CEE countries, such as Poland (+23%) and Romania (+86%), have shown impressive growth. Additionally, equity markets in Poland, Hungary, and Romania have experienced remarkable resurgence, with gains of 52%, 49%, and 63%, respectively.

A significant factor contributing to the resilience of the CEE market is the phenomenon known as “friendshoring.” About 17% of Ukrainian businesses have relocated abroad, with EU countries such as Poland (63%) and Germany (25%) being favored destinations, along with Belgium, Bulgaria, and Estonia. According to a report by the Polish Economic Institute, Ukraine accounted for 45% of all new foreign companies that established operations in Poland in the first three quarters of 2022. Moreover, about 10% of Ukrainian developers have migrated abroad due to the war, with Poland, Spain, Germany, and Portugal being the primary destinations, as reported by the Ukrainian IT community, DOU.

Concerning the market landscape for IT offshoring or IT nearshoring to Ukraine, while facing challenges, the situation shows promise. The country’s IT industry achieved a record-high revenue from exports, surpassing $7 billion in 2022, while about 52% of IT companies kept 100% of their contracts. Despite potential safety issues, 86% of foreign businesses maintained their operations fully, with 77% of local businesses successfully attracted new clients during wartime.

2 Major Insights About the Eastern European IT Market

Digital Transformation

Central and Eastern Europe (CEE) have enthusiastically embraced digital transformation, driven by the pandemic’s impact. According to PwC’s Global Survey, 45% of CEOs in CEE believe that without transforming their business, their companies will not be economically viable in a decade. To bolster the region’s attractiveness for foreign investment and ensure business sustainability, CEE entrepreneurs have prioritized investments in automation and talent upskilling. Moreover, the adoption of modern technologies such as AI, IoT, blockchain, 5G, and cloud computing across diverse sectors including finance, healthcare, manufacturing, and transportation has fueled innovation and enhanced competitiveness on a global scale.

These efforts yield significant results. For instance, Poland’s digital economy value is projected to surge by 175 percent between 2021 and 2030, already topping the ranking of the largest digital markets in the CEE. Microsoft’s Digital Futures Index (DFI) highlights CEE’s outperformance in certain areas compared to Western Europe. Czechia excels in digital business maturity, Croatia in digital skills, Romania is attractive for digital nomads, and the Baltic countries are known for their start-up-friendly environment.

IT Outsourcing & Outstaffing

The Eastern European IT industry has been growing in leaps and bounds, transforming into a mature market that competes with global heavy weights. Its revenue is projected to show an annual growth rate (CAGR 2023-2027) of 8.4%, resulting in a market volume of $23.69bn by 2028.

The most prominent sector of the EE tech industry is IT outsourcing which is going to reach almost $6bn in 2024, according to Statista. About 4,000 Eastern European IT outsourcing and outstaffing companies specialize in a wide variety of services, including custom software development, web development, cloud consulting, app development, tech managed services, IT staff augmentation, and cybersecurity.

The Eastern European IT industry has been growing in leaps and bounds, transforming into a mature market that can compete with global heavy-weights. Its revenue is projected to show an annual growth rate (CAGR 2023-2027) of 7.84%, resulting in a market volume of $15.70bn by 2027. There are 2 key aspects that contribute to its vibrant development.

