Three global tech players — Google, Microsoft, and IBM — increased their revenue by more than 11% year over year by expanding to Latin America and doing business in Mexico. Should other US tech companies follow suit?

I’m David Gomez, Alcor’s Lead IT Recruiter in Latin America with 8 years of hands-on experience. Alcor is an all-in-one service for opening R&D centers with 0 to 100 devs in a year in Eastern Europe and Latin America. We combine EOR and IT recruitment in Mexico into an all-encompassing R&D center solution with full operational support and more.

In this article, I’ll share my insights into the pros and cons of doing business in Mexico, which I’ve acquired over the years, and break down the legal details of owning a business in the — rightfully dubbed — Silicon Valley of Latin America. Without further ado, let’s look into…

Mexican Economy and Foreign Investment Dynamics

Over the last few decades, Mexico has dazzled the world of investment. It’s a story of a diamond in the rough: since the 1960s, Mexico has been devising incentives to reel in foreigners. At that time, the first way to increase foreign direct spending was to set up maquiladoras.

A maquiladora is a foreign-owned factory with an established legal entity in Mexico that typically exports goods and operates near the US-Mexico border. As for maquiladoras’ pros and cons, the benefit lies in a 16% VAT tax exemption for US companies approved for the IMMEX program, which is designed specifically to tackle unemployment and boost the Mexican economy. However, the maquiladora model has also faced backlash because it exploits a cheap labor force.

Luckily, other models, such as nearshoring, have brought in more foreign direct investment (FDI) combined. In 2020, Mexico ranked 9th worldwide in FDI inflows. In the first quarter of 2023, nearshoring spiked FDI by 48% compared to 2022, with the bulk of investment coming from the US. As for the overall FDI figures for 2023, Mexico is treading the path of success, achieving $36 billion — a 27% rise in contrast to the previous year, again with the US as the most significant contributor. Meanwhile, the numbers for the first quarter of 2024 amounted to $31 billion.

The technology industry in Mexico is also progressing rapidly. The ICT sector is forecast to grow at a CAGR of 10.6% until 2029, making it one of the key industries for Mexico’s GDP. Other segments of the IT market follow along — Statista projects that the IT services market will reach a new peak of over $20 billion in 2028.

Such advancements are possible, in part, thanks to over 50 international treaties. Mexico is the second-largest trading partner in goods and services, alongside the US. As a result, Mexico offers legal safety to foreign investors. The main driver of US nearshoring is the USMCA, a free trade agreement between Mexico, Canada, and the US, which entered into force in 2020 and replaced NAFTA, the North American Free Trade Agreement. It’s no surprise that US tech sharks like Apple, Amazon, Cisco, Dell, Google, Microsoft, and Oracle have entered the oceans of business in Mexico.

Advantages of Expanding Business to Mexico

Access to Talent Treasure Trove

Mexico’s vast population makes it one of the richest talent pools in LatAm — there are 700,000 software developers and counting. Mexican universities supply 124,000 tech graduates yearly. Given that six of them are in the LatAm top 50, the tech skills of Mexican devs are ranked 2nd among LATAM developers and 4th globally. These coders excel at Java, Python, C#, PHP, and Ruby, not to mention Mexico’s leading position in mobile development.

Affordable Salary Rates

According to Alcor’s internal data, Mexican annual remuneration rates range from $20K to $70K, about 40-60% lower than in the US, depending on whether you hire in Mexico City or smaller tech hubs. Compare: a software developer in the US costs a business up to $149K a year. The stark contrast between IT salaries in Mexico and the US allows US tech companies to reinvest costs in their products while maintaining code quality.

Auspicious Business Climate

Mexico ranks 10th in Kearney’s Global Services Location Index for its financial appeal and A4 business climate. Furthermore, the federal government introduced the 2022 Economic Reactivation Plan, which aims to digitize and facilitate the business climate for small to mid-sized businesses. Another focus is on strengthening cybersecurity and economic growth through innovation. Overall, conditions for prospective US business owners keep improving.

Aligning Cultures & Time Zones

Mexico’s strategic geographical location helps it align with the US in culture and time zones — UTC-6, UTC-7, UTC-8 — which largely overlap. As for cultural differences, Mexicans place a higher emphasis on building personal relationships within the business cycle and are more accustomed to a hierarchical decision-making structure. Notwithstanding, these are hardly barriers to effective collaboration with US tech companies.

