Figuring out which country’s tax system works best for your tech product business is a priority for setting up a professional offshore development team and saving costs. Some tech companies may be looking for zero-tax countries in Europe, but such locations just do not exist. The good news is that there is a list of the top 8 European countries with the lowest taxes and I’m eager to share it with you.

I’m Viktoriia Keliar, COO at Alcor, a full-cycle provider that specializes in building software R&D centers with IT recruitment and Employer of Record support from 0 to 100 developers in 1 year in Latin America and Eastern Europe.

Having a strong legal background and over 10 years of experience in launching back-office processes for software teams in LATAM and Eastern Europe, I’m ready to describe the lowest income and corporate tax European countries for setting up offshore development offices, provide you with their tech market and taxation system overview. So, keep reading to determine countries with the lowest taxes in Europe and choose the perfect destination for your tech business expansion in 2024.

Rating Criteria

To prove that our research is trustworthy and covers all the requirements that usually disturb foreign employers who want to establish a software team in Europe, we gather information and statistics on:

- market overview (availability of tech experts and local IT market stats);

- taxes (corporate, personal income, and social security tax rates);

- advantages of cooperation with residents of those countries for foreign tech businesses;

- challenges and pitfalls of collaboration with local developers for American employers.

We hope this information will be very helpful when choosing the right location for managing your product tech business in Europe.

Lowest Personal Income Tax Countries in Europe

Country |

Personal Income Tax, % |

Average Salary,

|

Average Gross Developer Salary, USD/per year |

| Bulgaria | 10 | 11,500-13,500 | 35,000-42,000 |

| Hungary | 15 | 15,450-17,300 | 38,000-44,500 |

| Czech Republic | 15-23 | 21,000-23,800 | 45,000-53,000 |

| UK | 20-45 | 33,800-36,300 | 57,500-72,000 |

| Poland | 12 or 32 | 21,200-22,620 | 50,000-60,000 |

| Romania | 10 | 19,600-21,300 | 43,000-52,500 |

| Cyprus | 20-35 | 22,600-24,800 | 48,000-60,000 |

| Estonia | 20 (22%, starting from 2025) | 22,200-24,600 | 50,000-58,000 |

Lowest Corporate Tax Countries in Europe

Country |

Corporate Income Tax, % |

Pitfalls of cooperation with US companies |

| Bulgaria | 10 | A lot of time required to fulfill tax obligations |

| Hungary | 9 | Limited tech talent pool |

| Czech Republic | 19 | Average English proficiency |

| UK | 25 | Higher developer wages, compared to other countries on the list |

| Poland | 9 or 19 | High demand for talented developers |

| Romania | 16 | Breakneck IT industry development rate, rising wages |

| Cyprus | 12,5 | Lack of IT experts, bureaucracy |

| Estonia | 20 (22%, starting from 2025) | Small tech talent pool |

Tax Rates in Europe Compared to the US

If you wonder why many American tech companies opt for IT outsourcing to Europe, then take a look at the tax rates in Europe compared to US (represented in the table below):

Country |

Corporate Income Tax, % |

Personal Income Tax, % |

Social Security Tax, % |

| USA | 21-33 (including both federal and state taxes) | 10-50.3% (including both federal and state taxes) | 12.4 (employer’s share — 6.2%) |

| Bulgaria | 10 | 10 | 24.7-25.4 (employer’s share — 14.12-14.82) |

| Hungary | 9 | 15 | 31.5 (employer’s share — 13%) |

| Czech Republic | 19 | 15-23 | 44.8, including state health insurance (employer’s share — 33.8%) |

| UK | 19 (25% — from financial year starting April 1, 2023) | 20-45 (with no tax under a certain threshold) | Employee pays 10% of weekly earnings between £242 and £967 and 2% of weekly earnings above £967 |

| Poland | 19 (reduced rate of 9% is also available for small taxpayers, with certain exceptions) | 12% for income not over PLN 120,000, and 32% applying on the portion of income that exceeds PLN 120,000 (as well, 4% an additional solidarity surcharge applies to the portion of income that exceeds PLN 1 million) | 34.19-35.85 (employer’s share — 20.48-22.14%); employees also are required to make a 9% healthcare contribution |

| Romania | 16 | 10 | 37.25 (employer’s share — 2.25%) |

| Cyprus | 12.5 | 20-35 | 17.6 (employer’s share — 8.8%) |

| Estonia | 20 (22%, starting from 2025) | 20 (22%, starting from 2025) | 37.4 (employer’s share — 33%) |