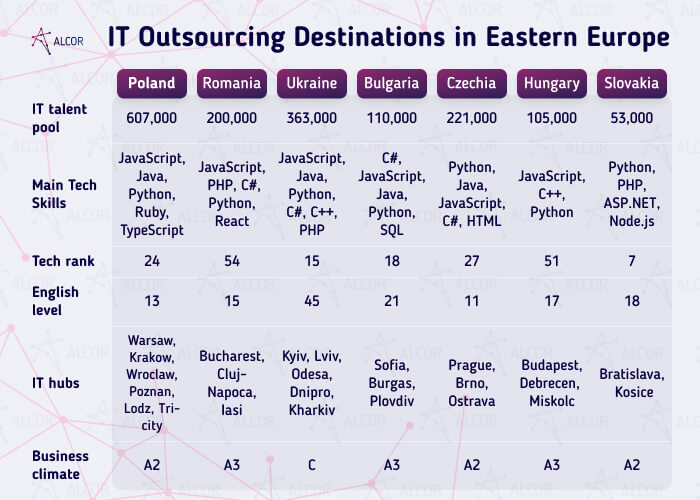

Top 8 IT Outsourcing Destinations in Eastern Europe

Poland

Tech talent pool: 607,000

ICT graduates: 20,000

IT businesses: 60,000+

Tech hubs: Warsaw, Krakow, Wroclaw, Poznan, Lodz, Tri-city (Gdansk, Gdynia, Sopot)

IT industry ranking in Europe: 7th with $8.2bl in revenue

Technology skills: JavaScript, Java, Python, Ruby, Shell, TypeScript, PHP, C#

Coursera Global Skills Report 2023: 24th out of 100

Global English proficiency ranking: 13th out of 113

2023 Kearney Global Services Location Index: 13th

Romania

Tech talent pool: 200,000+

ICT graduates: 10,000

IT businesses: 8,000

Tech hubs: Bucharest, Cluj-Napoca, Iasi

IT industry ranking in Europe: 12th with $3.3bl in revenue

Technology skills: JavaScript, Java, PHP, C#, Python, React, Angular, HTML, and CSS

Coursera Global Skills Report 2023: 54th out of 100

Global English proficiency ranking: 15th out of 113

2023 Kearney Global Services Location Index: 30th

Discover how an IT recruitment agency in Romania can accelerate your team expansion!

