AI in Mexico is leaping: in 2023, it ranked 3rd in UNESCO’s AI Technology and Government Readiness Index. Given that AI developments will contribute 1.5% to 2% to the global GDP, it’s no wonder that the AI sector of Mexico appeals to investors. But how can US tech firms capitalize when choosing Mexico for nearshore software development?

I’m David Gomez, Alcor’s Lead IT Recruiter in Latin America. We specialize in building R&D centers in Mexico and other LATAM and EE countries for tech businesses to scale. With us, you can hire from 0 to 100 top-tier devs in a year, plus have your legal matters managed and an IT office set up.

In this article, I’ll outline the nuts and bolts of the Mexican AI market and elaborate on trends and regulations. Bonus: you’ll get expert salary stats and an outline of opportunities and challenges of outsourcing your AI development to Mexico. Let’s dive in!

Mexico’s AI Industry Landscape

Market Dynamics & Predictions

The Mexican AI industry is a chief contributor to its economy. As of 2024, the Artificial Intelligence market should reach up to $2.8 billion. By 2030, growing at a whopping CAGR of 28.5%, its market volume will amount to $12.5 billion. The country’s sector develops in Robotics, Generative AI, NLP, LM, Machine Learning, and Computer Vision. Further predictions continue the upswing: by the end of 2032, the Generative AI segment should hit $13.9 billion.

Spheres Adopting AI

According to IBM, the businesses embracing Artificial Intelligence in Mexico rank 5th in Latin America. This high adoption in the global and Mexican landscape covers such spheres as automation of IT processes, security, monitoring, business analytics, and more. While 81% of companies have or plan to benefit from Artificial Intelligence, 38% are implementing it in their project management.

Over the next two years, most of these companies plan to keep investing in this technology, adding at least $1.5 billion in 2024. What’s more, local fintech companies adopted it in their products, showing a sharp rise from 28% of firms in 2021 to 54% in 2023. With the investment flowing in, — $508 million as of 2023 — the AI industry in Mexico is poised for further growth.

AI Sectors & Companies

According to The Manifest, the leading companies in the AI industry of Mexico include Yalantis, 9Series Inc., Rocket Code, Icalia Labs, Immediatum, Raven, LIA Code, and others. Moreover, there are 214 AI startups in the country, such as Yana, Kolors, Pulsar, and Apli, with the most emerging AI in Mexico City.

Regarding the sectors, here’s a quick breakdown:

- Mexico’s 20% growth rate of e-commerce fuels the adoption of generative artificial intelligence. Conversational AI, such as WhatsApp, boasts high penetration and 90 million users, paving the way for more innovation.

- The Generative AI market will skyrocket at a 46.42% CAGR rate in the upcoming years, ultimately hitting over $5 billion.

- Wizeline and the Tecnológico de Monterrey Campus in Guadalajara launched G.A.I.L. — the first generative artificial intelligence laboratory in Mexico and Latin America.

- The Machine Learning Sector is expected to peak at $7.73 billion in 2030, growing at the rate of 36% and representing one-third of the US market value. Most notably, the upward trend in ML is seen in Healthcare, 6WResearch states.

AI Technology in Mexico: Trends and Perspectives

The three big trends dominating Mexico’s AI industry boil down to reskilling, nearshoring, and governance. As outlined in the Digital Maturity Report 2024, 70% of CEOs of large companies expect generative artificial intelligence to drive competition and require new skills in the workforce. However, the obstacles to its full adoption include capability gaps, vague investment priorities, and the absence of a business AI strategy. And that’s precisely what the country will focus on.

Mexico also looks set to attract more investors, anticipating at least $240 million of AI-related capital in 2024. 34% of Mexican companies are ready to raise funds themselves. As for other trends in Mexico’s technology development, the country is about to become a future hub for chip manufacturing. Artificial Intelligence will also be implemented in public service, led by Pemex and IMSS, agriculture, and education. In academic terms, Mexico comes 6th in AI-dedicated research.

But the question about Artificial Intelligence governance remains, which leads us to…

AI Regulation in Mexico

The threats of AI deployment concern its usage in election campaigns, resident surveillance, privacy breaches, and general disinformation. On the other hand, it has been used to advance resource management and data-driven diagnostics in healthcare and policy creation.

Mexico was one of the first countries to introduce a national AI strategy in 2018. It covers such areas as governance, R&D, education, data infrastructure, and ethics and regulation. Regrettably, the adoption of AI regulation in Mexico progressed rather slowly. The good news is that the government is not idle.

In 2023, the Mexican Senate created the National Alliance for AI to strengthen the ecosystem of AI technology in Mexico. The official proposal outlines measures for the areas of public policies and rights, education and labor markets, cybersecurity and risk management, inclusion and social responsibility, data infrastructure, and innovation. For democratic governance, the alliance suggests establishing business standards for its implementation, launching national offices to monitor its usage and results, regulating open-source data laws, and more.

Is Outsourcing AI Development to Mexico in 2024 a Good Idea?

Pro: Top-Tier Talent Pool

According to the OECD, AI-trained talent in the country grew by 45% between 2021 and 2022. Since an AI-based specialization encompasses Python, Java, and AWS, the talent pool of 700,000 IT specialists presents an opportunity to find seasoned tech gems.