List of Countries with Lowest Taxes in Europe

Bulgaria

Market Overview

Bulgaria is a fresh and prospective player in the IT industry, and it has already become a popular choice for Eastern European software development. With a large talent pool of 115K candidates and 28% female specialist body, Bulgarian operating revenue of sourcing companies is expected to rise to $9.2 billion by 2025, which is more than double the revenue of $4.7 billion that was registered in 2021.

Taxes

Bulgaria opens our list as the country that has one of the lowest tax rate in Europe. The country’s 10% flat rate of personal income and corporate income taxes are among the lowest in the European Union. The social security tax rate in Bulgaria is 24.7 – 25.4% of the employee’s gross salary and divided in a ratio of approximately 3:2 between employer and employee, making it a European country with very low taxes.

Benefits of Starting a Business in Bulgaria

Besides taking off the significant tax burden, Bulgaria has much more to offer. The country has a favorable climate for IT companies and is paced 35 out of 112 in the Global Innovation Index.

Risks of Starting a Business in Bulgaria

One of the main cons of starting a local company and hiring Bulgarian developers is the enormous time required to fulfill their tax obligations. In fact, it could take up to 454 hours to pay for social security contributions and VAT. Although the country has a highly competitive fiscal policy, companies still need to put in a lot of effort to benefit from this system.

Solutions

You may find a trusted agency specialized to carry your operational and law support to help with staff augmentation in Bulgaria or other aspects. Alcor is one of those. Not only are we able to hire you the best software developers but you can take advantage of our lawyers and accounting team to help you with payroll and contracts.

Hungary

Market Overview

Hungary is another attractive player among the best tax havens in Europe. With more than an 80,100 specialist talent pool, Hungarian software developers took the leading 30th place in the latest Courcera’s Global IT skills ranking with a score index of 72% in technology and 78% in data science. It is anticipated that there will be a 7.88% annual growth rate in the IT sector revenue this year, which will lead to a market size of a solid $2.22 billion by 2027.

Taxes

The country’s personal income tax of 15% is among the lowest in Europe. It applies to all income earners, regardless of their income level. The corporate income tax rate in Hungary accounts for 9%. The social security tax is 31.5%, in which the employer’s share is 13% and the employees’ 18.5%.

Benefits of Starting a Business in Hungary

Besides the tax system, Hungary is ready to offer you well-educated programmers, as more than 70 high-education institutions prepare 2,700 ICT and 12,000 STEM students annually. Also, ranked #17 out of 113 in the mastery of English, so it won’t be a problem for Hungarian software developers to communicate with native speakers.

The Risks of Starting a Business in Hungary

The major pitfall of choosing Hungary as a location for hiring offshore devs or team augmentation in Eastern Europe is tech talent scarcity compared to other countries in the region. In fact, the predominant amount of software developers are located in Budapest, so the tech ecosystem across the country is not so developed. Additionally, you are likely to face operational hardships in terms of legal compliance, dealing with local taxes (including payroll taxes), etc. Just like it would be in any foreign country you discover for your business.

Solutions

Not to miss a chance of starting a software R&D office in one of the tax havens in Europe you can turn to a reliable all-in-one-place company that will guide you through an unfamiliar environment, helping to choose between IT staff augmentation vs IT outsourcing models, prevent unpredicted expenses, and ensure a smooth workflow.

Czech Republic

Market Overview

Well, the Czech Republic is not that loud and famous when it comes to outsourcing IT specialists but has a couple of bites for you to offer. For example, a solid 150K of software developers, who demand worldwide respect for their skills in coding in C++, C#, Java, PHP, C, Python, Ruby on Rails, Swift, and other programming languages. In fact, the Czech Republic’s IT market will experience a 3.64% compound annual growth rate from 2023 to 2028, resulting in a $2.34 billion increase in market share.