Ukraine

Tech talent pool: 363,000

ICT graduates: 27,000

IT businesses: 5,600

Tech hubs: Kyiv, Lviv, Odesa, Dnipro, Kharkiv

IT Exports market: will reach $5.49bl by 2028

Technology skills: JavaScript, Java, Python, C#, C++, PHP

Coursera Global Skills Report 2023: 15th out of 100

Global English proficiency ranking: 45th out of 113

2023 Kearney Global Services Location Index: 42th

Bulgaria

Tech talent pool: 110,000

ICT graduates: 6,100

IT businesses: 10,000

IT hubs: Sofia, Burgas, Plovdiv

IT industry ranking in Europe: 21th with $900 million in revenue

Technology skills: C#, JavaScript, Java, Python, SQL, PHP, .NET

Coursera Global Skills Report 2023: 18th out of 100

Global English proficiency ranking: 21st out of 113

2023 Kearney Global Services Location Index: 25th

Czech Republic

Tehc talent pool: 221,000

ICT graduates: 16,000

IT businesses: 7,700

IT hubs: Prague, Brno, Ostrava

IT industry ranking in Europe: 11th with $3.7bl in revenue

Technology skills: Python, Java, JavaScript, C#, HTML, Swift

Coursera Global Skills Report 2023: 27th out of 100

Global English proficiency ranking: 26th out of 113

2023 Kearney Global Services Location Index: 31st

Hungary

Tech talent pool: 105,000

ICT graduates: 4,000

IT businesses: 12,490

IT hubs: Budapest, Debrecen, Miskolc

IT industry ranking in Europe: 14th with $1.8bl in revenue

Technology skills: JavaScript, C++, and Python

Coursera Global Skills Report 2023: 51st out of 100

Global English proficiency ranking: 17th out of 113

2023 Kearney Global Services Location Index: 19st

Slovakia

Tech talent pool: 53,000

ICT graduates: 3,000

IT businesses: 3,900

IT hubs: Bratislava and Kosice

IT industry ranking in Europe: 23th with $630M in revenue

Technology skills: Python, PHP, ASP.NET, Node.js

Coursera Global Skills Report 2023: 7th out of 100

Global English proficiency ranking: 18th out of 113

2023 Kearney Global Services Location Index: 48st

Software Development Outsourcing to Eastern Europe Can be Easier with Alcor

As you can see, Eastern Europe is a large offshoring region with multiple unique IT hubs. To make a good pick before starting IT offshoring/IT nearshoring to Poland, Romania, Bulgaria, Ukraine or other EE countries, I recommend partnering with the local R&D center services provider like Alcor. Such a partner knows all the specifics of these Eastern European locations, from talent availability and developer’s average salaries to labor laws and taxation systems. Unlike staffing agencies, we don’t offer talent leasing but set up loyal research and development teams in Eastern Europe for US IT companies.

One of the businesses that benefited from our solution is Sift. Not only did we consulted them on IT markets, but we also helped them setup an offshore center in Europe with 30 skilled programmers in just a year! What services did we provide? Sift enjoyed full-cycle IT recruitment, employer branding, payroll, legal and compliance support, real estate leasing, and procurement management. On client’s request, we can also provide Employer of Record services, which allow IT companies to bypass any legal complexities of hiring foreign developers.

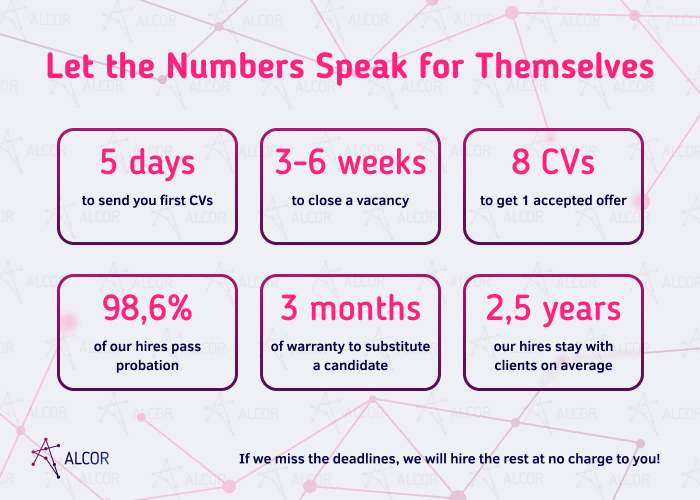

With our one-stop-shop services, you can be sure of getting your own R&D branch with 10 developers within just 2 months. There are no third parties, cloudy pricing, or buy-out fees — we do everything in-house, providing 24/7 AM support and a pay-as-you-go model. In addition, you can be sure of the quality of our candidates, as 98.6% of them pass probation with flying colors, while their average tenure is 2.5 years!

Embark on your seamless team expansion today with Alcor!

FAQ

1. How beneficial are the Eastern European outsourcing destinations?

By getting an engineering team in Eastern Europe, American IT companies can significantly reduce their labor costs. The average developer salary in this region is about 2-3 times lower than in the USA. Read this article to learn more.

2. Is it safe to outsource software development to Eastern Europe?

Most Eastern European destinations are EU member states, meaning they comply with GDPR as well as international security standards like ISO/IEC 27001. However, it’s not uncommon among IT outsourcing vendors to breach IP rights. Thus, building your own tech team is a more secure and reliable option.

3. How big is the Eastern European talent pool?

Eastern Europe is home to 1 million IT professionals, with Poland, Ukraine, and Romania boasting the largest talent pools.

4. What are the top offshoring locations in the EE region?

There are at least 7 solid Eastern European offshoring destinations that foreign IT companies can choose from, including Poland, Romania, Bulgaria, and Czech Republic, etc.

5. What is the best way to hire Eastern European developers for IT companies?

If you are a product tech company seeking an effective and safe way to scale up abroad, you should consider partnering with a professional IT recruitment company. By getting a dedicated engineering team, you’ll retain full control over your software development and expenses, have direct communication with developers, and protect your IP rights.