In 2022, the Colombian IT industry demonstrated remarkable growth, generating an impressive $1.3 billion in revenue across various segments. No wonder more and more foreign IT companies decide to tap into this promising destination to run their software product development. Yet amidst the allure of this thriving tech landscape, business taxation in Colombia remains a pertinent concern for tech entrepreneurs looking to establish their presence in the country.

I’m Viktoriia Keliar, COO at Alcor, with strong expertise in legal compliance for tech businesses and tax structuring. At Alcor, we focus on IT recruitment in Colombia plus other Latin American and Eastern European countries, as well providing support to tech companies with legal compliance. In this article, I’ll share everything you need to know as an IT entrepreneur about taxation in Colombia and provide the best solution to launch your business in this country.

Colombia Economy Overview

With a staggering cumulative growth of 24.5% since 2010, the technology industry in Colombia now contributes nearly 3% to the country’s GDP, which demonstrates its economic significance. In 2021, the Colombian ICT market reached $8.2 billion while the projection skyrockets to a remarkable $12.98 billion by 2026, attracting significant funds and investments. Through just the first two months of 2023, Colombia showed a 24% increase in foreign investments. Taking these numbers into account, it’s no surprise that Colombia stands out as the fourth-largest IT services provider in the realm of LATAM countries. Such a thriving tech ecosystem attracted plenty of big IT players to do their business there (with Google, Amazon, IBM, and others among them). Notably, the United States, Ecuador, Mexico and Spain have emerged as key countries in availing Colombian top-notch software development services.

According to the 2023 Index of Economic Freedom, Colombia is ranked 62nd among 176 countries, demonstrating resilience amidst a demanding economic environment. Thus, Colombia embraces a balanced atmosphere of moderate freedom, fostering business launches, welcoming investments, and safeguarding property rights, making it a distinctive destination for entrepreneurial ventures.

Legal system & Taxation authorities

First and foremost, Colombia’s legal system relies on written laws and codes set by Congress while regions, namely departments, districts, and municipalities, have the authority to regulate certain tax-related issues. The National Tax and Customs Directorship (DIAN) administers the Colombian tax system, while local tax agencies and municipalities handle tax collections.

Navigating the tax landscape in Colombia’s IT domain also involves understanding the general tax regime applicable to all businesses. To begin with, the tax structure in the country operates at three levels — national, departmental, and municipal. For resident individuals and companies, taxes extend to their worldwide income and assets. At the same time, non-resident individuals and corporations are only subject to taxes on their Colombian-source income.

It’s also worth mentioning that Colombia has taken steps to prevent double taxation and tax avoidance by signing double taxation treaties (DTTs) with countries like Switzerland, Canada, Spain, Portugal, Italy, France, the United Kingdom, and 9 other countries. Colombia has also implemented Base Erosion and Profit Shifting (BEPS) measures to ensure fair taxation and promote a business-friendly environment.

Colombia Taxation for the IT Industry

There’s a diverse array of taxes and fees in Colombia that foreign businesses must be aware of before entering this market. Let’s have a closer look at each of them:

Corporate income tax

According to the Tax Reform Law (Law 2277) implemented by the Colombian Executive Branch that took effect on January 1, 2023, the CIT rate for local and foreign IT companies in Colombia is 35% of the company’s net taxable income. Each year, Colombian businesses must adhere to specific deadlines (between April and May), for filing their corporate income tax returns. This deadline depends on the taxpayer’s type and the last digit of their tax identification (ID) number, necessitating careful attention to ensure timely compliance.

Interestingly, IT companies have the advantage of accessing tax benefits related to research and development (R&D) activities. They include a 25% tax discount and a 100% tax deduction for investments made in science, technology, and innovation projects. Such projects aim at solving commercial challenges, creating new knowledge, exploring market opportunities, or addressing internal process issues. In short, these incentives encourage IT companies to invest in research and innovation, fostering growth and technological advancement within the software development industry in Colombia.

Cross-border payments

Moving on to other types of business taxes in Colombia, local companies may be required by law to withhold a certain percentage (ranging from 15% to 33%) when making specific payments to foreign entities. These payments encompass royalties, dividends, and fees for various services like administrative, consulting, management, and technical support. This requirement, however, may not apply if a company makes payments to counterparties from countries that have entered into a double-taxation treaty (DTT) with Colombia.