Taxes

The Czech Republic is famous for Wolfgang Amadeus Mozart, medieval castles, and some of the lowest tax in Europe. The taxation system in the Czech Republic implies a flat corporate income tax of 19%. When it comes to personal income tax, in 2024, annual income up to CZK 1,935,552 (approximately €80,648) or monthly employment income up to CZK 161,296 (approximately €6,720) will be subject to a tax rate of 15%. Income that exceeds this amount will be subject to a higher tax rate of 23%. The employer contributes 9% of the employee’s gross salary to the state health insurance funds and 24.8% to state social security funds. In turn, an employee contributes 11% of their gross income (contribution rates for social security and health insurance are 6.5% and 4.5%, respectively).

Benefits of Starting a Business in the Czech Republic

What can attract you to the Czech Republic besides being among the most tax friendly countries in Europe? The capital city, Prague, is positioned as the 11th top city for online work, meaning that jurisdiction, digital communication options, living expenses, and business rules all contribute to enhancing the effectiveness of remote work. And the cherry on top is the low retention rate of 18%, meaning that a new tech team is likely to be loyal and stay for a long time in your offshore development office.

Risk of Starting a Business in the Czech Republic

One thing to mention about developers in the Czech Republic is that they are not so much into learning English, compared to their Central and Eastern European neighbors. Thus, the country is placed #26 in Europe in its English proficiency skills, which might lower the speed and quality of communication.

Solution

There are a couple of approaches you can try out like providing English language courses and setting up speaking clubs with native speakers, but be ready to invest a solid period of time to achieve the desired outcome.

Learn about Build Transfer Operate in Europe and nearshore outsourcing to LATAM to choose the best model for starting a business abroad!

Poland

Market Overview

Poland is a true treasure on the European map for IT outsourcing and is also representative of low tax countries in Europe. With the largest talent pool in its economic region of 400K programmers, Poland’s IT sector is projected to rise by 7.6% between 2024 and 2028, resulting in a market volume of $9.99 bn in just a four-year term.

Taxes

Poland offers a 19% corporate tax rate that can be reduced to 9% for small taxpayers, while personal income tax is 12% for income that doesn’t exceed PLN 120,000, and 32% applies on the portion of income that is up to PLN 120,000 (as well, an additional solidarity surcharge of 4% applies to the part of income that gets above PLN 1 million). Also, the social security tax is equal to 34.19-35.85%, where the employers’ share is from 19.21 to 22.41% – and employees are also required to make a 8.3% healthcare contribution on top of that.

Benefits of Starting a Business in Poland

There are so many benefits to find in IT recruitment in Poland from brilliant technical skills to high-standard working ethics. The country takes a solid 5th place in the world tech skills ranking and is ranked 9th in the world in terms of software competencies. At the same time, the salaries of Polish developers are 2-5 times smaller than those of US-based IT specialists. It is no surprise that Poland attracts both tech giants and tech unicorns.

Risks of Starting a Business in Poland

Considering that the number of tech businesses in Poland now amounts to 67,433, it might be challenging to hire Polish Senior, Lead, and C-level developers without local professional recruiters. Why? Because all of these businesses are actively competing to recruit top-tier talent and considering nearshoring/offshoring to Poland, intensifying the competition in the Polish tech hiring sector.

Solutions

Polish developers who work for US companies adjust their schedules and usually sync up in the afternoon, so it’s possible to conduct calls and keep in touch. What’s more, offshore developers ensure round-the-clock software development – so your business never stops!

Curious about another location with low taxes? Then check out our article on offshore software development in Ukraine!

The UK

Market Overview

The United Kingdom is mostly known for looking for an outsourcing location rather than being the one itself. However, the country has a very promising IT sector with more than 466,000 programmers and software development professionals in employment in the United Kingdom. And the industry is growing at explosive rates of 6.84%, resulting in a market volume of $117.10 bn by 2028. But one thing that really allures foreign investors is the possibility of establishing a relatively low-tax offshore company.

Taxes

The corporate tax in the UK will increase from 19% to 25% starting April 2023, while the personal income tax stays the same:

- For earnings between £12,571 and £50,270, you will be charged a basic rate of 20%;

- For earnings between £50,271 and £150,000, a higher rate of 40% will apply;

- For earnings of £150,001 and above, a high tax of 45% will be charged.