Following the stats from our LinkedIn search, even though AI and ML Engineers are scarce, numbering 2,100 and 1,700, respectively, Python, Java, Cloud, Data Science, and AWS IT specialists abound, totaling 61,500. Just enough to match the US demand for 33,000 jobs posted on ZipRecruiter!

Pro: Wise Cost Decision

Compared to the United States, artificial intelligence software developers in Mexico tend to earn 2.5 times less than their US counterparts. Take a senior AI Engineer’s salary: in Mexico, they make $62,500 a year, while in the US, this number skyrockets up to $132,000. In data science, the American vs. Mexican software engineer salary difference is even more striking — $42,000 against $126,000 annually.

| Position, senior | Gross Annual Income, USD | |

| Mexico | USA | |

| AI Engineer | $62,500 | $132,000 |

| ML Engineer | $60,000 | $132,000 |

| Data Science Engineer | $42,000 | $126,000 |

| Python Developer | $62,500 | $126,000 |

| Cloud Engineer | $68,500 | $174,000 |

Con: Complex Legal Market

When it comes to nearshoring to Latin America, legal queries are one of the major concerns for tech businesses. Understandably, it’s different in payroll management, PIT withholding, retirement, and public holidays. Or take severance. Terminating a Mexican employee? Be ready to pay a substantial sum. Put simply, if you want to incorporate a company in Mexico on your own, brace yourself for a challenge.

That’s why recommend turning to a seasoned provider for help. Alcor’s track record lists cases of achieving 100% legal compliance between the two companies’ locations. See our solution for Ledger, a French cryptocurrency company aiming to expand to another market.

Con: Drawbacks of Outsourcing

Software outsourcing isn’t a one-size-fits-all solution. Here’s what you should consider:

- It’s better for short-term projects. You may work with different software engineers throughout the development cycle, so with long-term scaling plans, your best bet is to hire Mexican devs in-house.

- Your control over the team is limited. The third party, i.e., an outsourcing agency, will always stand between you and the team. Besides, you’ll have to pay exorbitant buy-out fees if you want to hire talented coders.

- You shouldn’t expect high loyalty or dedication to your product. As outsourcing programmers switch from project to project, they tend to see them as purely commercial milestones. If you need coders who would go the extra mile, there might be better choices than this model.

Summing up, outsourcing or outstaffing in Mexico is appealing. At the same time, I wouldn’t advise navigating legal pitfalls on your own – outsourcing to Mexico bears fruit faster when done with a provider. Your success rests on your business model: the more you align your business needs with the benefits and drawbacks of outsourcing, the better.

Better than AI Software Development Outsourcing

You can also consider Alcor’s 360-degree R&D solution, which combines Tech Recruitment and EoR.

Here’s how it works:

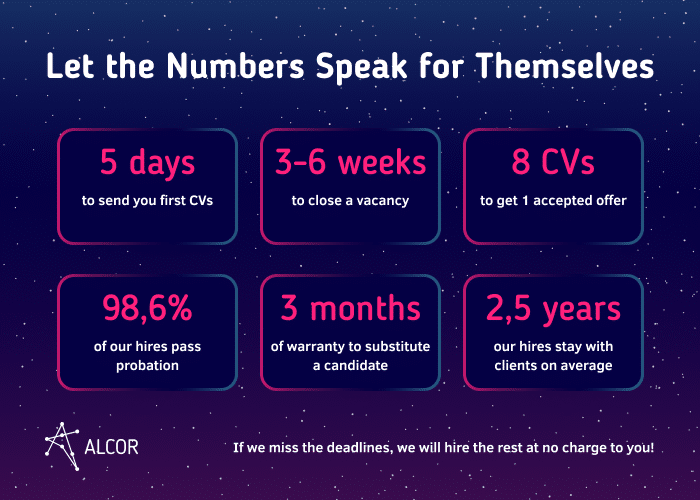

- You send your request for positions; we benchmark candidate availability and salaries and send your first blind CVs; then, we craft your ICP and EVP and interview the applicants. With our 80% CV pass rate, you’ll get seasoned coders quickly: from 2 to 6 weeks is our solid guarantee.

- Once you pick your future hires, our IT recruiters in Mexico start with the EoR part of our solution. This includes taking care of your coders’ employment and managing their HR, taxes, and payroll. The best part? You don’t need any legal entity if you hire Mexican developers with Alcor.

- Ultimately, we offer full-cycle assistance in opening your own R&D center, should you wish to establish a foreign office. We handle your office lease, IT infrastructure setup, equipment procurement, and even more.

Alcor’s approach worked wonders for People.ai, an ML platform for business process optimization. We hired 25+ AI devs for the client, with half of them specializing in AI engineering, while facilitating their payroll, legal compliance, and tax management. Here’s more: it took us only one month to launch their R&D office and ensure equipment procurement and back-office support.

Alcor’s service is stellar: 100% of our EoR clients stayed with us in 2023, while others commended our expertise on Clutch. Join the cohort!

References about the AI Sector in Mexico

- UNESCO’s Artificial Intelligence Readiness Assessment

- Statista

- DataCube Research

- IBM AI Adoption Study

- BN Americas

- Mexico Business News

- Wizeline

- 6WResearch

- Digital Maturity Report 2024

- LATAM Republic

- Context News

- Oxford Insights

- DataGovHub

- Advox

- Propuesta de Agenda Nacional de la Inteligencia Artificial para México 2024-2030

- OECD

- Nearshore Americas