Romania has earned a reputation as a flourishing IT hub in Eastern Europe and a promising destination to hire skilled programmers. It’s one that has the largest number of certified software developers in Europe and the presence of such tech giants as Google, Amazon, Microsoft, Adobe and others, which attracts more and more IT companies to enter the Romanian job market. On top of that, Romanian taxation for tech companies is one of the most beneficial and business-friendly in Europe when it comes to software development. Yet entering a foreign market may seem slightly confusing due to the local taxation policy, which always has its nuances and complexities.

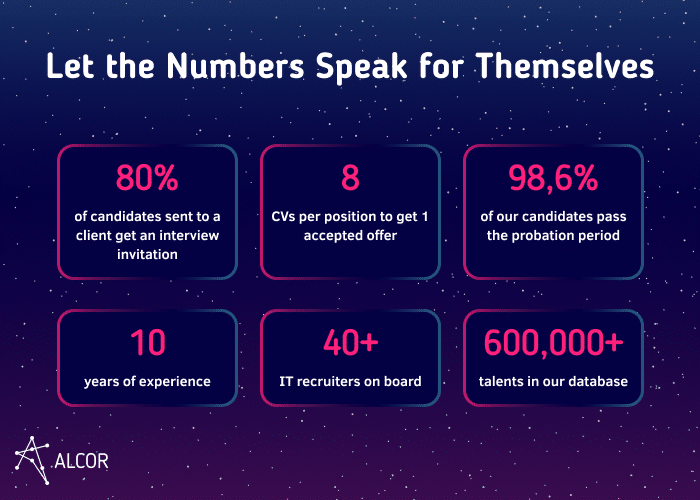

Our company Alcor provides IT recruitment services in Romania and other Eastern European countries. As a local expert, we have plenty of insights on Romanian taxes for tech businesses. And in this article, I will guide you through everything you need to know about software development in Romania and taxes for IT employees in this country, as well as share the most efficient way to build a development team in Romania.

Taxes in Romania for Tech Business

Usually, IT companies in Romania utilize the standard taxation process. After opening an IMM (Întreprinderilor Mici și Mijlocii) there are two options. According to the first, if the derived company’s revenues do not exceed the equivalent of 500,000 euros and the company has at least one full-time employee, the income tax rate is 1% (micro-company tax). The second option covers companies that have a profit bigger than the equivalent of 500,000 euros or have no active full-time employees. In this case, companies must pay 16% of corporate income tax (CIT).

Apart from CIT or micro-company tax, IT companies in Romania must also pay an additional contribution of 2,25% for every employee out of their net salary, which is the labor insurance contribution.

In general, the fiscal year in Romania follows the calendar year, but taxpayers can go for fiscal year-end which differs from the calendar one. All taxes are declared through specific declarations and are paid at the deadlines provided by law through bank transfers or online.

Get more insights about this EE location by reading our article on IT outsourcing to Romania.

There’s one more point to mention regarding setting up a tech business in Romania, besides taxes for IT companies – it’s economic freedom. According to the 2022 Index of Economic Freedom, Romania ranks 47th among 177 countries. It means that this country is moderately free in terms of launching a business, openness to investments, and property rights. Thus, in addition to fairly clear tax policies the Romanian economy is open for running an IT business.

Romanian Taxes for Software Developers

First of all, there are two possible ways of collaboration with Romanian developers – an employment contract (CIM) or a B2B contact (SRL/PFA). Let’s have a look at each of them in detail.

Employment contract

An employment contract (Contractul individual de muncă) foresees that a company hires a software developer as an employee following the Romanian Labor Code. This approach suggests paying social security contributions by both the employer and employee. 35% of social contributions paid by employees consist of the following:

- Social insurance – 25%

- Social health insurance – 10%

In addition, the employee also pays a 10% income tax on their salary.

