As LATAM’s 2nd largest fintech ecosystem, Mexico never ceases to impress with its rapid development and constant improvements in this area. With 54.76 million digital payments users, this country is at the forefront of the region’s fintech development and has the potential to become a key player in the global fintech industry. But what is the secret of the fintech sector in Mexico, and what can it offer to your tech business?

I’m David Gomez, Lead LATAM IT Recruiter at Alcor, an all-in-one place R&D services provider that builds Valley-like teams from 0 to 100 software developers within a year for Western tech product companies. We offer end-to-end tech recruitment services across Eastern Europe and Latin America, a thorough Employer of Record service (EoR), and other operational support tailored to your needs.

In this article, I’ll take a closer look at the Mexican fintech market, fintech law, and its influence on the functioning of this industry, as well as the pros and cons of fintech development outsourcing to Mexico in 2024. Last but not least, I will introduce a perfect alternative to conventional outsourcing software development in Latin America for your enterprise company ― your software R&D center. Read to the end and find out all the ins and outs of the fintech industry in Mexico!

Fintech Market in Mexico

Between 2019 and 2023, the financial technology industry in Mexico grew at an annual rate of 18.4%, one of the highest in the region. In 2022, 184 new fintech companies emerged, with lending, enterprise technology, and payments making up 60% of Mexico’s technology ecosystem.

In addition, the number of large fintech hubs is gradually increasing, with Guadalajara as Mexico’s Silicon Valley and Mexico City at the top of the list, which has been ranked 2nd in the region for four years in a row according to the Global Startup Ecosystem Index 2024.

The main factors behind this rapid growth were the general digitalization of society, combined with an increase in the use of smartphones and the Internet among the Mexican population from 81 million to more than 97 million people in 2020−2023, about 75% of the total population. Thus, by the end of 2022, the country had 96.8 million Internet users, representing an annual increase of 9.3%.

Key Niches in Mexico’s Fintech Sector Domain

- Insurtech

Mexico excels as a leading fintech hub, consistently attracting international investment and driving advancements in insurance technology. Representing 21% of total sector investment, Mexico is shaping the future of insurance tech in the LATAM region. The integration of financial technologies and service automation is making this sector increasingly accessible to a wider audience.

Moreover, with a robust 15% growth rate, 114 additional tech companies in Mexico, and a 26% attraction rate, insurance technology is poised to be the standout market in Mexico for 2024.

- Blockchain & Crypto

Ranked 16th in the Global Crypto Adoption Index, Mexico’s crypto segment is on a remarkable trajectory, with revenue expected to reach US$1,4+ billion in 2024. This indicator leads to optimistic forecasts of a CAGR of 8.53% for the sector by 2028.

In the field of blockchain technologies, the Mexican banking sector accounts for 29.7% of the market value. Of the 40% of Mexican companies researching blockchain, 71% explore cryptocurrency technologies. These technologies are actively leveraged by financial technology companies in Mexico for fast, secure, and low-cost international transfers and online trading, revolutionizing the financial technology sector in Mexico.

- AI & ML

According to the Finnovista Fintech Radar México 2024, the growth in the number of fintech companies actively implementing AI and machine learning is also impressive. Thus, from 28% in 2021, the number of such companies skyrocketed to 52% in 2023. The main areas of AI and ML use are the development of prediction and decision-making algorithms (26.1%), fraud detection and prevention (21.7%), automation of tasks and internal processes (21.7%), which increase operational efficiency, as well as customer focus (13%), predictive analytics (8.7%), and service personalization (8.7%).

Top Mexican Fintech Companies & Startups

As of 2024, the Mexican fintech ecosystem has 773 local businesses, marking an impressive 18.9% growth since 2022. However, that’s not all — beyond these homegrown fintech companies, Mexico is also a hotspot for around 217 foreign startups hailing from over 22 countries. According to Finnovista Fintech Radar México 2024, altogether, this dynamic landscape brings the total number of fintech ventures in Mexico to nearly 1,000, making it a thriving epicenter of innovation and opportunity.

Footnote: The primary geography of countries that open their fintech companies in Mexico is the United States (25.8%), Chile (20.3%), Colombia (16.1%), and Argentina (13.4%). Half of the foreign fintech companies operating in Mexico come from these three Latin American countries, accounting for 49.8% of foreign startups in the sector.

