Since tax rates differ in each country, the question of where to set up your company and recruit employees is at the core of your success. But how to get the hang of the taxes in the US vs. Europe?

We at Alcor know the ins and outs of tax systems around the world. Our core expertise is IT recruitment in Poland, Romania, and Bulgaria for tech product companies, which includes the adoption of the best practices of hiring professional software engineers, managing payroll & accounting functions, and ensuring legal compliance. Today I’d like to shed more light on the question of taxes in the US vs. EU to help you find the tax haven for your company!

Comparison of US and European Tax Rates

US Tax Rates Overview

First and foremost, any corporation will pay: 21% of federal corporate tax, and from 1% to 12% of state income tax (depending on a state and tax bracket, if applicable), with some states imposing no tax under a certain threshold (or at all); in addition, some localities may also impose their own taxes. Since 2023, the annual income of corporations that meet certain criteria may also be subject to a minimum 15% tax depending on the annual income posted in their financial statement, rather than taxable income. The average combined US tax rate compared to other countries is not high, staying at the level of 25.81%.

Then, there’s an equivalent to the personal income tax in the US, which is levied on a federal, state and, in some cases, local level, making up the bulk of respective budgets. Typically, the federal tax is withheld from an employee’s wages: this federal tax rate ranges from 10% to 37% with different tax brackets, and states’ — from 0.25% to 13.3% (depending on a state and tax bracket, if applicable), with some states imposing no tax under a certain threshold (or at all). Most employers also pay the federal unemployment tax (FUTA), which is 6% of the first $7,000 paid to the employee as wages during the year, as well as state unemployment taxes (SUTA) and applicable local taxes, if provided by regulations.

Additionally, according to the Employer’s Tax Guide (Publication 15), employers are required to pay Federal Insurance Contributions Act (FICA) taxes, which consist of Social Security tax and Medicare tax. The Medicare tax rate hasn’t changed since 2022 and amounts to 1.45% for both the employee and employer. In total, the FICA tax constitutes 7.65% for the employer.

On the whole, the average tax rate may be high if federal tax bills are at their maximum level. Exorbitant federal tax rates in 2023 stem from the implementation of the 2022 Inflation Reduction Act and the phasing out of some provisions of the 2017 Tax Cuts & Jobs Act, says Forbes. At the same time, state-level business cuts are aimed at providing tax relief. For example, Pennsylvania’s corporate income tax went from 9.99% to 8.99% in January, 2023. More than that, the tax is to be phased out in the next few years in North Carolina, and the rates are already cut in Oklahoma, Arkansas, and some other states, creating better business opportunities. In conclusion, while federal tax bills may be rising, the corporate tax balances out the tax expenses and may alleviate the tax burden.

What about tax rates in Europe?

European Tax Rates Overview

Unfortunately, no-tax countries are a myth. For example, Monaco has a zero personal income tax rate, but the corporate tax is 25%. On average though, the Tax Foundation reports that the corporate tax rate in OECD countries is 21.5%.

Apart from varying from country to country, personal income tax rates usually differ depending on the tax brackets. However, top tax rates in European countries vs. the US turn out to be higher in many cases. When we consider the personal tax rate in Denmark vs. the USA, it is approx. 55.9% against 37-50,3%, depending on the state. As for the Germany’s tax rate vs. the US, the result is 45% (plus a 5.5% solidarity surcharge on top of income tax). On the other hand, when US taxes are compared to other countries, mostly Eastern European ones, the former are clearly higher. For instance, Czech Republic has a personal income tax rate of 23%, and it’s not at the top of the list of countries with low income tax.

Discover the specifics of nearshore software development to Eastern Europe and IT outsourcing in Europe!

When speaking about social security tax, the European tax rates vs. the USA ones may look unreasonable. In contrast to the US combined rate of 15.3%, European rates range between 13.97% (not including medical insurance and pension contributions) in Switzerland and a whopping 65-68% in France, based on the 2022 table by Trading Economics.

Speaking about European taxes vs. American taxes in the future, the EU sets out to achieve tax fairness, i.e. to bring the corporate tax to 15% for all countries, so that the tendency to lower this rate to attract more multinational companies dies down. At the moment, the countries with the CIT below this level oppose such a decision, so it is still a work in progress.

The Highest and Lowest Tax Rates in Europe and the US

While contrasting taxes in the USA vs. the EU, you may find the details overwhelming. That’s why I’ve prepared a table chart with tax rates of the US and 8 European countries to give you the big picture.

Country |

Corporate Tax, % |

Personal Income Tax, % |

Social Security Tax, % |

| USA | 21-33% (including both federal and state taxes) | 10-50.3% (including both federal and state taxes) | 15.3% (employer’s share — 7.65%) |

| Denmark | 22% | Up to 55.9% | Employer pays approx. $2,000-2,425 per year per employee, and employee — approx. $13.5 monthly |

| France | 25% | Up to 45% (with no tax under a certain threshold, 3% surtax on the portion of income that exceeds €250,000, and 4% for income that exceeds €500,000) | 65-68% (employer’s share — 45%) |

| Germany | 15.825% (plus municipal trade tax of 7-17%, depending on the location) | Up to 45% (with no tax under a certain threshold, and 5,5% solidarity surcharge applying on top of income tax) | 40.45% (employer’s share — 20.225%), may vary depending on the location |

| UK | 19% (25% — from financial year starting April 1, 2023) | 20-45% (with no tax under a certain threshold) | Employee pays 12% of weekly earnings between GBP 242 and GBP 967 and 2% of weekly earnings above GBP 967; additionally employer pays 13.8% on employee’s weekly earnings above GBP 175 |