Notably, the government established certain benefits such as salary tax exemption for IT sector in Romania. It applies to IT businesses and developers who choose the employment contract as their cooperation model. When a tech company and an IT employee, hired by such company, meet criteria specified in Romanian law No 1168/2017 (the “Law”), the state offers a 10% tax exemption for programmers. Thus, the Law establishes such criteria:

- The employee must hold a title listed in the Law Annex;

- The employee must work in a specialized IT department in accordance with the internal organization of the company;

- The employee must have a diploma after the completion of short-term or long-term academic studies issued by an accredited higher education institution or hold a baccalaureate diploma while carrying out one of the activities mentioned in the Order Annex;

- The company must obtain income exclusively from the software development activities during the previous fiscal year;

- The company must generate a yearly income of at least 10,000 euros per employee within the IT department (tax-exempted employees).

In addition, the company applying for these fiscal advantages must be registered with one of the NACE codes as a business line (code 5821, 5829, 6201, 6202, 6203, 6209), clearly stating “computer software creation” in its Statute.

Have a look:

Non-IT employee: Gross salary: 1000 euros, taxes are 45%, Net salary: 587 euros

IT employee: Gross salary: 1000 euros, taxes are 35%, Net salary: 652 euros

Yet this type of collaboration obliges tech companies and IT employers who nearshore software development to Romania to open an LLC, bringing more financial liabilities and administrative hardships. As an alternative, they opt for B2B collaboration.

B2B contracts

When it comes to a B2B agreement in Romania, a foreign tech company can collaborate with a Romanian developer via a contract according to the Civil Code. In this case, a developer chooses to register themselves as SRL or PFA, but for their employer it doesn’t change the rules of the game.

SRL (Societate cu Răspundere Limitată) refers to a Limited Liability Company, which means that a developer acts like a small firm that signs a contract with your company for providing development services. With SRL, it’s mandatory for a developer to have a registered accountant who will calculate and pay their taxes. When it comes to tax rates, there are certain conditions to consider. If the income does not exceed the equivalent of 500,000 euros and the firm has at least one full-time employee, the income can be taxed at 1%. When the income exceeds this sum, or the company doesn’t have any full-time employee, the income is taxed at 16% CIT. In both cases, there’s an additional 8% tax for the dividends.

The second option is PFA (Personă Fizică Autorizată) which refers to an Authorized Physical Person, meaning that a developer acts as a sole trader and provides IT services to the company. However, with PFA, the contractor takes personal responsibility for paying and calculating taxes without having a personal accountant. The income tax rate for PFA is 10%. In addition, PFA is obliged to pay social contributions as follows:

- Pension contribution: 25% of the minimum threshold of RON 36,000 or a higher amount if higher incomes are registered;

Note: The minimum wage is set at RON 3,000. Accordingly, the ceiling of 12 minimum salaries is RON 36,000 while the ceiling of 24 salaries is RON 72,000 a year.

- Health contribution: 10% of the minimum threshold of RON 36,000 or RON 72,000, depending on the annual income. The same contribution applies to those with incomes below this threshold (but not less than RON 18,000), with the mention that it will be calculated for half of the minimum threshold.

It’s important to highlight that it doesn’t matter to the company which way of B2B collaboration the developer chooses. In both cases, the procedures at the end of the month are the same – the programmer sends an invoice to be paid by the client. Yet it’s a common practice that at first developers start cooperating with IT companies through PFA and later, after reaching the income limit, switch to SRL.

Which Tax Is Most Cost-Effective?