Looking at the fintech sector in terms of the most used technologies by market share, almost 70% of fintech companies in Mexico used open finance and APIs in 2023, making them the most common technology. This is followed by cloud computing, artificial intelligence, and machine learning, as more than half of all fintech companies use these technologies.

From global giants like PayPal and Square to innovative startups like Revolut and Nubank, Mexico has become a hotspot for foreign and local startups. As of 2024, Mexico was ranked 41st out of 100 in the world by the Global Startup Ecosystem Index and 4th in the Latin American region. With several unicorns, Mexico’s startup ecosystem is becoming increasingly favorable and open to innovation.

So, let’s take a deeper dive into the sector of financial technology in Mexico and take a look at some of the leading Mexican fintech companies and startups:

- Bitso is Mexico’s first Bitcoin exchange. It allows international flows of pesos, US dollars, and Bitcoin to facilitate US-to-Mexico remittances.

- Clic is the first payment unicorn in the country and SoftBank’s Latin America Fund’s first investment. It allows businesses to accept all payment methods digitally with no cash involved.

- Konfio is a leading financial services platform that offers corporate credit cards, working capital loans, and payment solutions.

- Stori is a fintech company that offers credit products, primarily credit cards, to individuals with limited access to traditional banking products.

- Clara is a fintech payment platform offering corporate cards, invoice payments for international transactions, and expense management software for businesses. The company operates in Mexico, Brazil, and Colombia.

Mexico’s Fintech Legislation

A significant milestone in the development of fintech in Mexico was the adoption of the Law on the Regulation of Financial Technology Institutions by the Mexican government (Ley para Regular las Instituciones de Tecnología Financiera), also known as the Fintech Law, in 2018.

This Law establishes authorization requirements, information security measures, and performance and transparency standards to protect consumers and maintain financial stability. Generally, the Law applies to all fintech companies engaged in activities related to open banking, crowdfunding, electronic wallet systems, electronic payment institutions, virtual asset transactions, and temporary permits for developing new models.

Regarding current trends, 44.1% of the Mexican fintech market is not engaged in any of the above activities and is mainly a provider of technology focused on financial solutions. That is why they do not require any license. The remaining 55.9% must operate under a specific permit provided by Mexican Fintech Law.

Mexico vs Other Fintech Hubs in Latin America

Brazil

With well-known fintech startups such as Unico, Jeitto, and Fitbank, Brazil leads the region with 31% of the total number of fintech companies. In contrast to Mexico, where 773 local fintech startups are active, Brazil has 855, bringing the total number to more than 1500. Their specialization includes B2B services, payment systems, lending, financing, and digital banking.

Argentina

The fintech industry in Argentina has seen remarkable growth, expanding by 11.5% between 2021 and 2023. During this period, the number of fintech ventures surged from 276 to 343. Notably, women now occupy approximately 32% of leadership roles within startups, a figure that exceeds Mexico’s by 3%. This underscores the increasing role of women in key decision-making positions within LATAM’s fintech sector.

Colombia

As of 2024, Colombia ranks third in Latin America in the fintech industry, just after Mexico. By 2021, there were 279 companies in the country, which is twice as many as five years earlier. Additionally, the explosive growth of the industry is evidenced by the increase in the number of adults using banking services, from 55% in 2008 to more than 90% in 2022.

Chile

The fintech sector in Chile has recently experienced a boom, with the number of startups created in the country more than doubling over the past four years. Thus, in 2023, there were 300 Chilean fintech companies, 473 fewer than in Mexico. Overall, 82% of the adult population in Chile uses at least one fintech app, which is why the fintech market is expected to reach US$10.8 million by 2025.

Uruguay

The fintech sector in Uruguay exploded in 2021, when the country broke into the global Top 20, according to the Global Fintech Index. In the same year, 63 fintech companies in Uruguay offered a wide range of financial services. In addition, as of 2023, Uruguay has the highest “fintech maturity” index in Latin America, outperforming Mexico and other countries in the region.

Is Fintech Development Outsourcing to Mexico in 2024 a Good Idea?

After reviewing the main patterns and current trends in Mexico’s Fintech-as-a-Service (FaaS) landscape, we can now move on to the main point — the pros and cons of fintech outsourcing to Mexico.

