A 50% increase in hiring developers from Latin America in 2023 is a vivid sign of the growing trend among US tech companies. Many choose to incorporate in Mexico due to its rich talent pool, cost-effectiveness, time zone synergy with the US, and welcoming business environment. But is it the best way to legally hire Mexican programmers?

I’m Viktoriia Keliar, COO at Alcor, an Employer of Record company that builds R&D centers for US tech companies from 0 to 100 engineers in a year. With extensive expertise in legal compliance and tax structuring within the IT realm, I’ll guide you through the basics of company incorporation in Mexico, including various legal entity types, the setup procedure, and the necessary documents. Additionally, I’ll introduce a hassle-free alternative for entering this market. Intrigued? Then, let’s dive in!

Business Landscape in Mexico

Thanks to the government’s decisive reforms, Mexican GDP achieved a historic milestone of $1.41 trillion in 2022, securing its place as the second-largest economy in Latin America and 15th largest globally. One big driver of this growth? Embracing digitalization and innovation, especially regarding Mexico’s AI industry, has propelled Mexico to third place in LATAM.

So, how is Mexico’s tech industry doing? Well, it’s booming! In fact, it’s named the second-largest technology market in Latin America, with a whopping valuation of $28 billion. Focusing on Mexico’s fintech, AI, 5G, blockchain, and cybersecurity, it’s forecasted to grow at a CAGR of 10.6% over the next five years.

Nearshore outsourcing in Mexico is a big part of the tech success story. The country offers

- high talent availability (700,000 software developers),

- beneficial A4 climate for doing business,

- 40%-60% lower rates for programmers,

- business incentives like a tax credit of up to 30% on R&D income,

- 50 free trade agreements, including USMCA.

This places Mexico in the 10th position in Kearney’s Global Service Location Index, attracting more US tech businesses to consider incorporating a company in Mexico. Tech enterprises like Google, Microsoft, Samsung, Intel, Oracle, and IBM already have their R&D centers in this vibrant LATAM destination.

We’ve got a detail-rich article if you are curious about software development in Guadalajara!

Unsurprisingly, many international companies allocate their funds to Mexico’s development, primarily from the USA (47%), Spain (14%), Canada (7%), Japan (4.6%), and Germany (4.5%). In 2022, Mexico was Latin America’s second-largest recipient of foreign direct investment (FDI), with notable investments like Tesla’s whopping $5 billion injection.

How to Choose the Type of Legal Entity

-

Public Limited Company (Sociedad Anónima or S.A.)

Sociedad Anónima is the most common business structure for company incorporation in Mexico. It requires a minimum of two shareholders and a statutory capital of at least MXN$50,000, which is around USD$3,000. When you establish a public limited company in Mexico, its ‘value’ is divided into shares, which shareholders possess. Since there is no limit to the number of shareholders, it’s possible to raise needed capital easily, even if your company is just starting.

Regarding company type, Sociedad Anónima is like a corporation in the US. It is best suited for larger businesses and those aiming to go public down the road. Despite the bureaucratic and administrative burdens, this type of company has the biggest potential for growth and profit.

-

Limited Liability Company (Sociedad de Responsabilidad Limitada or S. de R.L.)

If you’re not going the Sociedad Anónima route in Mexico, the next best thing to do is set up a Sociedad de Responsabilidad Limitada (S. de R.L.). To incorporate such a company, you’ll need from 2 to a maximum of 50 members whose liability is capped by how much they’ve invested in the company.

S. de R.L. was created as an ideal alternative to Sociedad Anónima. It’s perfect for small and medium-sized companies, like family businesses and joint ventures, because it has a simple and flexible legal regime. Unlike Sociedad Anónima, S. de R.L. members handle their taxes individually (in the part of the distributed dividends) through tax returns rather than the company taking care of them all at once.

Starting an S. de R.L. won’t break the bank, either. You need to deposit MXN$3,000, which is roughly USD$170, to get things rolling. It may have fixed or variable capital, represented by equity interests owned by partners. Bear in mind that these interests have restricted transferability.

-

Investment Promotion Company (Sociedad Anónima Promotora de Inversión or S.A.P.I.)

Mexico introduced a fresh addition to its corporate policy not long ago: the Sociedad Anónima Promotora de Inversión (S.A.P.I.). Think of it as an upgraded version of the traditional Sociedad Anónima, with some extra perks in financing and company growth for those businesses looking to push the envelope in innovation and attracting foreign investment.