Moreover, according to Colombia’s transfer pricing regime, entities engaged in transactions with related foreign companies must calculate their revenues, deductible costs, and expenses based on comparable prices and profit margins used in transactions.

Payroll taxes

There are no special taxes in Colombia for the IT industry. Rather, employers operating within the IT sector, much like their counterparts in various other fields, adhere to the standard payroll taxes and social security commitments that are universally applicable across all industries. Regarding payroll taxes in Colombia, tech companies must contribute 9% of the monthly payroll. However, some employers might be exempt from this tax if their employees earn less than 10 times the minimum monthly wage. In this case, the employer will be liable to self-withholding income tax on their earnings, with rates (0.4%, 0.8%, or 1.6%) contingent on their primary economic activity. On the other hand, software developers also have their own tax obligations. They need to pay Personal Income Tax (PIT) and social contributions. The PIT rate varies from 19% to 39% depending on their income. Annual income below USD 11,083.35 is exempt from PIT.

Leave tax management and other operational support to lawyers and IT recruiters in Bogota to focus on software development instead!

Social security contributions are divided between employees and employers, totalling around 8-10% for employees and 16-23% for employers (excluding the payroll tax). Notably, employers are responsible for withholding both income tax (PIT) and social contributions from employees’ salaries, then forwarding these amounts to the tax authorities on behalf of their employees. These contributions vary according to the individual’s salary. The table below represents these respective rates:

| Salary Range (monthly) | Pension System | Healthcare | Professional Risks | |||

| Employer | Employee | Employer | Employee | Employer | Employee | |

| Below 10 x Minimum Monthly Wage | 12% | 4% (+1% if earning more than 4 MMW) | – | 4% | 0.522% – 6.96% | – |

| Above 10 x Minimum Monthly Wage | 12% | 5% (+ between 0.2% and 1% if earning more than 16 MMW) | 8,5% | 4% | ||

| Ten minimum monthly wages equal 2.904,16 USD | ||||||

Indirect taxes

Business taxes in Colombia also include VAT (value-added tax). Most goods and services are subject to the standard VAT rate of 19%, but some may be exempt or taxed differently. For U.S. companies, for instance, there are no VAT obligations for purchasing IT services from a Colombian company.

However, things can become more complex when Colombian companies receive services from abroad. In such cases, VAT is imposed on the provision of services, regardless of whether they are rendered in Colombia or overseas, if the beneficiary of the services is in Colombia. Other indirect taxes include property tax, industry and commerce tax, billboards tax, and a financial transaction tax.

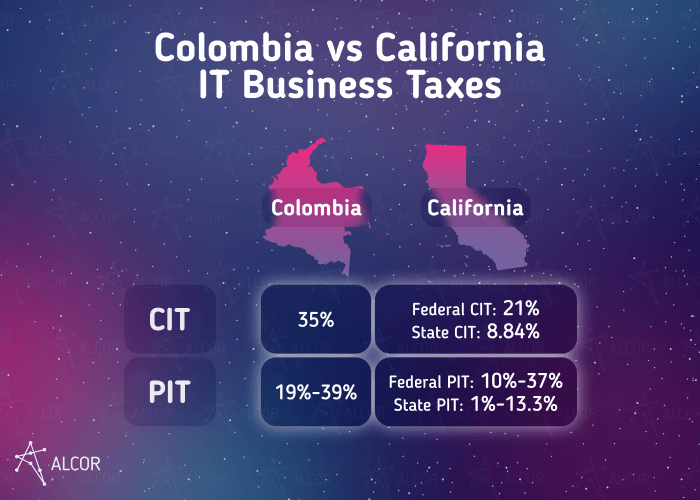

Colombia vs United States Business Taxes

American tech companies often opt for Colombian nearshore software development due to 150,000+ software engineers in its talent pool and 2-3 times lower salaries. However, when considering this option, one should also examine the differences in Colombia and US business taxes to ensure full compliance.

The United States presents tax regulations that differ significantly from one state to another. Federal and state taxes together contribute to a variety of tax rates, posing challenges for businesses with operations across multiple states.