Advantages of Fintech Development Outsourcing to Mexico

- Booming tech industry

As of 2023, Mexico is the second-largest IT market in Latin America, underscoring its importance as a center of technological innovation in the region and creating ample opportunities to develop fintech services. Mexico’s ITO market is projected to grow from $4.42 billion in 2023 to $7.90 billion by 2028. This is the third most innovative tech economy with excellent ratings in creative outputs, knowledge and technology, market and business sophistication, human capital, and research, making the country an increasingly popular destination for software outsourcing.

- Large & talented dev pool

With a large tech talent pool of over 700,000 software developers and 124,000 skilled graduates each year, Mexico is the 2nd largest country in Latin America regarding overall skill proficiency. Mexican developers stand out for their high-quality education: six universities are among the top 50 in Latin America. In addition, their experience covers a wide range of programming languages and technologies, including JavaScript, Python, C#, SQL, React.js, and Angular, demonstrating their versatile and comprehensive technical skills.

- Attractive developer salaries

Another competitive advantage of the Mexican fintech industry is relatively low labor costs for hiring professional software developers. Just look at the average salary in Mexico for a software engineer, which is two or sometimes three times lower than in the United States. No wonder why American employers are actively nearshoring technology to Mexico.

| Position | Senior Developer’s Gross Annual Income, USD | |

| Mexico | USA | |

| Business Intelligence Developer | 57,600 | 108,000 |

| Salesforce Developer | 60,000 | 114,000 |

| Mobile App Developer | 62,400 | 114,000 |

| ETL Developer | 48,000 | 114,000 |

| Cybersecurity Engineer | 45,000 | 170,000 |

| AI Engineer | 62,400 | 132,000 |

| Blockchain Developer | 68,400 | 132,000 |

| Data Science Engineer | 42,000 | 126,000 |

| DevOps Engineer | 72,000 | 138,000 |

| Cloud Engineer | 68,400 | 174,000 |

- Friendly business environment

Thanks to the country’s prudent fiscal and monetary policies, the strengthening of the peso against the dollar and slowing inflation in recent years, a freely floating exchange rate, and the stability of the country’s economic outlook and GDP, Mexico boasts an A4 Business Climate as of 2024. In addition, Mexico ranks 10th in Kearney’s 2023 Global Services Location Index, making more and more organizations choose to offshore their IT operations or incorporate in Mexico.

- Geographic & Cultural Affinity

Finally, US tech companies choose Mexico as an outsourcing hub for fintech services due to its proximity and cultural similarities. Real-time communication is seamless, with a maximum 2-hour time difference and a shared border. As a bonus, the similarity in corporate culture and work ethics—expressed in dedication, punctuality, and a willingness to go the extra mile to meet deadlines—enhances workflow productivity. Mexican developers are resourceful problem-solvers and employ a direct, assertive communication style, which minimizes misunderstandings in international teams.

Disadvantages of Outsourcing Fintech Development to Mexico

However, certain risks exist in the Mexican fintech sector that may deter those who want to enter this relatively young but dynamic market:

- Complicated payroll process

Tech companies might face challenges with local tax regulations in the process of software outsourcing in Mexico, such as bureaucracy in payroll management. Employers in Mexico are required to do numerous calculations and payments, such as personal income tax withholding, occupational risks, sickness, maternity, disability, retirement, social benefits, and state payroll tax. Some of them are deducted from the employee’s salary but must be calculated and withheld by the employer, while other payments are solely the employer’s responsibility. For example, if a Mexican developer earns $60,000 annually, the employer must pay over $78,000. There are other mandatory payments for employers, such as a 13th salary or obligatory payments for overtime work.

- Hidden costs & overpricing

Some IT outsourcing vendors tend to mark up the price for their services by more than 50%, and many clients need to realize this. As a result, software developers who do all the work receive much less than they deserve. What’s even worse, some IT outsourcing companies sell the services of middle-level developers at senior-level developer rates (and so on) to make as much profit for themselves as possible. As a result, an outsourced developer must do more work that doesn’t match their level, while a client receives lower-quality results. Not a win-win situation, right?

- Team indifference

If you decide to outsource fintech software development in Mexico, you won’t have direct access and control over this team. Your provider will be an intermediary between you and them, creating an unnecessary level of management that can complicate the feedback process. Plus, these developers will remain employees of your outsourcing provider and will only partially integrate into your team and product. As a result, their motivation will be much lower than in in-house or R&D teams, leading to a lack of interest in the longevity of your product.