Challenges of Doing Business in Mexico

Laggard Bureaucratic Procedures

Mexican regulations, as well as licensing and permit requirements, can be complex endeavors requiring time and scrutiny. I also advise US companies to consult experts on Mexican laws applicable to your business before establishing operations, as your success in navigating foreign business customs largely depends on the provider you choose and their approach to how to do business in Mexico.

Liability to Cyberattacks

Potential cyberattacks are one of the challenges of doing business in Mexico. Microsoft reports that Mexico ranks second regarding cybersecurity risks. Data issues mainly stem from the need for a structured and all-encompassing data protection law. On the other hand, cyberattacks are largely directed at the private information of individuals aged 18 to 24. While this situation challenges US tech businesses and encourages serious efforts aimed at data encryption, they also offer an additional way to safeguard products from data leakage.

Starting a Business in Mexico: Short Overview

A US company doing business in Mexico can operate without having to register a separate local entity. Instead, it can open a foreign branch from the US by obtaining a business license. The procedure involves the Ministry of Economy, Notary Public, and Foreign Investment National Commission. Also, foreign entities in Mexico should ensure compliance with reporting obligations.

Other aspects to note are the differences in taxation and labor law between Mexico and the US. The taxes in Mexico are as follows:

- A 30% corporate income tax rate (CIT) on the annual gross income, with 10% withholding tax on dividends, is distributed from the net income (after CIT levied), resulting in an effective rate of 37%.

- R&D businesses can benefit from a tax credit of up to 30%.

- Personal income tax applies to both employees and independent contractors (B2B model), with progressive rates varying from 1.92% to 35% based on the individual’s amount of income. In addition, both the employer and the employee must pay social security contributions (SSC). For instance, if the employee earns an annual income of $60,000, the employer’s obligation for SSC will typically amount to around 30%, while the employee’s contribution will be approximately 2.8%.

- Non-resident employees face a special personal income tax regime with the rates from 15% to 30%, depending on the individual’s amount of income. However, the income up to approx. $7,400 earned within 12-month period is exempt from taxation.

The legal sphere might seem complex for a US tech company, but a reliable EoR provider can work wonders. EoR stands for Employer of Record, a model that allows you to hire in a foreign location without opening a legal entity. Your provider takes care of HR & payroll, plus accounting & compliance.

At Alcor, we don’t believe in the impossible. One of our stunning legal cases is 100% compliance with two legislations we arranged for Ledger, a French cryptocurrency product company. The company’s goal was to expand into another European country but remain transparent in all operations and avoid registering a local legal entity. While our IT recruiters and researchers were scouting the network for top-notch coders for Ledgers, Alcor’s legal and financial specialists achieved full legal compliance that covered tax management, labor law assistance employment contract support, and even IP rights protection. As a result, Ledger fully abides by both laws and has risks and tax processing handled by Alcor.

Owning a Business in Mexico VS Nearshoring

Summing up, when owning a business in Mexico, your key responsibilities will revolve around due tax reporting, labor law compliance, accounting, and payroll. If you’d like to delegate these duties, here are a few established solutions:

- Nearshoring. Practically, it’s a form of outsourcing business processes to a third party that shares a border with the company’s home country. For example, US companies tend to nearshore software development in Mexico due to geographical proximity. Nearshoring allows US tech businesses to save time, cut costs, and get things done by coders abroad via a third party. On the flip side, this approach is rather short-term, implies low loyalty and limited management, and includes buy-out fees if the company decides to hire on their behalf.

- R&D center. Unlike nearshoring from the US to Mexico, this model is suitable for long-term projects. First off, an R&D center services provider assists in hiring seasoned software engineers to work in-house. This increases control levels and team loyalty, as well as allows the client to oversee the process. Next, the provider handles payroll & accounting, taxes and compliance, and, most importantly, office lease and equipment procurement. As a result, you get your own fully-backed branch operating in Mexico in addition to your US office!