When it comes to social security, the UK can be a bit tricky as the employee pays 12% of weekly earnings, between £242 and £967, and 2% of weekly earnings above £967. Additionally, an employer pays 13.8% of the employee’s weekly earnings above £175.

Benefits of Starting a Business in the UK

UK tech companies investing in innovation can benefit greatly from research and development (R&D) relief. In particular, small and medium-sized enterprises (SMEs) meeting certain criteria established by local law can receive an extra 130% deduction on R&D investments, along with the normal deductions.

Risks of Starting a Business in the UK

Britain is a top player in the global tech industry. In fact, its sector is in a leading position compared to the biggest representatives from Western Europe. This eventually results in high competition for IT talents which is already extreme in the UK.

Solutions

Need the best developers? Then offer better conditions, invest in the working environment and education, offer high salaries, and develop your employer brand. Also, go beyond traditional hiring methods like unique referral programs, internships with the perspective of employment, or cooperation with IT recruitment professionals. In case you don’t have a sufficient budget for that, take a look at cheaper European destinations.

Wondering about nearshoring software development to Eastern Europe and IT recruitment in Europe? Contact us for more details!

Romania

Market Overview

Romania is a flourishing Eastern European tech destination for innovative companies. With a relatively small population, their software developers’ database reaches out to 24K specialists. The International Trade Administration reported that Romania achieved the largest number of certified IT specialists in Europe, exceeding even the US numbers.

Taxes

Maybe Romania is not a representative of tax free European countries but definitely deserves to be on list of tax havens in Europe due to a few incentives that make its tax system stand out. There are two main options for corporate income tax. If the company’s revenue is below €500K and it has at least one full-time employee and meets other criteria established by local law, the income tax rate is 1% (micro-company tax). For other companies, the 16% corporate income tax (CIT) will be generally applied. When it comes to personal income tax its rate is 10%, making it one of the lowest income tax in Europe. In addition, IT companies in Romania must make security contributions which amount to 37.25%, where the employer’s part is 2.25%.

Benefits of Starting a Business in Romania

The country provides tax system benefits for developers in Romania, including a salary tax exemption. This feature applies to IT businesses and developers who use an employment contract as their cooperation model and meet the criteria outlined in Romanian law No 1168/2017. The law offers a 10% tax exemption for programmers, provided they hold a diploma after completing short-term or long-term academic studies, or a baccalaureate diploma in specific fields of study.

Risks of Starting a Business in Romania

One drawback of outsourcing to Romania is the head crashing rate of IT industry development that is accompanied by an increase in software developers’ salary rates. In a few years, the job market will become overheated and the country is likely to adjust its price tags to those represented by its competitors in the Western European region.

Solutions

The optimal approach in this situation would be to nearshore to Romania without delay. This is because the current market conditions are favorable, with a considerable pool of skilled technology professionals available at a reasonable cost. Furthermore, competition in the industry is relatively low, making it easier to recruit top-quality programmers.

Cyprus

Market Overview

With a 1.2 million population, Cyprus can’t surprise you with a big IT talent pool. In fact, there are only about 2,494 people engaged in IT Development in Cyprus as of 2024. Yet, the country is among the most tax free countries in Europe.

Taxes

Cyprus is an attractive location for businesses due to its low corporate tax rate of 12.5% for resident companies and offers a special tax treatment for non-resident companies, which are exempt from paying taxes from income arising outside of Cyprus. Personal income above €19,500 is taxed at 20%, which increases to 25% for earnings over €28,000, to 30% for earnings over €36,300, and to 35% for earnings over €60,000. An employer must make social insurance contributions equal to 8.8% of an employee’s gross salary, and contribute 2% of all earnings of its employees to the social cohesion fund. As well, an employee is required to make social insurance contributions at 8.8% of their salary.

Benefits of Starting a Business in Cyprus

As was mentioned before, Cyprus is mostly known for its minimal taxation, comfortable business environment, and pleasant climate. If these three conditions fully satisfy you and the absence of a pool of qualified developers doesn’t bother you, then this destination is a perfect fit.

Risks of Starting a Business in Cyprus

Firstly, the bureaucratic system in Cyprus is quite tough, meaning you have to undergo a lot to establish a company. Add to that the lack of IT specialists which makes it very difficult to create a tech team, and these things turn many companies off.