What Might be Better than Fintech Software Development Outsourcing?

Your own software R&D center in Mexico with a professional team of Senior/Lead developers and full EoR and operational support, and Alcor will gladly create one for you!

Our cooperation will start with Mexico’s software engineering staffing. Our tech recruitment team will hire 20 talented software developers in Mexico in 3 months. We don’t like wasting the time of our clients, that’s why we:

- send the first CVs of pre-vetted candidates in 5 days;

- and close one position in 2-6 weeks (we work on several positions simultaneously).

Plus, we care about the quality of our candidates, so our headhunters choose only from the top 10% of tech talent in the country, 80% of whom always get approved by clients and invited to interviews. Not to mention that our tech recruiters close 15% of vacancies from the first CV. As a result, our clients like People.ai and Sift enjoy a 98% talent retention rate.

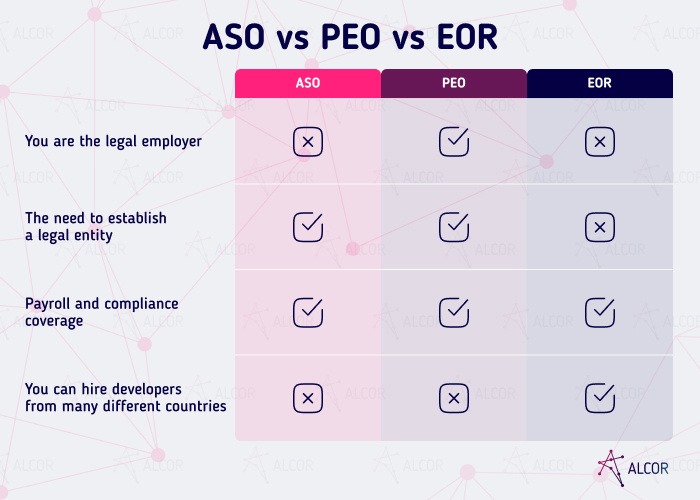

After we attract and hire software engineers from Mexico for you, we provide an Employer of Record service. Why is this beneficial for your business? You don’t have to open your legal entity in Mexico and still get 100% legal compliance while expanding here. And that’s not all — we will handle all functions like HR payroll, taxes, accounting, onboarding/offboarding, and employee benefits. In case of any questions and requests, you’ll have your key account manager to assist you.

Need to lease an office, purchase equipment, or issue stock options to your developers? Not a problem. We offer 360° operational support at a la carte pricing. You can also benefit from powerful employer branding, IT support, visa support, and other services — just name it. We are always happy to go the extra mile for our clients!

For BigCommerce, a tech product company that provides e-commerce solutions to support successful brands in 120 countries, we built an R&D center from scratch. We took care of all the tech recruiting, payroll and accounting, legal, real estate, and other operational services. In just six months of cooperation, we created a team of 30+ highly qualified specialists, including PHP, JS, Scala, Ruby, Angular, React, MySQL, and GCP engineers.

Mexican Fintech Conferences We Recommend to Attend

To keep up with all the trends in the Mexican fintech market, mark these dates in your calendar, and don’t miss the opportunity to join this thriving industry!

- Fintech Summit Latam, Hybrid Conference & Expo México City, 2024

Date: August 14th- 15th

Location: Mexico City - Mexico Tech Week 2024

Date: October 21 – 27, 2024

Location: Mexico City - Mexico Finance & Fintech Summit 2025

Date: April 09 – 10, 2025

Location: Mexico City - Open Finance 2050

Date: June 11th – 12th, 2025

Location: Mexico City - 10th America Digital Tech & Business Congress 2025

Date: June 18th – 19th, 2025

Location: Mexico City

References about Fintech in Mexico

- America Economia

- Blockchain Council

- Chambers and Partners

- Coface

- Coursera

- Finnovating

- Finnovista Fintech Radar Mexico 2023

- Finnovista Fintech Radar Mexico 2024

- Global Crypto Adoption Index 2023

- Global Startup Ecosystem Index 2024

- Global Innovation Index 2023

- Mexico Business News

- Statista

- The 2023 Kearney Global Services Location Index

- The International Trade Administration, U.S. Department of Commerce

- LatAm Insurtech Journey 2024