| Poland | 19% (reduced rate of 9% is also available for small taxpayers, with certain exceptions) | 12% for income not over PLN 120,000, and 32% applying on the portion of income that exceeds PLN 120,000 (as well, 4% an additional solidarity surcharge applies to the portion of income that exceeds PLN 1 million) | 34.19-35.85% (employer’s share — 20.48-22.14%); employees also are required to make a 9% healthcare contribution |

| Bulgaria | 10% | 10% | 32.7-33.4% (employer’s share — 18.92-19.62%) |

| Romania | 16% | 10% | 37.25% (employer’s share — 2.25%) |

| Hungary | 9% | 15% | 31.5% (employer’s share — 13%) |

Sources: Trading Economics, Orbitax, PwC

Overall, when it comes to taxes in Europe vs. the USA, they are similar in the United States and some Western European countries, such as France, Germany, and the UK. In this case, France has the highest tax rates, not counting the personal income tax. At the same time, company and personal income tax rates are far higher in the USA than in low-income tax countries like Poland, Bulgaria, Romania, and Hungary.

Regarding the social security Denmark tax rate vs. the USA, it is lower in Denmark than in the US, but all other ranges are higher. The total US tax rate varies from 38.65% to 65.65%. So, Eastern European tax rates compared to the US are a bit lower, but the final difference depends on state taxes.

Are you looking for IT staffing in Europe? Contact us to learn more!

Another important note about taxes in the EU vs. the USA is that the USA has a rather complicated tax filing system, so apart from the tax rates, employers should bear in mind the added cost of tax preparation.

All the differences about taxes in Europe vs. the US considered, Eastern European countries offer more benefits for personal income taxes, while corporate income taxes and social security taxes in the US are quite reasonable. Summing it up, launching a business in the USA or Western Europe might seem feasible, but Eastern Europe is superior in terms of employment and recruitment, especially because of 1M+ people in the IT talent pool. But how can you hire the best software developers in Eastern European countries and receive complete support from tax and payroll points of view?

Consider Alcor BPO Your Trusted Partner

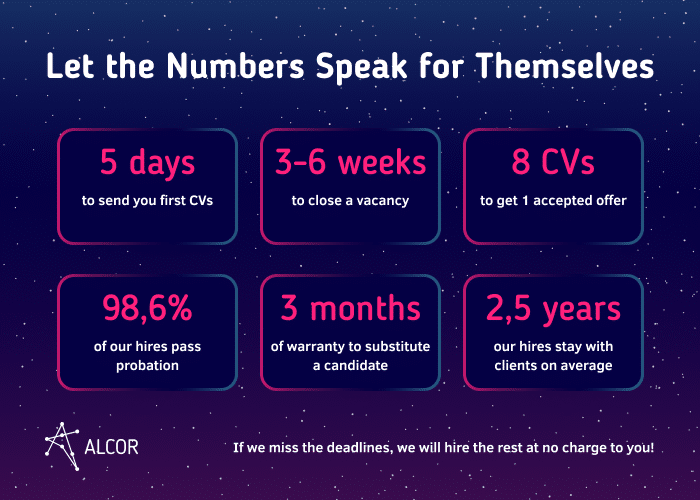

Being an IT recruitment agency in Romania, Poland, and other low-tax countries in Eastern Europe, Alcor specializes in full-cycle tech recruiting and all kinds of back-office functions for our clients, tax planning & consultations, as well as employer of record and payroll & accounting outsourcing services included. Thanks to our focus on the tech industry and IT law experience in Eastern Europe, payroll and tax solutions that we offer are tailored for software development teams. Moreover, Alcor’s finance team has internationally acclaimed ACCA/DipIFR certificates and GAAP expertise. To sum up, our team is second to none, and the results of our clients prove that.

One of them is ThredUP, a US-based consignment store, that decided to set up a software R&D center with remote developers in Eastern Europe to advance its business. The main stumbling block was figuring out the legal and accounting side of the question. Not only did ThredUP want to hire Ukrainian developers and rare IT experts from other EE countries, but also they wanted to choose the best business model for Eastern Europe. Alcor consulted the client on taxes in the EU vs. the US, ensured uninterrupted payroll and handled all transactions and accounts. Additionally, our lawyers took part in lease negotiations and provided professional support during the establishment of the R&D center. As a result, our client received well-organized HR payroll and a fully backed R&D center.

Want to know if an R&D solution is worth trying? Then check out our article and compare it with the BOT model!

As for tax support, Alcor can also help with legal compliance in different countries. That’s what we did for Ledger, a French cryptocurrency company that needed to hire 20 QA engineers in Eastern Europe without registering another legal entity. Our legal team helped them do so transparently, i.e. while maintaining control over all business operations and in compliance with French laws. The wow effect that Ledger received from our cooperation is the reason why they keep doing business with us now.

FAQ

1. How does the US tax system differ from the European one?

The tax system in the US is more complicated in terms of filing taxes and also includes the federal corporate tax, the state income tax, the federal unemployment tax (FUTA), the state unemployment tax (SUTA), and the Federal Insurance Contributions Act tax (FICA), unlike European countries. On the other hand, social security taxes in Europe often comprise multiple taxes, such as pension, medical care, etc.

2. What is the highest taxed nation in the world?

According to our sample of countries, France has the highest rates for social security taxes, making it the most taxed country.

❓ 3. Are US taxes higher than in Europe?

As for who pays more in taxes, it depends on a particular country. The US has higher rates compared to Eastern European countries (Poland, Bulgaria, Romania, Hungary), but lower rates in contrast with Western European states (France, Germany, Denmark, and the UK).

4. What countries have no tax?

Monaco has a 0% personal income tax rate, but its corporate tax rate is 25%.