In contrast, Colombia has another approach, providing a uniform tax system that maintains consistency across the entire country. This streamlines the tax landscape, granting businesses a clear and predictable tax framework, regardless of their location within the country. Nevertheless, it’s essential to bear in mind that when compared to high-tax states such as California, Colombia’s taxes are still considerably higher.

Yet Colombia boasts a unique appeal due to its cost-effective labor market, so despite the relatively higher tax rates the country presents very affordable labor costs. For instance, a senior full-stack software developer’s annual salary in the US is $150K, while a software engineer’s salary in Colombia with the same level of expertise amounts to $48K. Beyond that, the tax structure in Colombia is less complex than in the USA, leading to a lower compliance burden for taxpayers. All of this makes the country an alluring option for businesses considering Colombian software development outsourcing and looking to optimize their operational expenditures.

Another challenge American tech entrepreneurs encounter when entering the Colombian market is double taxation. As of now, there is no existing tax treaty between Colombia and the United States to prevent this, leading to a potential increase in expenses. To handle this issue, seeking guidance from local experts can be a valuable solution. Collaborating with professionals familiar with both tax systems can help you explore strategies to optimize tax payments in cross-border cooperation. This approach ensures compliance with tax laws while cutting down costs of your IT business operations in Colombia.

Consider Alcor BPO Your Trusted IT Recruitment Provider in Colombia!

If you’re considering nearshoring to this country, navigating Colombia’s taxation system might seem complex. Still, with thorough research and professional guidance, you can ensure compliance to run your business transparently abroad. However, if you aim at building your own team by hiring developers from Colombia and managing their payroll, paying taxes in Colombia can be quite challenging. Alternatively, you can consider partnership with a reliable IT recruitment agency in Latin America that also handles accounting and legal matters, allowing you to focus on core operations.

That’s what a US-based IT product company Sift decided to do. The company wanted to expand abroad and looked for assistance in both IT recruitment and legal compliance in their offshoring destination. After analyzing the local tech market and gathering feedback from various IT companies about local vendors, they promptly contacted Alcor for further exploration and potential collaboration. We engaged a team of our researchers and recruiters to help Sift build its own software development team with skilled engineers. With Alcor’s help, in just one year the company hired nearly 30 developers, including talents with rare and niche skills. Apart from recruitment, Sift opted for outsourced compliance with European and American laws, tax management for their offshore developers, labor and contract law support, as well as protection of their intellectual property rights.

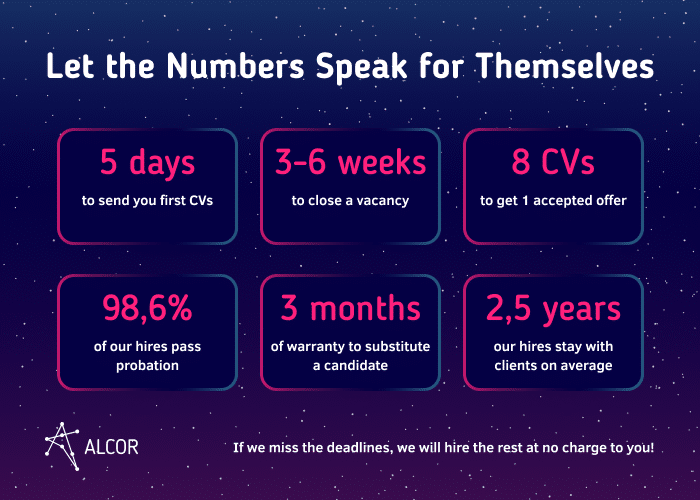

At Alcor, we help product tech companies with IT recruitment in Latin America and Eastern Europe to build their own engineering teams with Senior/Lead developers. We’ll help you figure out the pros and cons of doing business in Mexico, Argentina, Colombia, and Chile. Our internal recruitment department consists of 40 experienced headhunters who take care of candidate sourcing, interviewing, and onboarding. The hiring quality speaks volumes – 98% of our candidates successfully pass the probation period and get positive feedback from their colleagues! Apart from full-cycle IT recruitment, we also help with legal compliance, payroll management, employer branding campaigns, and procurement management.

We’ve already helped People.ai, Gotransverse, Ledger, and others to run their businesses abroad! Are you ready to make that step forward and expand your business with a dedicated and skilled engineering team? Feel free to contact us for more information!