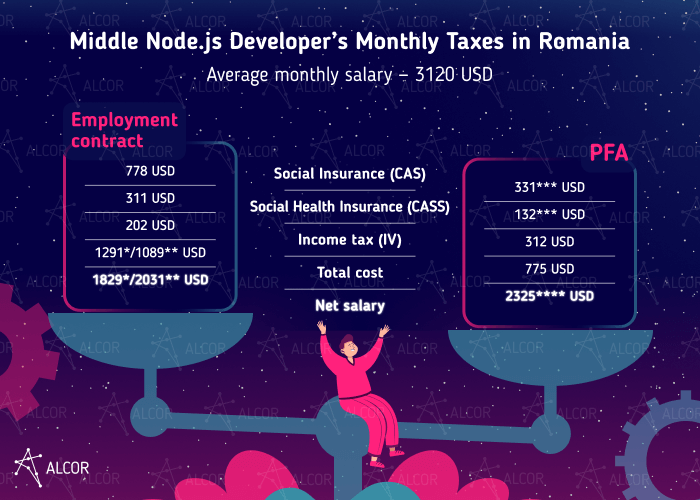

Considering all the nuances of both collaboration options, let’s see which type of taxation in Romania is the most effective for software developers. The picture below illustrates the tax rate for a Middle Node.js Developer in Romania according to the employment and B2B contracts.

The average RON to USD currency exchange rate is 4,57

* the criteria of the Law are not met

** the criteria of the Law are met

*** Since the earned annual income exceeds 24 gross minimum wages, the ceiling from which tax is deducted is 72 000 lei

**** ca. 20 USD for accountancy included

As a rule, developers gain up to 15% of the net income using B2B agreements. However, junior programmers tend to choose direct employment contracts since it follows the Labor Code, which empowers and protects employees’ rights and interests. In this way, they feel more secure to step into a new job and first wish to just earn money. Middle and senior-level developers use B2B since their income gets higher while this type of cooperation enables saving a great deal of money.

In addition, there’s one more nuance to mention while speaking about these two types of cooperation. When developers go for direct employment, they state their salary expectations in net, so the employer has to consider additional expenses on taxes. On the contrary, software engineers who prefer working via B2B agreements discuss their gross remuneration, including taxes. Thus, the responsibility for paying taxes and their amount remains on the programmer.

Consider Alcor BPO Your Trusted IT Recruitment Provider in Romania

Taxes in Romania for software developers may seem complicated, but I do hope that this article helped you get a grasp on them. However, if you want to build your own team of skilled developers in Romania and handle payroll & taxes alone, it can be quite a challenge. As an option, you can consider working with a reliable IT recruitment agency in Bulgaria, Romania, and other EE countries who also provides support from the accounting & legal side while you stay focused on core operations.

That’s what Sift decided to do, intending to expand in the Eastern European market. The need for a reliable and experienced partner led the company to Alcor. The plan was to hire 30 programmers within a year. We engaged our IT researchers, recruiters as well as an account manager to help Sift execute its plan. Our headhunters used various sourcing tools and techniques to hire skilled candidates with the needed tech stack. Some of the positions were even closed from the second CV and in just one year the company got its own development team in Eastern Europe. Apart from IT recruitment, Alcor helped Sift remain fully compliant with American and Eastern European laws, tax management, payroll, and labor & contract law assistance.

Alcor provides IT recruitment services in Romania, Poland, Bulgaria, and other Eastern European countries. We focus on hiring Senior/Lead developers and programmers with niche skills for product tech companies. We also assist in creating employer branding campaigns and procurement management while our accounting and legal teams can help you with local laws and taxes.

Apart from Sift, we also helped Dotmatics, Ledger, People.ai, and others build their offshore development teams. Share your hiring needs with Alcor to enter a new market with flying colors!

FAQ

1. What taxes do tech businesses pay in Romania?

There are two taxation options. The first one refers to micro-companies whose revenues do not exceed the equivalent of 500,000 euros. In this case, the tax rate is 1%. The second scenario covers companies with a profit bigger than the equivalent of 500,000 euros or there are no full-time employees. These companies must pay 16% of CIT.

2. What is the Romanian tax rate for developers with an employment contract?

If a software developer decides to cooperate via the employment contract (CIM), the tax rate of social contributions is 35% plus a 10% income tax. However, the Romanian government offers some taxation benefits for IT businesses. Read this article to learn more about them!

3. What type of cooperation in Romania has the best tax rates: the employment contract or B2B agreement?

When Romanian developers work via a B2B contract, they gain up to 15% of the net income. However, there are two types of B2B agreements (SRL and PFA) in Romania which have their specifics and nuances. Start reading this article to find out which tax rate and type of collaboration are the best for your team in Romania!