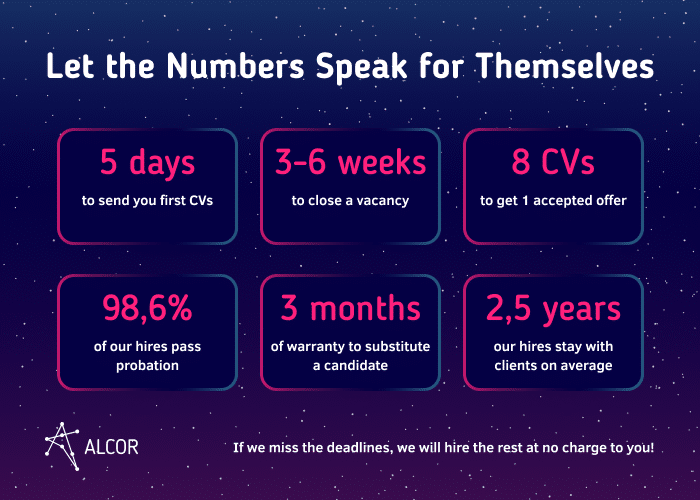

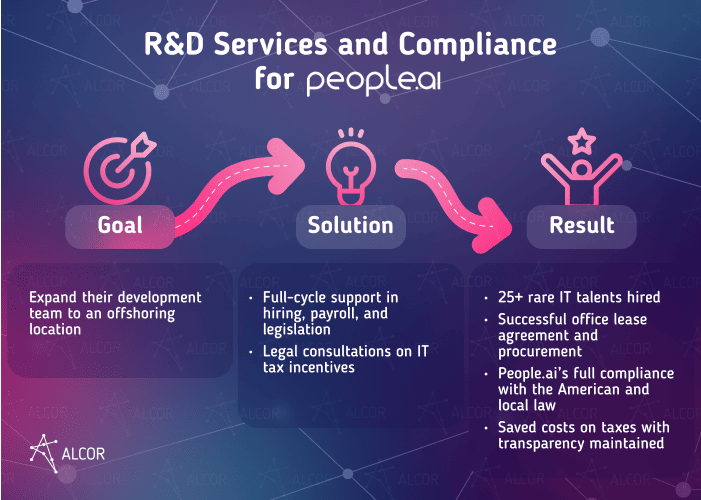

If you and Alcor become partners, we hire a team that’s entirely yours from day one: 5 devs in a month, 20 within three months, and 100 in a year! Look at how we set up an R&D office for People.ai, a machine-learning software company.

Mexico as an Emerging Tech Business Hub

The option of IT outsourcing to Mexico shines even brighter from a bird’s-eye view of its tech infrastructure. It’s a hub of startups, tech parks, and tech universities.

Here’s a brief overview of the most prominent Mexican hubs that US business owners may find appealing:

- Mexico City ranks among LatAm’s top 10 tech hubs and leads the way in the Mexican FinTech industry and AI in Mexico. It is a place to be for US tech giants such as Google, Meta, Twitter, and Uber.

- Monterrey is located next to the US border and attracts US investors with its 100 innovation parks and 320 IT companies. Moreover, a combination of Mexico’s most prestigious universities, clustered in Monterrey, and industrial corporations secures Monterrey’s fame in EdTech.

- Guadalajara is a Mexican competitor to Silicon Valley in the US. As 5th most digitized city in the region, it hosts 600 tech companies and proudly carries the title of one of LATAM’s top 50 IT clusters.

Want more data about prospects for US tech firms doing business in Mexico? See for yourself:

Your Own Software Team in Mexico with EOR Services in a Month

Eager to hire developers in Mexico while developing your company in the US? Alcor’s 40 recruiters are here to help you in Mexico and other locations, such as Argentina, Colombia, Chile, Poland, Romania, Bulgaria, and Ukraine.

On top of that, we’ve developed a one-stop-shop service that unites Employer of Record and tech recruitment. Suppose you opt for IT recruitment in Mexico. In that case, our 40 expert recruiters handle the entire process, from crafting your employer value proposition on the local market and designing ideal candidate profiles to discovering tech gems in professional networks and interviewing them for you. In addition, you get a key account manager and weekly updates on our progress.

What happens after we hire everyone you need? Here comes the EoR service of Alcor’s unique solution. It includes compliance with all local laws, tax payments, onboarding/offboarding, employment of software, and even employee benefits coverage. All this is to make your expansion from the US to Mexico or other locations where Alcor operates hassle-free!

We guarantee full legal compliance and business navigation in new labor markets tailored to your needs. Alcor also provides 360-degree operational support covering IT infrastructure setup, visa support, and more.

Do customers appreciate that? Our EoR clients attest to Alcor’s excellence: our 2023 customer retention rate is 100%.

Intrigued? Drop us a message!