Solutions

Take a look at European countries with a bigger talent pool and consider providing a relocation option for your tech team members. In case you decide to build a team in Cyprus, find reliable lawyers who will be knowledgeable about the legislation system in Cyprus and preferably have respectable experience in establishing a tax guide for tech companies on the island.

Estonia

Market Overview

The leading Baltic territory with more than 20K IT specialists, Estonia has experienced significant year-over-year growth of over 60% and last year generated €1.5B in turnover during the first three quarters. At the same time, Estonian Startup Database documented 1500 startups.

Taxes

You might be surprised that in 2023 Tax Foundation placed Estonia #1 in the list of most tax-friendly countries. Corporate and personal income taxes in Estonia are 22%, although we would admit that their social security tax is pretty high. The employer is charged a rate of 33%, which includes 20% of public pension insurance contributions, 13% of public health insurance contributions, and 0.8% for unemployment insurance. Meanwhile, the employee is charged 1.6%, which only covers unemployment insurance contributions. Additionally, if an employee has joined the funded pension system, a contribution of 2% is withheld from their gross salary payments toward their pension account.

Benefits of Starting a Business in Estonia

The best part about the Estonian tax system is that the corporate income tax system in Estonia enables companies to reinvest their profits in a non-taxable way, while corporate income tax is only applied to profits that are distributed. Therefore, Estonia does not impose any corporate income tax on profits that are reinvested and retained by the company.

Risks of Starting a Business in Estonia

Despite comfortable tax planning, the relatively small talent pool may make it difficult to start an offshore dev center in Estonia, and because of it, the demand for technical talent, including software developers, consultants, and ICT engineers, is constantly increasing.

Solutions

One thing you should do is to create a strong employer brand for your IT company in the local job market, as this will bring more attention to your company in the tech community, attract developers, and win out against the competition.

What about other popular IT destinations?

Ukraine

Among other popular IT destinations in Eastern Europe, Ukraine is a country with a huge talent pool of over 346,000 IT professionals and the lowest personal income tax rate of 5% for individual entrepreneurs (independent contractors or FOPs). The main risk is an ongoing war. Despite this difficulty, it is worth mentioning that 52% of tech companies retained all of their contracts, while 32% of businesses retained between 90% and 99% of their contracts, finding IT offshoring and IT nearshoring to Ukraine useful. At the same time, 85% of Ukrainian devs keep working full-time.

Portugal

Portugal has 95,000 IT experts and a flexible taxation system, depending on the company’s profit. According to the 2023 EF English Proficiency Index, Portugal has outstanding English proficiency, ranking seventh in Europe and eighth overall. Portugal’s market for IT services is anticipated to grow to $2.79 billion in 2024, with the leading segment—IT outsourcing—expected to account for about $1 billion of that total.

Lithuania

Lithuania boasts 50,000 IT specialists, but they are still not enough to grow the industry. Most top-tier experts are employed abroad and are open to relocation. However, the taxes here are lower than average with 15% corporate tax and 20% personal income tax (up to EUR 228,324/annually).

Latvia

The talent pool is equal to 50,000 in Latvia – one of the lowest in Eastern Europe. Deloitte reported that almost half of Latvian companies spent less than 1% of their profit on R&D, which proves that the IT sector is not striving in the country. However, the taxes are affordable, and 700 computer science graduates yearly stimulate the growth of the sector in the area.

Moldova

Moldova offers the lowest taxes of 12% and a pool of 16,500 tech talents with 2000 engineering graduates yearly. However, they usually aim at relocation to Eurozone countries in search of higher salaries. Judging by the English proficiency, the country is at #35 place, which is also a little lower than average.

Slovakia

Slovakia boasts a 55,000 IT talent pool with the lowest personal income tax of 10%. In Slovakia, the IT industry contributes 2.9% of all jobs and 4.6% of the GDP. Remarkably, 92% of Slovak coders speak English well. However, Slovakia, which ranks eighth in the Central and Eastern Europe (CEE) area for the number of developers, has a lesser pool of IT talent than its neighbors.