What sets S.A.P.I. apart from Sociedad Anónima is its protection of shareholders. For instance, investors get more bang for their buck, with fewer hoops to jump through when it comes to calling meetings, filing a civil legal action, or opposing a shareholder’s board meeting resolution. Plus, S.A.P.I. enables the bringing in of new investors without losing control of the organization and decision-making. But, like everything, there’s a flip side. Having too many partners can cause power struggles, resulting in possible loss of control of the company.

A viable alternative to company incorporation in Mexico is an Employer of Record (EoR) service. In this case, IT companies avoid the hassle of setting up a legal entity and dealing with compliance and administrative tasks. Instead, a local EoR provider covers everything from the employment of software developers and HR payroll & accounting management to tax payment and legal and regulation navigation. This model worked well for an IT company, Gotransverse, that could hire 6 Full Stack developers in 6 weeks via the local EoR provider Alcor. Continue reading to discover how Alcor’s EoR services can benefit your expanding tech business.

Procedure of Company Incorporation in Mexico

Imagine you have chosen the most suitable type of business structure. Now, let’s see how to incorporate a company in Mexico. Here is a step-by-step guide for your consideration:

1. Register your company name

Firstly, you need to come up with the name of your future company. Make a list of 4-5 options and apply with the Mexican Ministry of Economy (“Secretaría de Economía”) to get a permit. It’s wise to have a few options up your sleeve to increase the chances of getting one approved. If your preferred name is also a brand name, you should register it as a trademark with the Mexican authority IMPI (Instituto Mexicano de la Propiedad Industrial).

2. Register your articles of incorporation

One of the main steps of the procedure to incorporate a company in Mexico is drafting and legalizing the articles of incorporation and bylaws. In Mexico, these are bundled into a single document known as the “acta constitutive.” It serves several important purposes, such as establishing the company’s legal structure, corporate governance, capital structure, shareholder rights, protection of interests, and compliance. In other words, it’s a set of rules and regulations that govern a company’s internal and external operations.

Here’s what must be included in the articles of incorporation:

- name and address of your company;

- names and addresses of the company’s owners or partners;

- purpose of the company;

- amount of capital contributed by each member or partner;

- powers and responsibilities of the company’s managers;

- rules governing the distribution of profits and losses.

The articles of incorporation and bylaws must be formalized before the Mexican Notary Public. Shareholders can do this in person or through a Power of Attorney (PEO) appointed by non-residents to act on their behalf. Once the bylaws are legalized, the legal representative can register the business with the Public Registry of Property and Commerce in Mexico.

3. Obtain a fiscal address & tax ID number

After drafting and approving your articles of incorporation, the next step is securing your fiscal address in Mexico. This can be done at the Internal Revenue Service (the Servicio de Administracion Tributaria). Once your company is registered, you can use the fiscal address for all your business communications.

Fiscal address is also crucial for obtaining your tax ID number, which is used for issuing invoices and financial documents, filing state and federal tax returns, and paying taxes. You can obtain it at Mexico’s Tax Administration Service (SAT).

4. Open a corporate bank account

One of the requirements for running your company in Mexico is opening a bank account. You can consult your legal representative or local lawyers to choose a bank suited for your business. The articles of incorporation, your tax ID, identity papers, and other pertinent paperwork usually must be sent to the bank.

5. Register before IMSS

To hire software developers in Mexico, your legal representative should register the company before the Mexican Social Security Institution (IMSS). This registration process also initiates the company’s application and registration with the National Worker’s Housing Fund Institute (INFONAVIT). Additionally, it automatically sets up individual retirement savings accounts, known as Afore, for your employees.

6. Obtain permits, licenses, and mandatory insurances

In addition, depending on the nature of your business, you may need to obtain licenses, permits, certificates, and insurance from relevant authorities at the municipal, state, or federal level to run a business in Mexico.

Documents for Incorporation in Mexico

Now, let’s see what documents you would need to incorporate a company in Mexico:

- Notarized passport copy of the nominee’s resident legal representative;

- Power of Attorney granting powers to the resident legal representative to register the company on behalf of our Client;

- Copy of registration with the Public Register of Property and Commerce or notarized letter confirming the submission of the registration application;

- Copy of the lease agreement for the Mexican legal registered office address;

- Copy of tax registrations (RUT) issued by the tax authorities, SAT, for the Mexican company and all of its directors.

In general, the process of Mexico company registration can take 2 to 6 months, considering the bureaucratic aspects of this process. This may be disadvantageous for IT companies that function in a rapidly evolving technology field. Below are listed additional aspects to bear in mind when incorporating in Mexico.

What Else to Consider after Incorporating in Mexico

Tax Payments

There are quite a few differences in comparing taxes in Mexico vs the USA. When incorporated in Mexico, you should be aware of the following taxes:

- Corporate Income Tax constitutes 30%. However, since dividends are subject to a withholding tax in Mexico, the effective tax rate may reach up to 37%.