Country |

Corporate Income Tax, % |

Personal Income Tax, % |

Social Security Taxes, % |

| Ukraine | 18 | 5 | 22 |

| Portugal | 12.5 or 21 | 13.25-48 | 34.75 (11 – for the employee, 23.75 – for the employer) |

| Lithuania | 15 – standard; 0,5; 20 – for credit institutions | 20; 32 (for more than EUR 228,324/year) | 33 (19.5 – for employee) |

| Latvia | 20 | 20 (up to EUR20004/year) 23 (up to EUR78100/year) 31 | 35.09 (24.09 – employer. 11 – employee) |

| Moldova | 12 | 12 | 24 (for employer) |

| Slovakia | 21 | 10 | 24.4 – for employer, 9.4 – for employee. |

Final Thoughts

Many foreign tech entrepreneurs mistakenly associate Europe with high-tax countries like France or Denmark. I hope that this article revealed another side of outsourcing to this continent — flexibility and relatively low taxes compared to the US.

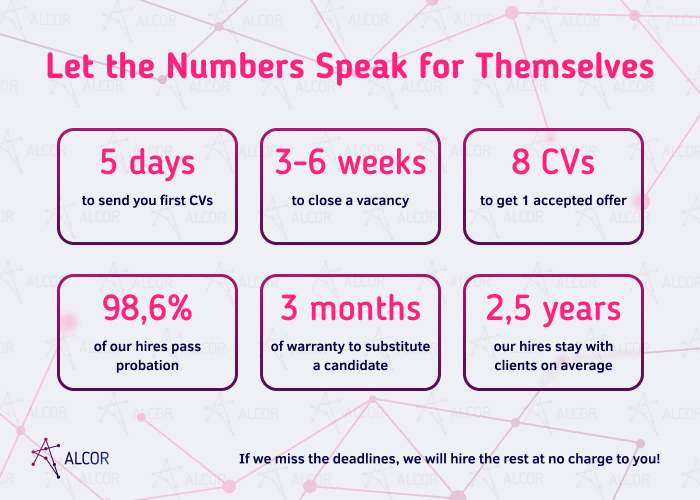

With 8 years of experience, Alcor knows how to hire a dedicated development team in Eastern Europe. Our team of 40 recruiters is ready to source professional software developers in Poland, Bulgaria, or Romania in just 2 to 6 weeks! For US and European tech product companies, we offer a comprehensive software R&D center solution.

First, we create an ideal candidate profile, source candidates for the position, and manage interviews and onboarding. Besides, we provide Employer of Record service. For the clients, it means that they don’t have to care about setting up a legal entity in the country since we cope with all these things. We employ the developers for the client’s R&D office in the chosen country, managing NDAs, service-level agreements, and all the employee legal documentation. Our team onboards them, handles monthly payroll, pays local taxes, complies with local laws, and manages employee benefits (health insurance, education/training, PTO, etc.).

We offer full operational support to the client’s office. It includes your brand’s promotion in the local market, hardware procurement for your team, office lease, insurance assistance, background verification, legal services, visa support, and IT support.

For example, one of our US-based clients Dotmatics chose Eastern Europe as their hiring outsourcing destination. With the help of Alcor, the tech company achieved its goal to close 24 complicated vacancies for Node.js, Java, C++, React, JavaScript, AWS, and Cypress tech stack within just 1.5-year-time.

Another product IT company headquartered in the USA, Sift, turned to Alcor for establishing their R&D branch with 20 software developers from Eastern Europe. We promptly assigned a recruiting team for delivering qualified IT recruitment services. After setting up their R&D office, we took over legal support and payroll management for their offshore engineering team.

Want to get assistance from a reliable Eastern European service provider? Then don’t hesitate and drop us a line now to move one step forward to your dream tech team!

FAQ

⭐ 1. Which country has the lowest tax rates in Europe?

Even though there are countries with lower taxes, Bulgaria sets perfect conditions for IT companies with the lowest corporate and personal flat tax rate of 10% – and a rich talent pool of programmers.

2. Is there a fully tax-free country in Europe?

Unfortunately, complete tax-free countries in Europe do not exist.

⚖️ 3. What are tax rates in Europe compared to the US?

Europe has a very diverse tax system, from the highest tax countries like France and Denmark, to low-tax countries like Bulgaria, Romania, and Hungary, which makes it a good destination for US-based tech companies.