- Value Added Tax is 16%, except in cases where the taxpayer’s address is in the northern border region of Mexico when it is reduced to 8%.

Moving on to the taxes on employment. These rates vary depending on the software engineer’s annual income. For instance, let’s take the average salary in Mexico for a software engineer of a senior level which is around $60,000. As an employer, you would pay around 30% in taxes including social security contributions, ranging from 44.9% to 60%. Other expenses to consider are an annual vacation premium, equal to 25% of the employee’s base salary, 10% profit sharing among employees, and 13th-month pay.

Employment of Programmers

The employment of software developers in Mexico is not a bed of roses either. The labor laws strongly protect the rights of the employees, which are further supported by Mexican unions and labor organizations. This is especially evident in terms of fair pay, benefits, termination requirements, and dispute resolution methods.

For example, in case of terminating a Mexican employee, the company is obliged to a substantial severance package. At the same time, the obligatory employee benefits include:

- 200% of overtime pay for the first nine hours worked after 48 hours in a week and for the first three hours worked after the first eight hours in a day;

- 12 days mandatory vacation time after working for one year;

- proportionate share of the company’s income for the year (profit sharing) after working for more than 60 days.

- 10% profit sharing of the company’s annual profits among the employees.

- minimum of 6 days PTO after working for one year;

- 9 official public holidays (relevant in 2024);

- 12-week maternity leave and 5-day paternity leave.

Mexican laws mandate that all employers pay employees in pesos via Mexican banks defined as appropriate by the government. The Mexican tax administration service must approve pay stubs before employers can provide employees with official documentation of their pay.

Other aspects to consider are employer obligations under Mexican law, the creation of the EVP tailored to the local market, and the compilation of a compliant employment agreement to hire developers from Mexico.

You can remove the administrative and compliance burden off your shoulders if opting for…

EOR Services in Mexico for Tech Companies

Yes, you got it right. Incorporating the company is not the only way for American IT businesses to reap the benefits of Mexican software development. Employer of Record is a feasible alternative that enables easy expansion to new markets, with no legal entity needed to hire software developers and run the business compliantly.

That’s what you can get with Alcor. Our EoR service is specifically tailored to IT companies like yours, allowing seamless entry to LATAM markets, such as Mexico, Colombia, Argentina, Chile, and Eastern Europe.

By cooperating with us, you’ll benefit from:

- Absence of buy-out fees, as the development team is yours from day one.

- 100% transparency, having only direct salaries instead of rate cards.

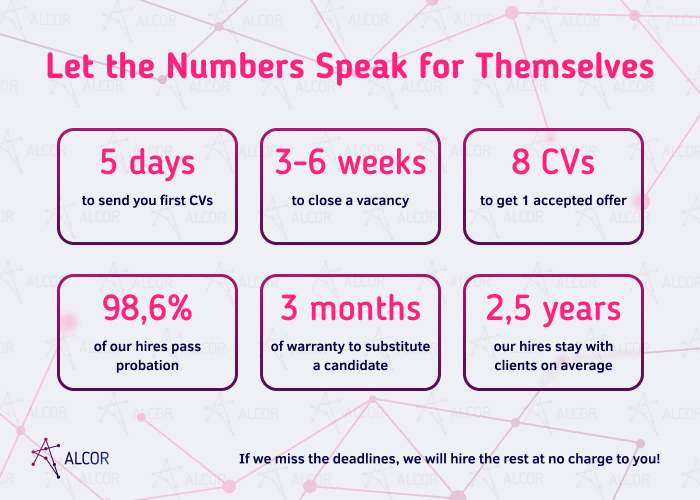

- High-quality developers with an average tenure of 2.5 years.

- 20%-40% cost reduction in comparison with outsourcing/ outstaffing in Mexico or other LATAM and EE destinations.

- 100% compensation for fines caused by our mistake.

Apart from EoR services, you can also get full-cycle tech hiring from our IT recruiters in Mexico and other LATAM and Eastern European locations, as well as operational support all under a one-stop shop R&D solution.

Curious how it works? Here’s an example of the IT company Dotmatics. To develop their unique software product for biologists, the company decided to build an engineering team abroad. Knowing the intricacies of the foreign market, they reached out to Alcor. With our EoR services, we covered the employment of software developers, HR payroll management, legal compliance, and tax payments. Our IT headhunters handled all the stages of the recruitment process, while our dedicated account managers assisted with business navigation and managed hardware procurements. As a result, Dotmatics got a fully backed team of 30 developers within a year.

Try it out yourself! Let’s book a call and discuss your expansion plans.